B2B EXCHANGE FOR CANNABIS AND HEMP PRODUCTS IN CANADA + DATA PROVIDER FOR ALL STAKEHOLDERS

The Canadian Cannabis Exchange is a B2B exchange for cannabis and hemp products in Canada, as well as a data provider of market insight for all stakeholders from growers to processors to distributors and regulators.

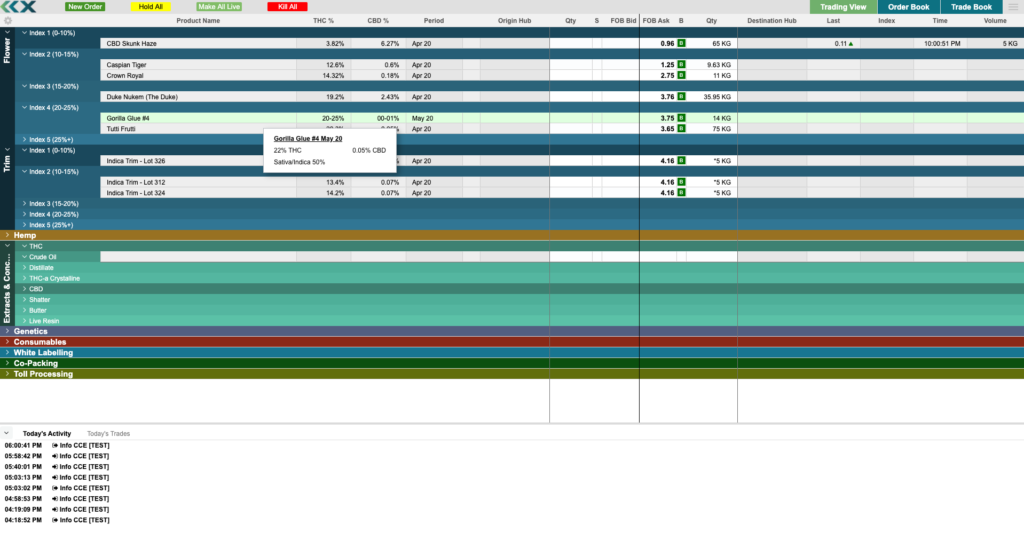

Those in the commercial cannabis space who are seeking to either sell their dried flower to processors, or processors trying to sell their product to wholesalers, can log onto the exchange to both list the products they have for sale, as well as see what other kinds of products and deals are currently being secured in the space.

Connecting Buyers & Sellers

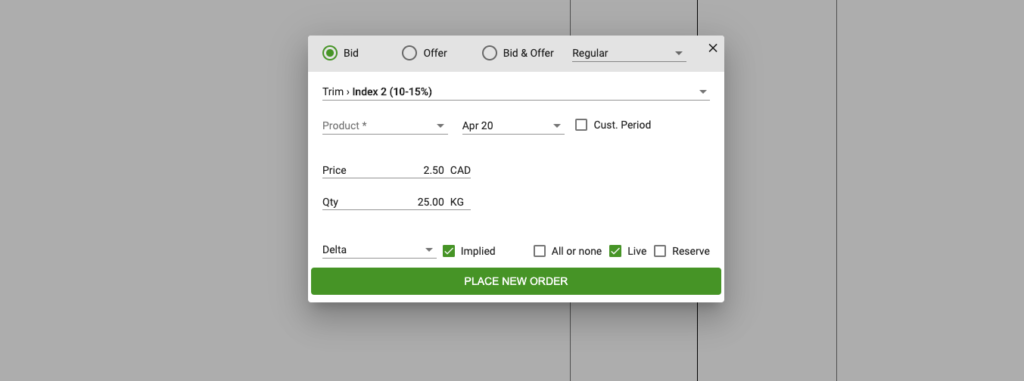

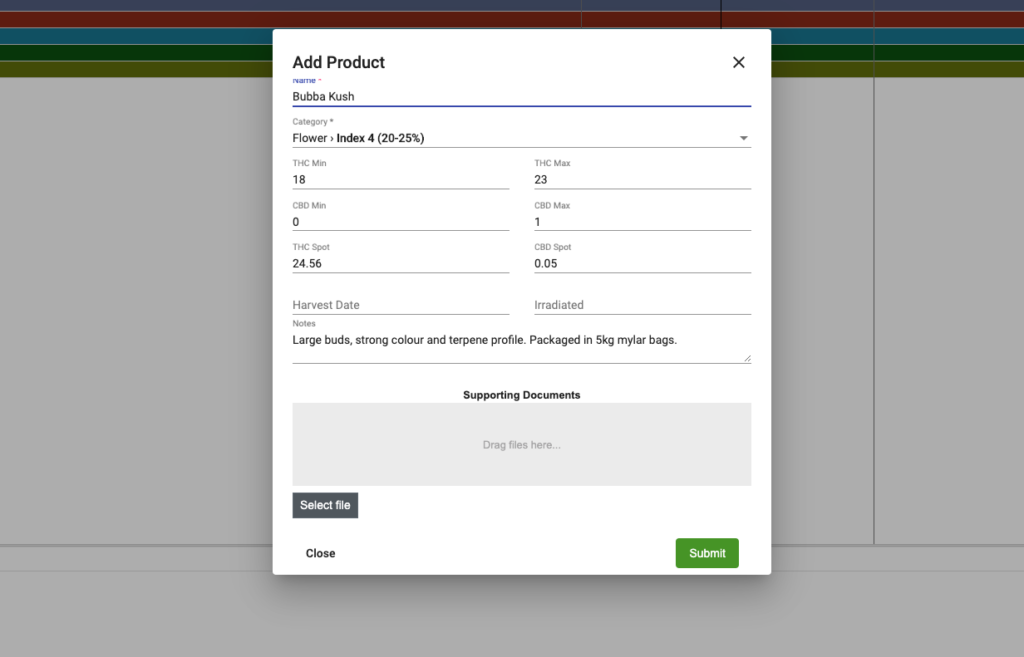

The company offers both free online access for buyers and sellers, as well as a subscription-based portal for those looking to gain a better understanding of the current state of the market, from prospective growers and processors, to even provincial buyers and regulators. Sellers who have a product they want to list can post that product on the exchange and provide information like the size of the batch, potency levels, testing results, desired price, etc. Buyers can then offer bids on the listings that the seller can either accept, refuse, or negotiate over. Sellers can always refuse a sale, unlike an auction site where once a product is listed the best deal secures it.

In addition, the Exchange then works with an authorized shipping agent who can then ensure the safe delivery of the product sold on their platform, without ever physically handling cannabis themselves. As such, they are not required to be licensed by any federal or provincial parties.

The CCE grew out of the experiences their co-founders, Steve Clark and Corey Riley, gained in both the cannabis industry, as well as managing trades in the oil and gas industry where similar platforms exist to serve that market.

Serving the Market

After co-founding an LP in 2018, 314 Pure Cannabis Ltd in Alberta, Riley and Clark began working on the platform that would become the Exchange by mid 2019. At first, they were just looking at how to get their product to market, and began to see there would be a need for more informed trades across the industry.

“We realized, once the business was up and going, how is the product going to get to market? It’s a commodity, just like orange juice and pork bellies, and it will move in the same way. So we had the idea of the exchange. We thought it had quite a lot of merit.”

Building the platform

In late 2019, Riley stepped away from 314 Pure Cannabis to work full time with the CCE and continued building out the platform based on his team’s understanding of similar technology in the oil industry, where sellers and buyers can connect to make real time trades. While Clark remained with 314, he still played a critical role in the development of CCE .

‘We’re just client to client, we’re just helping to marry the deal, helping negotiate the deal, and helping to deal with the counter party risks on the other side of the transaction. “

Around the same time Riley brought on Leif Undseth as the lead for brokerage and operations with the exchange. Undseth began helping to build the platform, as well as developing relationships with clients and starting the process of building the exchange offline in beta mode.

Undseth says this helped them to build the online platform with a better idea of what buyers’ and sellers’ needs really were, while building these relationships and even brokering deals over the phone and through email.

“By taking the time to talk to LPs over the last several months as we developed the site”, says Undseth, “we could not only build those connections, but also learn about their needs for how a platform like this can serve them, for buyers and sellers. We’re just client to client, we’re just helping to marry the deal, helping negotiate the deal, and helping to deal with the counter party risks on the other side of the transaction.

“There’s also a human connection behind it. We don’t just give a login and say ‘off you go’, we’re here to help with getting every deal across the line. Many deals have to be taken offline, because we offer more than just spot deals, we also offer supply deals, white labeling, co-packaging, toll processing, which are very unique deals so it’s all real time.”

Leveling the playing field

This entire process is also anonymous, says Undseth, which helps level the playing field between buyers and sellers, large business and small ones. Buyers don’t know who they are buying from, only the information about the product itself.

“It makes it more of a fair process, more of a true negotiation, where the big guy isn’t going to know the balance sheet of the little guy and be able to leverage that against them.

“What the platform does is it has all the listings in the main section, but it also shows today’s activites, today’s trades. So you get a summary of every listing, every price movement, every bid offer. You can see where a product closed, if the price went up or down from where it was listed, how many bids were on it before it closed, were people wanting all of the volume or were they saying ‘I’ll take 20kg of that’.

“So you can see what’s actually going on with the product. You’re not just seeing what leads to a product closing, you’re seeing what’s leading up to the product closing. It also lets you know when you go to bid on a product, if that product has been sitting for a week or two or if that product is the most wanted thing on the market and you need to jump on it.

“It makes it more of a fair process, more of a true negotiation, where the big guy isn’t going to know the balance sheet of the little guy and be able to leverage that against them. “

Including nurseries and provincial buyers

While much of their business right now from the over 100 licence holders who are currently using the Exchange are those buying or selling finished products, Undseth says they also help connect people with genetics suppliers like nurseries, and help provincial buyers have a better understanding of what is available on the market.

“For example,” he says, “current cultivators want to know what strains are selling the best, where they can get new genetics that have a new potency range they haven’t achieved before. So this platform is first a trading site to help you buy and sell whatever your needs may be, but also data, transparency, market insight for making better business decisions.”

Market pressure and demand data

As the only online brokerage of it’s kind in Canada currently, both Undseth and Riley say it has given them a unique position to understand market pressures and demands. Currently, the average price for wholesale flower is around $3 a gram, depending on quality, although both see that shifting over time depending on how the market evolves.

For his part, Riley says he sees demand being curtailed by a lack of retail stores, especially in Canada’s largest market, Ontario.

“I don’t know if we, as an industry in Canada, have a good feel for what the pricing is going to look like yet. The Ontario retail system has completely hamstrung demand, I think, with (so few) stores. So we don’t really know the true demand numbers yet. So with respect to today’s market, until Ontario gets their retail sorted, I don’t know.”

A call for more retail stores

Undseth agrees that more retail stores is key, as is the provincial buyers having a better understanding of the market

“The Ontario retail system has completely hamstrung demand, I think, with (so few) stores.”

“The more brick and mortar stores, the more educated the consumers become. The reason we see a potency driven (20%+ THC) market is because people thought, ‘Okay, this is my first try of legal cannabis, what’s the most potency I can get for my dollar?’.

“But now you’re seeing people get educated on taste, smell, quality, so we are seeing a shift where the market’s opening up to the 15%-18% range, as long as the terpene profiles are high. But this is a slow transition, for very select brands.”

Focus on brand and reputation for marketing pricing

For those companies who are producing a more niche product, perhaps under that current 20%+ THC range, but still of a high quality with a good terpene profile, Undseth says building their brand and reputation will be key to ensuring they can get to market at a good price. Part of their conversations and service offering for buyers and sellers, he says, is helping them understand those market demands, as well as how to modify their expectations.

“Before you’re able to build out that reputation, I’d say that the $3-$3.50 mark is a good place to plan for. Obviously it’s not the most optimistic case for wholesale prices, but that’s the margin we see going right now. It is very much a buyer’s market right now.

“The biggest thing we see in the market right now is if you have flower over 20%, you’re not going to be holding on to it for very long. Same thing if you have trim over 14%. So we really see an education with our clients if they’re wondering what they can do with their product if it came off at 10-12%, because they don’t want that to go to waste. So we let them know they can move that to extraction or tolling. Because sometimes reaching that 20%+ level just isn’t doable. And that’s just in trim and bud alone.”

Flexibility in price expectation

Because there is currently somewhat of an oversupply for the limited retail options in Canada, the advantage is with buyers right now, says Undseth. Sellers need to keep this in mind, especially those perhaps trying to get their first crop or two out the door with a certain price expectation.

“Before you’re able to build out that reputation, I’d say that the $3-$3.50 mark is a good place to plan for. Obviously it’s not the most optimistic case for wholesale prices, but that’s the margin we see going right now. It is very much a buyer’s market right now. ‘

“Extractors don’t really have an issue with access to product, whether it be hemp or flower, because there’s a ton of that flower in the 12-14% range that hasn’t moved in a few months and clients are just trying to get rid of it. What you’re seeing is that we need buyers for a lot of this product. A lot of people got into this industry saying they were going to grow the best product and now there’s no buyers. There’s not enough pull in the market especially if you’re not standing out and making yourself a known name in the industry.”

Be really good at what you do

Although he says he sees some small batch producers currently commanding a higher price, he says long term it will be important to not price themselves too high compared to the rest of the market. In addition, he says they should do what they do well, and seek a good partnership with someone who can complement their skills, both on the growing and the processing side.

“You need to be really good at what you do, and let someone else handle the rest. The processing speciality and the cultivation speciality are so unique that I would recommend getting really good at what you plan to do and then let someone else handle (the rest).”

“I believe there’s going to be a space for micros and the smaller growers, but it’s a matter of making sure they stay focussed on growing and what they are good at. What it really comes down to, is to make sure their costs aren’t too high. If they are one to two times the average price of the market even if they have a great product, it’s going to be hard to convince the consumer.

“A lack of flexibility (is a common mistake). Coming in with a preset notion because your board or your boss told you it has to be this way and then shutting down every deal that does not conform to that. Inflexibility kills deals.

“I recommend people come in with a mindset that, yes you built this business around a certain price, but these markets change every day and you need to be ready for that when you come to the negotiating table.”

“Coming in with a preset notion because your board or your boss told you it has to be this way and then shutting down every deal that does not conform to that. Inflexibility kills deals.”

Standard terminology for the industry

Corey Riley agrees, and says his experience in the oil and gas market connecting buyers and sellers reflected a similar lesson. Because the cannabis industry is so new, with so many different approaches and terminology, part of their process of development has been about building out their platform to ensure everyone uses the same language.

“We put a lot of time and effort into putting together a very robust set of documents and to have to have standard language throughout the industry. Coming from the oil side, it took years to come to a common language the industry agreed on. We’re trying to do that here, for the sake of the buyers and the sellers, rather than haggling over small minute details. So the market will decide what the terms are, we’re just trying to help facilitate that quickly.”