Retail sales have continued to climb in Ontario as the province ramps up brick and mortar licenses, the array of products increase, and prices continue to decline, according to the newest quarterly report released today for July 1 to September 30, 2020.

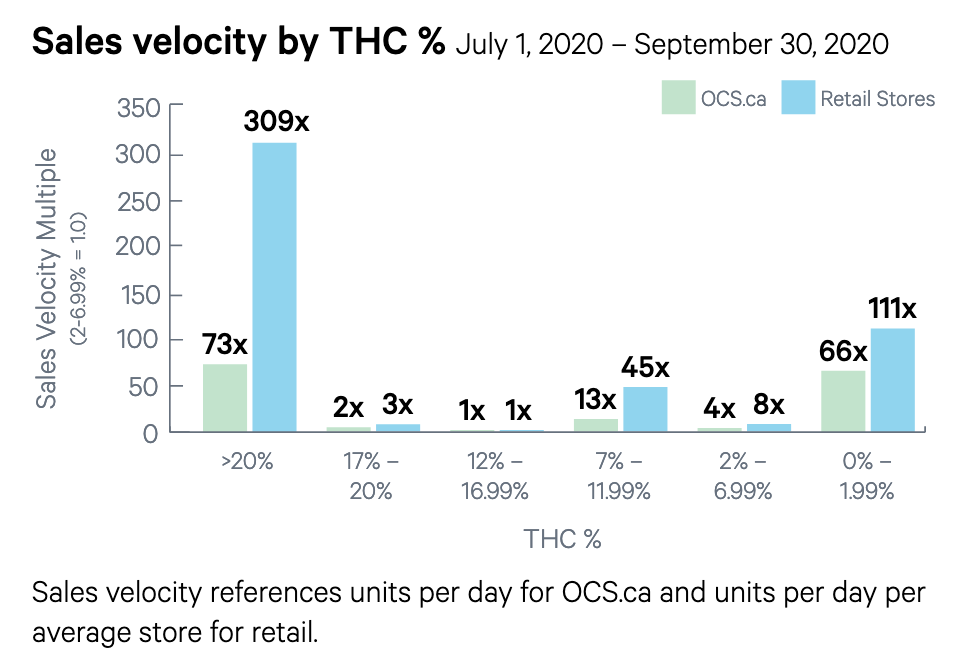

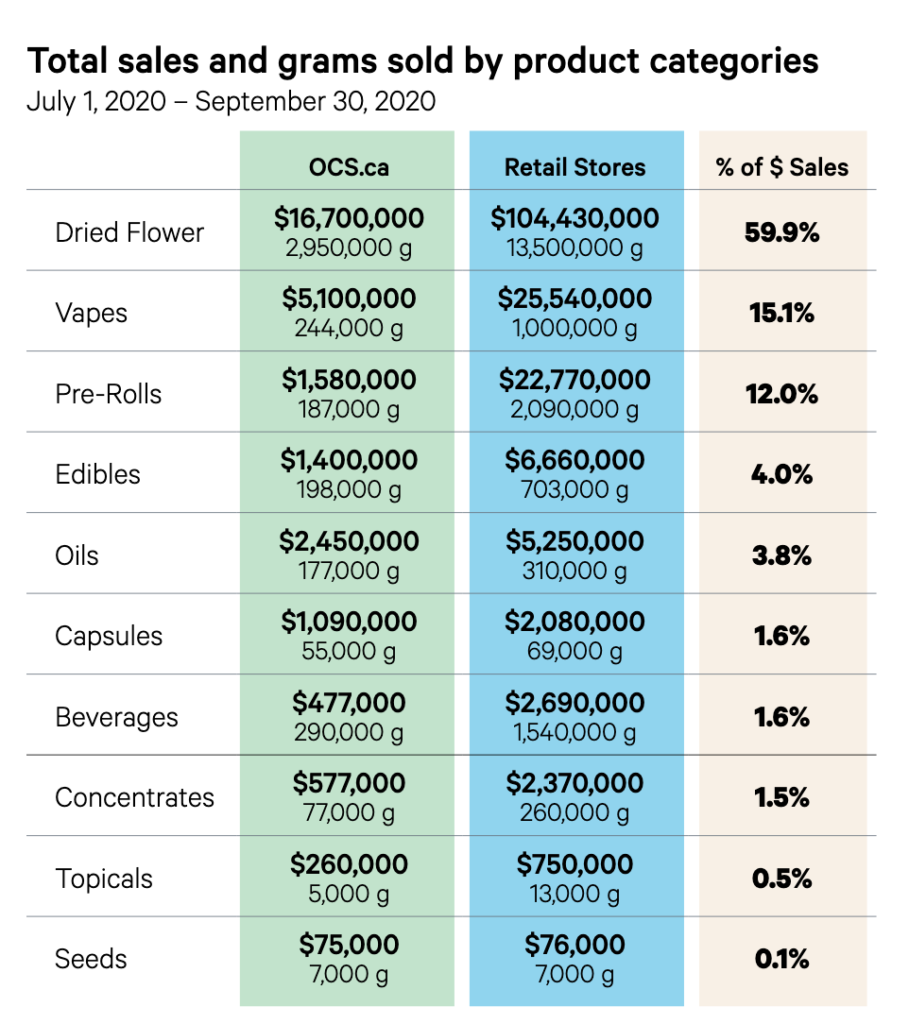

Dried flower continues to be the most popular product category, accounting for almost 60% of sales in the province, followed by vapes at 15% and pre-rolls at 12%. Edibles, oils, capsules, beverages, concentrates, topicals and seeds accounted for just over 13% of sales, combined. The majority of dried flower sales continued to be in the 20%+ THC category, followed by high CBD products with a range of about 0-12% THC.

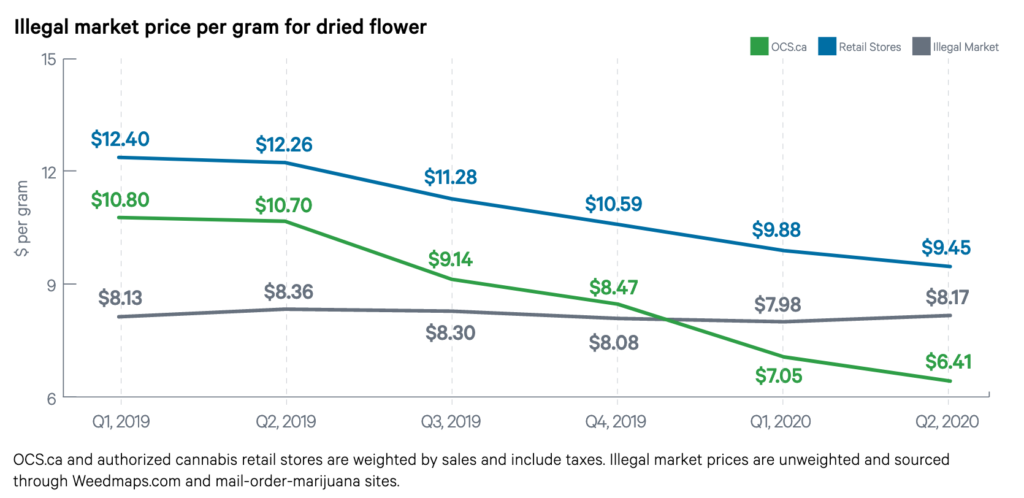

The average price of dried flower on the OCS.ca dropped to $6.41 a gram, driven largely by the increase in availability of 14-30 gram packages. This is well below what Statistics Canada says is the average price per gram on the illicit market, at $8.17 a gram. The drop in the price of dried flower is largely attributed to the increase in availability of larger amounts of dried flower in 14-30 gram containers.

Private retail sales dominate

Of the $204 million in sales in the Ontario cannabis market this past quarter, the vast majority (85%) of those sales were in province’s growing network of private retailers. Private retailers sold $173,900,000 worth of cannabis from July 1 to September 30, 2020. The OCS.ca sold $30,500,000 worth of cannabis in the same time period.

The province had 183 stores by the end of September of this year, an increase of 73 from the previous quarter. The province currently has more than 280 stores, following a recent announcement to increase the pace of authorizations to 20 per week.

The continued increase in stores and sales has led to the single largest jump in market capture since legalization. 36.2% of cannabis sales in Ontario came through the legal market, up 10% from the previous quarter, based on Stats Canada numbers.

Ontario continues to lead the country in sales, capturing 28.6% of national legal sales, followed by Alberta at 21.2%, Quebec at 18%, and BC at 14.7%.

The OCS sold 4,200,000 grams, while private stores sold 21,600,000, for a total of 25,800,000 grams sold in Ontario. The average order from the OCS.ca was 12.4 grams, with the average purchase price $89.42.

Retail clustering

Despite the rapid increase in retail stores, the distance Ontarians have to drive to a store has not changed much since the previous quarter (from 19km-18.5km), with most new stores clustering in regions where other retails are already operating. This increase in retail stores also means average sales volume is decreasing, as these stores compete for the same market.

Although stores are increasingly fighting over market share, the average monthly order per store remained about the same as the previous quarter, at 15,900 units per month.

sales do not add to total sales due to rounding. Dried flower equivalency (DFE)

conversion can be found here.

New retail stores a priority

The OCS says their main priority in the coming year will be the addition of new retail locations. Ontario initially lagged behind other provinces with the rollout of private retail stores, but has since been rapidly ramping up approvals of retailers. Ontario had no retail stores for the first six months of legalization, followed by a lottery that authorized only two dozen until the fall of 2019 when it began issuing new licences.

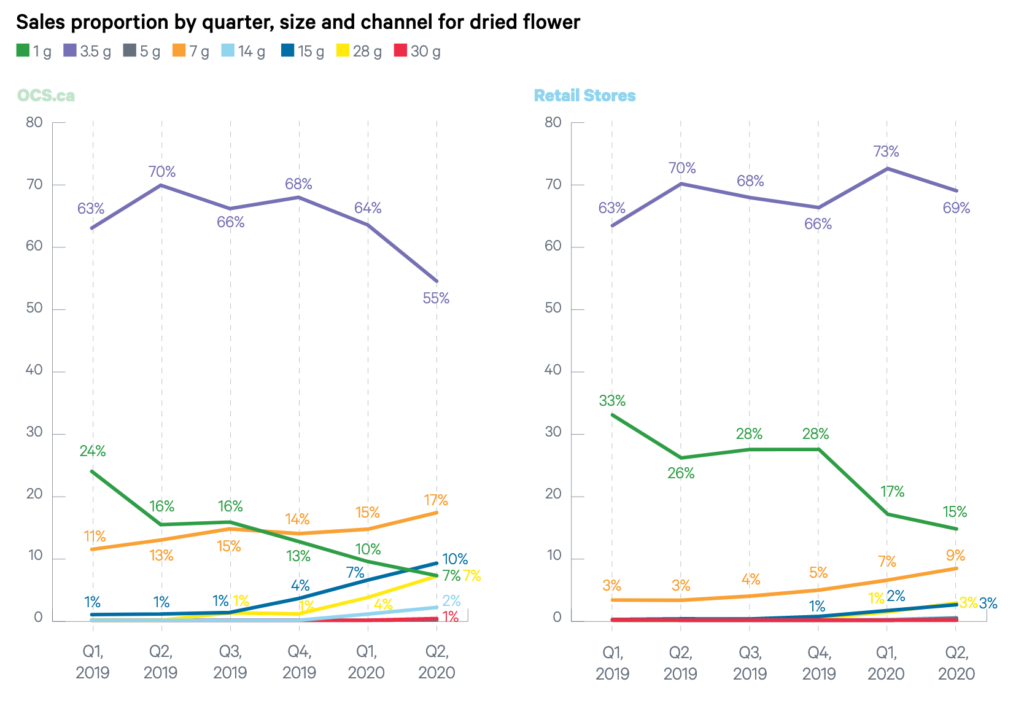

Sales of 1 gram and 3.5 grams packages of dried have declined in the OCS.ca online store, while 3.5 gram containers continue to slightly increase in sales at brick and mortar retail locations.

Despite the decline on the OCS.ca, 3.5 gram containers remain the most popular product in both sales streams, but the availability of 14-30 gram containers of dried flower earlier this year showed a significant increase in online sales for 20% of total sales. For retail stores this category combined is about 15% of sales.

The OCS.ca had 3.1 million unique visitors, down significantly from 5.3 million in the previous quarter, but still up from previous quarters.

Surveys from the OCS show that consumers prioritize purchases based first on quality, then potency (THC level), then on price and product description. Sustainable packaging was only a factor in purchase decisions in about 50% of sales.

New distribution centre

The OCS also began transitioning to their new, larger distribution centre in Guelph in the past quarter. The transition is expected to be complete in the spring of 2021 and will allow for more storage space for even more product categories, as well as more automation to assist in order delivery times for retailers and consumers. On average the warehouse took about 2.43 days to ship produce for its private retail customers.

The number of wholesale orders in Q2 that were processed by OCS more than doubled to 1,884 from the previous quarter, with stores ordering an average of 15,900 units per month.

Craft designation in 2021

The OCS also plans to be offering new product categories in the coming year, including an emphasis on craft and outdoor products. The tentative craft category will potentially look at establishing an annual capacity of about 10,000kg of dried flower, and will require products to be hand trimmed and packaged. Details on this new proposed plan could change in the coming months.