The Canadian cannabis market puts an emphasis on THC levels, with a heavy bias toward flower that’s 20% THC, or higher. As a result, many quality products are denied access to the supply chain, and the consumer is being underserved.

“I think this is a direct result of not understanding the importance of the role the broker played in the illicit market,” says Jamie Shaw, a director of the BC Independent Cannabis Association, and an advisor to the National Institute for Cannabis Health and Legalization (NICHE). “Provinces that decided to become brokers typically tend to try and treat it like alcohol, so THC percentage as a marker makes sense to them. The problem is that the broker’s job is even more important when retailers are buying flower sight unseen.”

Provinces that decided to become brokers typically tend to try and treat it like alcohol, so THC percentage as a marker makes sense to them.

Jamie Shaw, BC Independent Cannabis Association & NICHE

Given that the challenge is systemic, it’s fair to say that the market’s emphasis on high-THC cannabis has no single culprit. That said, it is also true that there’s been a lack of leadership among critical stakeholders, in part because there’s little motivation to change. Licensed providers (LPs) get a better price for more potent flower, labs are pressured to deliver results, and the entire marketing chain – from cultivator, to provincial regulator, to budtender – builds incentives around potency.

“Part of the challenge involves the complexity of the product, which has only been legal for a few years,” says Cheri Mara, Chief Commercial Officer, Ontario Cannabis Store (OCS). “The market is still maturing. If you look at the early days after alcohol prohibition, the government was selling bottles in brown bags from behind a counter.”

I expect that cannabis will become more like wine, with products known according to factors such as geographical origin and breeder information.

Cheri Mara, CCO, Ontario Cannabis Store

The OCS, like other regulatory agencies, markets Cannabis according to simple identifiers such as Indica, Sativa, or Hybrid – distinctions that are of limited meaning – as well as THC levels. However, this narrow emphasis is likely to change as LPs respond to more sophisticated consumer demand, and embrace more complex marketing strategies.

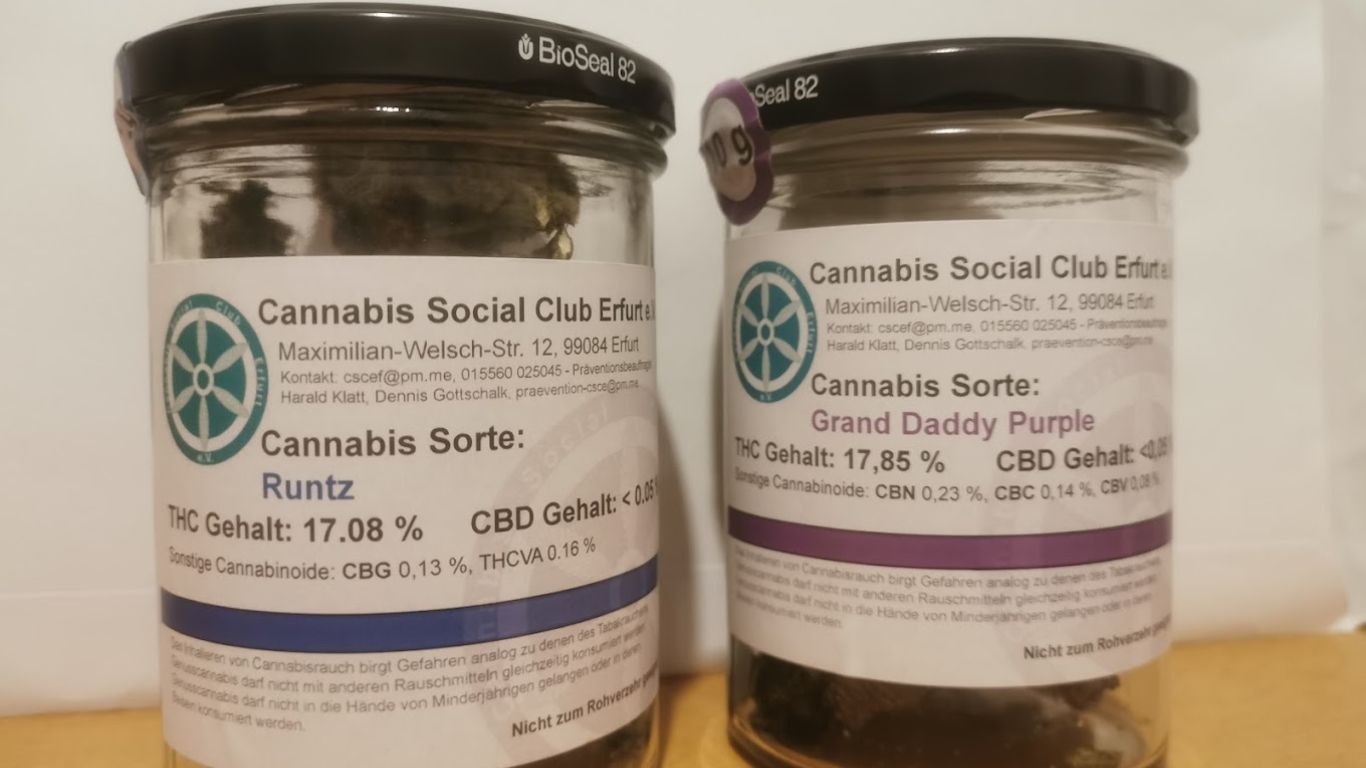

“In the early days, THC potency was easy to communicate,” says Mara. “In the future I would like to see terpene percentages, too – for me as a consumer that’s more important than THC. The OCS has a role to play in communicating that, by working with industry and partners. In effect, I expect that cannabis will become more like wine, with products known according to factors such as geographical origin and breeder information.”

It’s good news that the OCS – Canada’s largest cannabis online retailer and wholesaler of recreational cannabis – wants to provide more detailed information to consumers. However, at present the market across Canada is held captive to a near-obsession with THC levels. That’s hard to break, particularly given the financial incentives.

“We are absolutely caught in that loop,” says Shaw. “I’ve seen some amazing flower that ultimately didn’t get picked up due to fear the provinces wouldn’t like the THC level. It also isn’t helped by less educated consumers trying to get the most bang for their buck.”

Some micros, and a few independent advocates, are willing to push for a more sophisticated understanding of cannabis, but it’s been an uphill battle. The reasons are obvious enough: if LPs, labs, and governments are making money with a simplistic, THC-based value model, then there isn’t much incentive to change.

“Buying cannabis based purely on the THC percentage is like buying alcohol purely for the highest alcohol content,” says Nick Jikomes, PhD, Director of Science & Innovation at Leafly. “When I buy alcohol, I don’t purchase pure ethanol and buy the jug. I buy beer or wine that tastes good to me, from brands that I know and trust. Likewise, when I buy cannabis, I don’t buy pure distillate with 99% THC content.”

It’s actually created a serious problem in the industry: many products are tested at labs producing inflated THC results

Nick Jikomes, Director aof Science & Innovation, Leafly

THC and other compounds can produce different effects based on the strength and dose, as well as the receptivity and tolerance of individual consumers. For Jikomes, this speaks to the importance of consistency, and of a marketing message that moves past THC levels to include terpenes. (Leafly has a cannabis guide that colour-codes the various terpenes.)

“Cannabis flower that tests below 20% is harder for retailers to sell, and it’s almost always cheaper than flower labelled above 20%,” says Jikomes. “But there’s lots of absolutely fire stuff out there that tests under 20% THC. Look for buds with lots of frosty trichomes. I often find great flower in the bargain bin of dispensaries this way.”

As it stands, the emphasis on THC levels is distorting the market. High quality cannabis that might have 15% THC can be completely ignored. As a result, the consumer is being denied access to effective products – many of which deliver an excellent experience – based on a narrow emphasis on THC.

This overwhelming desire for high THC prompts companies to produce high THC products as a way to meet the consumers’ wants — thus reinforcing the consumers’ understanding that high THC products are quality. It’s a vicious cycle.

Tianna Wait, Founder of Cannalytics Research

“It’s actually created a serious problem in the industry: many products are tested at labs producing inflated THC results,” says Jikomes. “So, if you buy some flower that is labelled as 25% THC, it might not actually be 25%. It could be much lower. Same for CBD products.”

An understanding of the role of various cannabinoids can result in a sophisticated consumer making purchasing decisions based on aroma and flavour, as much as raw potency. But despite all this, we still have a market that’s heavily distorted by an emphasis on THC levels at 20% or above.

“Though the industry has matured – and research has revealed new insights on cannabis compounds like terpenoids and flavonoids, and how they interact with one another – consumers are already accustomed to looking for high THC labels,” says Tianna Wait, founder of Cannalytics Research. “This overwhelming desire for high THC prompts companies to produce high THC products as a way to meet the consumers’ wants — thus reinforcing the consumers’ understanding that high THC products are quality. It’s a vicious cycle.”

How to break this cycle? Provincial and territorial governments have a role to play, but they tend to be market followers, and not leaders. Labs, positioned in the middle of the supply chain, tend to respond to market demands, and not drive them, though some are more closely involved in product development.

Real change, it seems, will come from those stakeholders at either end of the supply chain: cultivators, many of them micros, who care about delivering quality cannabis; and consumers, who demand more sophisticated products.

“As the consumer becomes more educated, we can introduce complexity,” says Mara from the OCS. “I believe that with cannabis we will be having increasingly meaningful conversations around product differentiation – much as we talk about wine now.”