British Columbia is leading the way for those “legacy” dispensaries who are finding their way into a fully legal, regulated retail cannabis market.

While legalization has created many new opportunities for people who were not previously involved with the cannabis industry, British Columbia is unique in how many cannabis dispensaries and retailers have successfully made the transition from the illegal to the legal market.

Although most of the nearly 250 private retail cannabis licenses issued in the province are not directly connected to older “legacy” retailers, at least 25 are, or about 10% of total licenses. The province also has another 16 publicly run BC Cannabis Stores.

In Vancouver, which first began the process of regulating medical dispensaries in 2015, about half of the city’s two dozen legal cannabis stores are owned by former illicit cannabis dispensary owners, or in locations that formerly housed illicit retailers who then sold to new owners.

In Victoria, which began regulating medical dispensaries in 2016, the numbers are similar, with about seven of the first 13 currently-approved locations also being former dispensaries.

In fact, the first medical cannabis dispensary to receive a business licence from a local government in not only BC, but all of Canada, Tamarack Cannabis Boutique in Kimberley BC, was also the first fully legal non medical store issued a licence in BC.

While none of these stores were entirely legal prior, as medical cannabis retail stores were not federally legal at the time, many cities in BC took a lead in building local bylaws to regulate these stores anyway.

We believe in this industry, and we believe we’re going to play a part in bringing back the spirit of what it used to be. If we just hand the industry over to all the suits, then we’re never going to get the quality that we want. So we need those legacy retailers, we need those legacy growers, and we need them to transition. Those are the people that created the industry and those are the people that should benefit from the industry.

Dominic Mateer is the co-founder of Up In Smoke

Not all of the hundreds of dispensaries that had, at one time or another, operated in BC have transitioned, or even attempted to, but the fact that such a large portion have shows that the roots of cannabis activism and entrepreneurism are still finding their way into the new legal landscape. It also highlights how an often progressive attitude by British Columbians and many municipal policy makers helped pave the way for that transition.

Although Vancouver was the most noteworthy, being a large and well known city, Kimberly BC, population 7,500 was actually the first. Victoria, BC and other cities followed later on, passing bylaws that didn’t actually make the business or their activity legal, but regulated the buildings and owners in a way that gave cities a semblance of control over the massive proliferation of illegal medical retailers that had exploded exponentially across the province in the wake of Trudeau’s announcement in 2013 of his intention to legalize cannabis.

This effort arguably helped pave the way for many of these businesses to then successfully transition to a fully legal market by creating bylaws that ran business owners through security checks and established rules around things like dancing measures from schools or other cannabis retailers, that were often mirrored in non-medical retail regulations.

“We knew legalization was coming. We didn’t know when, but we prepared for it. We followed the city’s rules and got the city’s licence as soon as we could. We went above and beyond their rules, we made sure to pay our taxes, we made sure to keep accounting records, which definitely helped a lot.”

Mike Babins, the co-founder and owner of Evergreen Cannabis

Evergreen Cannabis – Licensed December 2018

Mike Babins, the co-founder and owner of Evergreen Cannabis in Vancouver’s Kitsilano neighbourhood, had been operating a medical cannabis dispensary since September 2015, when the city began issuing their Medical Marijuana Use regulations (MMRU) licenses. He operated until October 2018, and then opened again in January 2019.

Babins says he thinks taking the time to follow the city’s rules definitely helped them on the path to full legalization.

“It definitely put us on the right path,” says Babins. “We had to go through the same steps that everyone else had to go through, but I think in some ways it may have been easier for us than other stores that were trying to transition because we had been thinking a few steps ahead since the day we opened.

“I think we had a leg-up because we already were opened and had a following that helped us a lot with the transition. I’ve noticed the stores that opened out of nowhere just didn’t have the street cred right away. The majority of our regulars have stayed with us. And we’ve also attracted a lot of new people.”

MIKE BABINS

“We knew legalization was coming. We didn’t know when, but we prepared for it. We followed the city’s rules and got the city’s licence as soon as we could. We went above and beyond their rules, we made sure to pay our taxes, we made sure to keep accounting records, which definitely helped a lot.”

Still, he says, the process of becoming fully legal wasn’t easy. In order to make the final transition Evergreen was forced to close their old business for about three months before they were able to begin selling legally, while still paying rent and staff in order to ensure they could hit the ground running once licensed.

“It definitely was not seamless,” says Babins. “We thought we would be able to just easily transition, but the province called us up just before October 17 (2018) and said ‘you guys are so close to the end of getting a licence, if an inspector comes and you have an illegal product on site, you will lose everything’.

“So what we did on the last day before legalization, we liquidated all the product in the store, then the next day we did a thorough cleaning to make sure nothing was left on site, and then we kind of suffered for the next several months while we kept on all our staff and stayed open just selling accessories.

But having a loyal clientele, along with an established brand and location helped them hit the ground running once they were able to open in early January 2019, he says, as Vancouver’s first legal non-medical cannabis store.

“You can get good deals in the black market on larger quantities than we can sell, but if you look at per gram pricing, or maybe for an 8th or a quarter, it’s the same. In our shop today we have an 1/8th of MK Ultra for $15. That matches or beats any prices I have seen in the black market for years.”

MIKE BABINS

“I think we had a leg-up because we already were opened and had a following that helped us a lot with the transition. I’ve noticed the stores that opened out of nowhere just didn’t have the street cred right away. The majority of our regulars have stayed with us. And we’ve also attracted a lot of new people.”

Babins says he doesn’t see as many illegal shops in Vancouver as even just a year ago, as more either transition to the legal market, or just shut down. But he says he doesn’t hold any grudges on those who do stay open.

“If you’re choosing to stay that route, all power to you,” he says. “It’s not on me to stress how you’re doing business. All I can do is focus on my own, you do your thing. It’s the customer’s choice. If they are comfortable with the product, if they like you as a person, that’s fine. If they want to try the legal market, we’re here. But if we spend time focusing on everyone else we won’t have time to get our own work done.”

Prices not much different than legacy market

As someone who operated in the pre-legalization market, Babins says he thinks a lot of the claims that prices and quality are worse now are not really accurate. While he admits quality and selection weren’t great on day one, he says he’s seen it improve a lot since that time, and that save for bulk purchases of products over an ounce, prices are pretty much the same now as when he was selling in the legacy market. Before legalization he says the average price in his store was about $6-12 per gram and remains about the same today.

“The value brands and the bulk packaging is definitely different,” says Babins. “You can get good deals in the black market on larger quantities than we can sell, but if you look at per gram pricing, or maybe for an 8th or a quarter, it’s the same. In our shop today we have an 1/8th of MK Ultra for $15. That matches or beats any prices I have seen in the black market for years.”

“It’s definitely not as profitable as it was in the old days. People used to drive from far and wide to come here and they don’t have to do that now because there are stores near them. But I also recognized that even then it was a very artificial environment and it wasn’t going to last forever. It lasted three years and those were a really great three years. But I can still make a living for myself and my staff member, who is paid well.”

Tamara Duggan, the owner of Tamarack Cannabis Boutique

Tamarack, Kimberly BC

Tamara Duggan, the owner of Tamarack Cannabis Boutique in Kimberly BC, who made headlines in 2016 when Tamarack Cannabis Boutique became the first medical cannabis dispensary in Canada to receive a business licence, says she also believes the process of working with the city early on to be licensed for medical cannabis helped prepare her for legalization.

Duggan says she applied for her non medical retail cannabis licence as soon as the application process with the province opened in August 2018, and received her licence in November. They opened for business again on November 9 after closing in October, liquidating her old supply and preparing her store for the final provincial inspection before her licence would be issued.

Despite having an early start, though, Duggan says it still hasn’t been easy. While before she enjoyed a more captured market prior to legalization as one of the few stores anywhere in her region, she now has to not only compete with other private retailers, but with a nearby BC Cannabis Store that is larger and is able to sell at lower prices. Plus, she adds, the profit margins are much tighter in the legal, non medical market than it was while operating in the legacy market.

Not as fun or as profitable

“It’s definitely not as profitable as it was in the old days. People used to drive from far and wide to come here and they don’t have to do that now because there are stores near them. But I also recognized that even then it was a very artificial environment and it wasn’t going to last forever. It lasted three years and those were a really great three years. But I can still make a living for myself and my staff member, who is paid well.”

“It’s not an ideal situation for the private retailer and certainly not for the faint of heart. You just want to accommodate the people in your community who don’t want to drive to the government store. It comes down to customer service, to knowing the product, and listening to and helping your customers. We can’t compete with the BC Cannabis store on price, but we can provide a better experience.”

Tamara Duggan

“For another thing,” she adds, “it’s not nearly as much fun now as it was before. Primarily because right now I just go to the government website, make an order, and I’m done. Before I had to source our product, so that meant investigating different things, and people were constantly sending me free samples. So that was awesome and I don’t get that any more. Now the LPs send me emails to entice me, or free swag like shirts and hats and stickers, which is great, I guess, but it’s not quite the same as free (cannabis products).”

Despite this, Duggan says she still loves what she does and thinks Tamarack is in it for the long haul. She had to lay off several employees when she transitioned to the legal space, primarily because she had been using many to package her own product, something no longer necessary when products come prepackaged from the producers. And the nearby BC Cannabis store has siphoned off some of her business. But she says she is confident she can serve her clientele well and keep their business, focusing on better customer service and a long history in the industry and the product knowledge that comes with that.

“It’s not an ideal situation for the private retailer and certainly not for the faint of heart. You just want to accommodate the people in your community who don’t want to drive to the government store. It comes down to customer service, to knowing the product, and listening to and helping your customers. We can’t compete with the BC Cannabis store on price, but we can provide a better experience.”

Like Babins, Duggan says she sees prices for dried cannabis are relatively close to what she used to charge, although product variety and selection is not the same.

“I was selling for pretty much across the board at $33 an eighth before legalization. Now it’s still in the $30s for an eighth, but it’s not quite as cheap as before. Maybe the high $30s now. On average they’re all above the $33.”

“I was selling for pretty much across the board at $33 an eighth before legalization. Now it’s still in the $30s for an eighth, but it’s not quite as cheap as before. Maybe the high $30s now. On average they’re all above the $33.”

TAMARA DUGGAN

Edibles not affordable

Other products, like edibles, she says are far more expensive. Calling the limit of 10mg per package a “disaster”, she says the extra cost and packaging is a big turn off for many of her customers, especially ones who were used to products she used to sell at much cheaper price points.

“We all agree that 1000 mg for a candy or cupcake is ridiculous, but we think 100mg is sufficient per package. Consumers are absolutely not happy with that. In the past they could buy a gummy candy from us for $12.60 with a tax that was 80 mg. Now it’s around $10 for 10mg.

“If at one point you could buy a handful for maybe $60 and you’re getting a lot of product to last several weeks. Now if they spend $60 that might get them through 2-3 days, so it’s just not feasible.

To address this she says she has begun selling candy-making kits for consumers, selling them the cannabis oil and molds and recipes to add it to candy that they can dose out accordingly.

“Also, the lack of extracts,’ she adds. “Extracts were a huge thing from day one in the old business. Hash, shatter, wax and concentrate like phoenix tears. But we’re just now getting hash and bubble hash, kief just now, but the extracts that people want like shatter or phoenix tears, there’s nothing on the horizon yet so people are constantly asking and we’re saying we have to wait and see. So that’s a disappointment for the consumer who really likes the more concentrated product they’re not happy with what is available right now.”

“A micro-processor or grower would, I think, be delighted to deal with someone small who only wants a small amount. If I could buy from someone locally here who I have a relationship with, that would be ideal.”

tamara duggan

Rebuilding relationships with small batch growers

Duggan says ideally she would like to once again develop relationships with smaller growers in her area, similar to how she used to source products in the black market. Although she knows the BC government won’t currently allow it, she says she’s open to it and hopes the province will listen. While she can’t see larger producers being willing to deal with individual retailers, she could see the benefit of smaller, independent retailers like herself developing relationships with micro and craft producers who have smaller batches that are more realistic for individual stores, rather than the provincial distributor.

“A micro-processor or grower would, I think, be delighted to deal with someone small who only wants a small amount,” says Duggan. “If I could buy from someone locally here who I have a relationship with, that would be ideal. But I don’t know how likely that will be.”

She says she sees the benefit of the provincial distributor when dealing with larger cannabis producers, but for smaller growers with smaller batches of cannabis, sees an opportunity to allow a more direct grower-to-retailer relationship.

“If I could buy directly from a micro producer I totally would, although I have no interest in buying directly from a bigger LP. I am not a big player, so if I dealt directly with an LP I wouldn’t be a priority. That is one benefit of the LDB, it helps level the playing field. If you only want one case of something, if the LDB buys a large order, you can still get just one unit. So I think that’s actually more fair when dealing with a large producer. But I would be happy to deal directly with a micro cultivator or processor.”

“At the end of the day, I think clients who used to shop with me are going to find that now, two years later, prices are much more in line with what we were used to. I’m going to be selling eighths for $25-$35, much like I used to. I’m also going to have the much higher-end eighths for $50-60, which is something I used to also have on my menu.”

Dominic Mateer

Up In Smoke – Licensed April 2020

Dominic Mateer is the co-founder of Up In Smoke, another legacy-era Vancouver dispensary who was recently licensed by the city, with plans to open by mid June.

Up In Smoke operated in their current location on Broadway under a different name since 2014, before closing down the day before legalization, on October 16, 2018, following direction from the provincial and municipal government. Mateer and his partners then parted ways with a former business partner and spent much of 2019 preparing to apply for a retail licence from the province. The new business applied in September 2019 and received their license in early April of this year.

He says the entire process has been a long one, with the business having to sustain numerous operating expenses to maintain their retail location for 18 months without any business, plus the tens of thousands in regulatory fees to the province and City of Vancouver, but he’s excited to soon reopen and begin operating in a new, fully legal market.

Despite a common public perception that the products and prices on the legal market aren’t comparable to what was historically available in the black market, Mateer also says he sees the legal market improving considerably in the past year and a half, with prices coming down and quality and product diversity increasing.

“ I think by the end of the year we will see a market that is much closer to resembling what we left in the legacy market than what recreational looked like at even the beginning of this year.

DOMINIC MATEER

Prices and quality are improving

“At the end of the day,” says Mateer, “I think clients who used to shop with me are going to find that now, two years later, prices are much more in line with what we were used to. I’m going to be selling eighths for $25-$35, much like I used to. I’m also going to have the much higher-end eighths for $50-60, which is something I used to also have on my menu.”

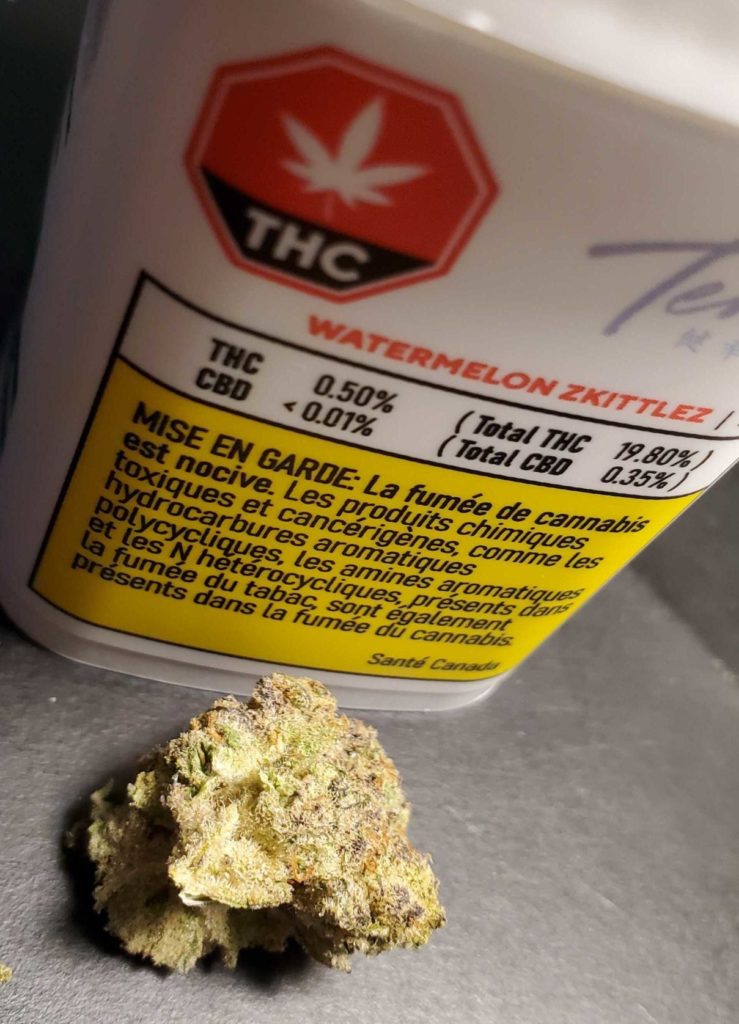

While some prices are higher, he says this is reflected in quality, and he, like Duggar, says he looks forward to a more mature market with more new, unique and even limited-run varieties that he can offer to entice consumers to his store.

“We used to be known as a store with really exclusive, hard-to-get genetics and people would come in and spend $40, $50, $60 an eighth no problem,” says Mateer. I think the selection and the range of prices is comparable. I think the quality is starting to get there. So we’re paying the same kinds of prices we used to, kind of, but the quality isn’t quite there yet. If we charge $35 an eighth, that might have been a quality level that we would have sold for $25 in the legacy market. But it’s close. And it is getting better.”

From shopping in the legal market, talking with producers, and buying products for his store, Mateer says he’s already seeing more small batch producers with more unique, interesting genetics that he says consumers are looking for.

“No one cares about Sensi Star and White Widow and Jack Haze. Especially not in BC. People want the new thing, like Gelato and Sherbet and Cookies, Zkittles, and OG’s, all the fun stuff. I think by the end of the year we will see a market that is much closer to resembling what we left in the legacy market than what recreational looked like at even the beginning of this year.”

In his experience, he also says he thinks the LDB is aware of these demands, and is responding to retailers who are demanding something better than over-dried, mass produced weed from big LPs.

We’re starting to see good genetics, well-cured products, and very recent packaged dates. It’s coming fresh, with tons of terps, it’s not over dried, or yellow. I would say that I don’t fully disagree with people who say it might be overpriced and the quality isn’t there, but we’re making huge strides.

DOMINIC MATEER

The LCB is improving

“(The BC LDB) are very eager to get this craft market available to BC. They’re very eager to get BC producers represented in the LDB. From what I have seen, I think they recognize the shortcomings that they have had up until recently. They are listening to consumers and retailers. They have even recently put out a product request form for retailers, asking to hear what specific products they need to bring into the market. So it’s important that (retailers) give them feedback. They take it well and they are open to dialogue.”

“Things are getting better. If you had asked me at the end of 2018 or even the beginning of this year, I would say the quality isn’t there. But just in the last three or four months, the level of quality and products that I’ve seen coming through the store in my wholesale orders, has gone up so much more that I’m actually able to stand up behind the product I’m putting on my shelves.

“We’re starting to see good genetics, well-cured products, and very recent packaged dates. It’s coming fresh, with tons of terps, it’s not over dried, or yellow. I would say that I don’t fully disagree with people who say it might be overpriced and the quality isn’t there, but we’re making huge strides. A lot of the bigger LPs are really big, but there are other LPs out there that have 20 light rooms, that have cool genetics, and there are lots of cool things coming out now, so I’m excited for this summer.”

The biggest difference when it comes to price, he says, is the wholesale prices he buys at. The cost of operating a store in the legal market is much higher than in the illicit space.

“You can probably get a store opened for a few hundred thousands, but I think most stores in Vancouver are spending well over that.,” says Mateer. “Just the product alone is so much more expensive than the legacy market. The average price per gram available to us is about six dollars a gram wholesale, which is double what we used to pay. Then there’s the licensing costs, which, between the city and province, are almost $50,000 a year.”

The path has been long, with a lot of ups and downs, but Mateer says he and his partners are in it for the long run, because they are passionate about the plant and about the consumers who share their passion.

“It hasn’t been easy, but we didn’t come in just to give up easily. We started in 2014 when there were about 40 stores around, we saw it go up to 200 stores in Vancouver, and we have seen it go down to where it’s at now, with around 20 stores, and we’re one of them.

DOMINIC MATEER

More legacy growers and retailers needed

“This is the whole reason I got into it, to do this,” he says. “It hasn’t been easy, but we didn’t come in just to give up easily. We started in 2014 when there were about 40 stores around, we saw it go up to 200 stores in Vancouver, and we have seen it go down to where it’s at now, with around 20 stores, and we’re one of them.

“This is what we’ve been working for, for about six years now. So we’re here for the long term. We believe in this industry, and we believe we’re going to play a part in bringing back the spirit of what it used to be. If we just hand the industry over to all the suits, then we’re never going to get the quality that we want. So we need those legacy retailers, we need those legacy growers, and we need them to transition. Those are the people that created the industry and those are the people that should benefit from the industry.”