Some cannabis growers who sold through the Shelter Market brand say they’ve been left unpaid after the company announced they were closing earlier this year.

In a series of tweets on January 25, Shelter announced that Agro-Greens, the licence holder behind the Shelter brand, was closing the Shelter Market medical platform.

Shelter Market was a popular online platform that allowed people to order directly through the national medical cannabis program. The sudden announcement left many of its registrants wondering where they would order their cannabis from. While patients were able to migrate over to Mendo’s new platform, many suppliers selling products through Shelter say they’ve been left in the dark and without payment.

If the money is gone, the money is gone. But say it. That’s my biggest issue, we need answers here.

Adam Anger, Greenterra Cannabis

Adam Anger of Greenterra Cannabis, a micro cultivator in Ontario, says his company didn’t typically sell through Shelter but had recently sold a small batch through the company in December of last year. Then in January, he received the same email others in his shoes received informing them that the medical platform was closing.

He says that was pretty much the last time they heard from anyone at Shelter or Agro-Greens.

“I have other businesses. I know stuff happens. The biggest thing is communication. If the money is gone, the money is gone. But say it. That’s my biggest issue, we need answers here. I hate being left in the dark.”

Mark Corrigan, President of Distinkt Cannabis in Ontario, says his company recently sold a small lot of dried flower through Shelter. They received partial payment near the end of the year before receiving an email on January 25 saying the company was closing.

“We didn’t get much information on what happened other than just a notice of closure email and that Agro-Greens was working through the accounting side and, hopefully, we would get paid something.”

Although all contracts any suppliers signed to sell through Shelter Market were with Agro-Greens—who holds the necessary federal processing and sales licences—the growers we spoke to say it was always Shelter employees they interacted with.

“Shelter was running the company,” continues Corrigan. “It was Shelter’s people that everyone was involved with. Agro-Greens might have had the licence, but we had no connection to Agro-Greens other than it was on the paperwork.”

Corrigan says the amount they are owed is relatively small, so he’s not overly concerned, but feels frustrated at the lack of communication and what he describes as both Agro-Greens and Shelter blaming each other.

All of our business dealings were with Shelter, doing business on behalf of Agro-Greens.

Josh Udala, Organnicraft

“There are too many question marks in this story. Shelter knows more than they say they know.”

One supplier who has done a considerable amount of business with Shelter and Agro-Greens is Josh Udala at Organnicraft. The BC micro cultivator had been selling under the Shelter Market platform since May 2020 and says he’d had a good relationship with the team.

Payments had been more or less on time, and he was happy with the company until January, when he says he was told they wouldn’t be able to make a final payment on several large batches sold in the last quarter of 2021.

“Up until January everything was fine,” says Udala. “They always paid us. There was nothing alarming, nothing that concerned me.”

Then in January, he says he was told they didn’t have the money to pay him back. He’s now working with legal counsel on the issue. Like Corrigan, Udala says that while all their contracts were signed with Agro-Greens, he feels misled by the individuals he dealt with at Shelter who were ultimately the face of the company.

Although he affords that some lower-ranking team members might not have known, he says he finds it hard to believe that upper management was unaware of the financial difficulties even as they continued to bring in new clients.

“There were only two occasions in the last eighteen months that I ever dealt with someone who actually worked directly for Agro-Greens,” says Udala. “All of our business dealings were with Shelter, doing business on behalf of Agro-Greens.”

“When you sign a contract with them, you deal with the Shelter employees to do business. They portray themselves as the CEO, the COO, the CCO, the Director of this or that at Shelter. Yes, all the contracts are signed with Agro-Greens; however, you deal with Shelter unless you’re dealing with batch releases or certain pieces of paperwork that have to run through the facility. You negotiate prices with Shelter. So what does that tell you?”

Although these growers say they feel the responsibility of the decision to close Shelter lies with Shelter’s leadership, David Purcell, the former Chief Commercial Officer at Shelter, argues that the decision was ultimately made by Agro-Greens.

“Shelter and Agro-Greens are and always have been two separate companies,” Purcell told StratCann. “Agro-Greens is the licence holder. Agro-Greens is the producer. Shelter owned the brands and the IP, and Agro-Greens produced for Shelter.”

The relationship between the two companies, he emphasizes, was that the Shelter Market medical platform was all owned by Shelter, but the patients/clients were “effectively held and administered by Agro-Greens.”

Because of this, he says it wasn’t possible for Shelter to have been responsible for any of those arrangements.

“Because Shelter had no licence, we couldn’t have made those deals even if we wanted to. So all of the relationships from a vendor perspective and from a raw materials perspective, all of those deals were Agro-Greens’ deals.”

“Agro-Greens notified us, Shelter, that they were going to be ceasing operations and, as a result, they would no longer be able to support Shelter Market because they’re stopping their operations.”

A representative for Agro-Greens ultimately declined to provide comment for this article.

The growers we spoke with said they think the issue highlights another pain point that they often face: how long payment on a crop they grew can take. While the grower can spend months just to get a successful crop out the door, it can be weeks or months before they receive payment for it.

This whole experience has definitely made us more cautious in choosing who we deal with and what payment terms are involved.

Brad Marta, Living Cannabis

“The terms are set up for producers to get paid last,” says Corrigan at Distinkt. “What I’ve learned is that I’m not going to dive into any more deals where we’re the last ones paid. Going forward, I’m going to be a lot more cautious.”

Adam Anger at GreenTerra shares a similar sentiment

“We put all the money into growing the product and we’re the last to get paid. There are so many middlemen involved, but we’re the one who has to take the hit if something goes wrong. That’s the problem.”

Brad Marta of Living Cannabis, a micro cultivator in BC who also sold products through Shelter Market, says he’s still seeking information on payment from Agro-Greens and agrees that the issue is a systemic one.

“The reality is, under normal circumstances, this industry is extremely difficult for a micro cultivator with limited funding resources, etc. We have to carry a large number of costs to get our product to market, relying on the trust we have with our processor once we hand over tens of thousands of dollars of product to them.”

Although Marta says he has a great relationship with another processor, he sold a small batch through Shelter late last year, like Corrigan.

“We’re frustrated that we didn’t see this coming, and perplexed how they could knowingly do this to a number of craft growers. This whole experience has definitely made us more cautious in choosing who we deal with and what payment terms are involved. It’s also been an eye-opener, knowing that there could be more of this happening with the current market prices.”

For him, it’s an example of yet another hurdle for small growers like himself who are struggling to make things work in an industry with cutthroat margins and an array of taxes and middlemen.

“I would just advise other micro cultivators to be cautious,” he says. “It’s easy to have pie in the sky dreams of getting into this industry, but there are many factors at play working against you. Build a relationship with a processor, visually see their facility if possible, and meet the people there. Aside from the industry creating some sort of certification system, or the government allocating a set portion of their payouts directly to the cultivators, we’re still having to work on gut instinct and trust with a processor.”

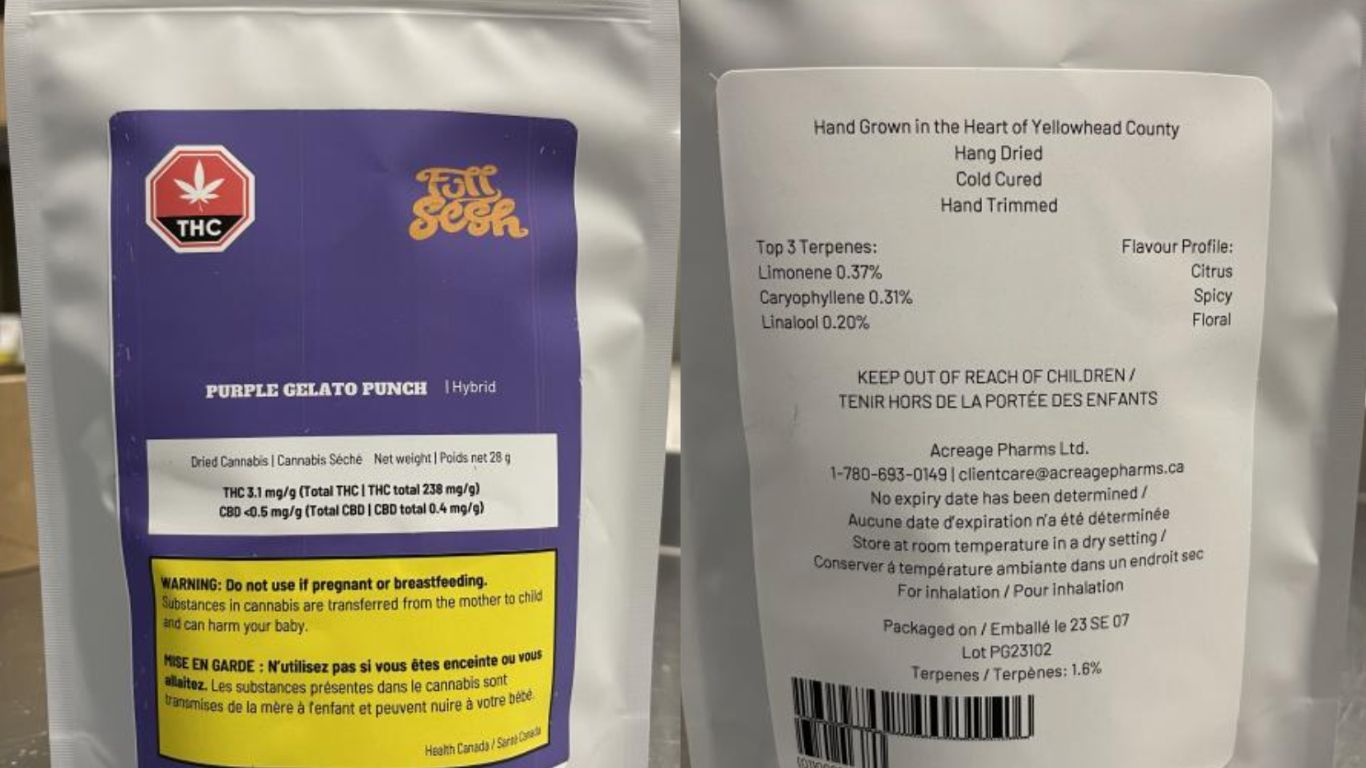

Featured image via David Wylie, The Oz.