Israel appears poised to pass a cannabis legalization bill in 2021. If it does, Israel’s regulatory framework could resemble the Canadian model to some degree.

While Israel has proposed variations to the Canadian model’s rules for its own framework, sources in both nations tell StratCann that the Canadian model, the first from a G7 country, works despite its imperfect regulations.

Nations such as Israel and others have the opportunity to use Canada as a springboard but make amendments to create the perfect framework.

Deepak Anand, Materia

Following in Canada’s path could prove beneficial for a nation already asserting itself in the cannabis space. Israel is already regarded as a leader in cannabis research and innovation. Notable leaders in the cannabis space to call Israel home include organic chemist Raphael Mechoulam, who is viewed by some as the “father” of cannabis research.

Lawmakers began to ramp up efforts in the past year or so. In February 2020, Prime Minister Benjamin Netanyahu tweeted his support for the expungement of thousands of criminal records stemming from personal use and possession charges.

In the same tweet, the PM said work on a committee to examine the Canadian import model would begin, leading to an eventual legal market in the country. The decision followed a similar path made by nations like Luxembourg, which used Canada for a legalization fact-finding mission in 2019.

If it were to pass today, Israel would become the third nation to legalize cannabis after New Zealand and Mexico’s efforts came up short in 2020.

In the months since the PM’s announcement, Israel’s two leading parties, the Likud and Blue and White, issued a June 2020 joint declaration showing their desire to advance cannabis reform in Israel. That same month, two bills focusing on decriminalization and the sale of cannabis passed the preliminary readings in the country’s legislative branch, the Knesset.

By November, the four-month-long government-assigned committee of police officers, as well as the Health and Public Security Ministries, suggested that legalization was the correct path forward. The decision set forth the bills to be rewritten into a new law, with expectations for it passing in the fourth quarter of 2021.

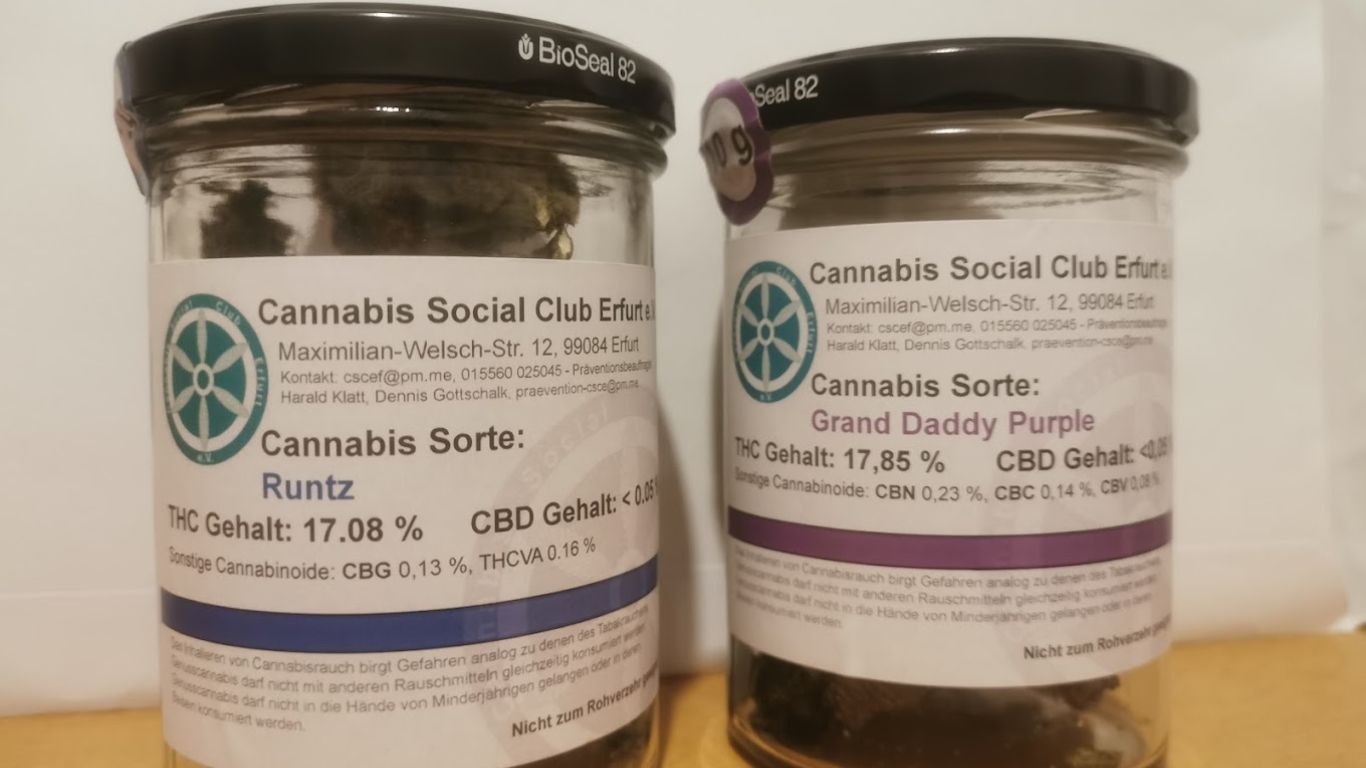

That month also saw the publishing of the first draft of the proposed bill. Per the proposal, sales to adults 21 and over from licensed operators were permitted. Standard prohibitions such as underage sales, consumption, and driving under the influence were also included. Unlike Canadian law, Israeli operators would be allowed to brand their product packaging.

An Evolving, Unfinished Canadian Framework For Nations To Replicate

Canada received credit from sources for its ability to create a thriving federal market for businesses while giving its regulations room to grow and develop over time.

Overall, Canada’s legal cannabis market hinges on a robust regulatory framework with very clear definitions, roles and responsibilities for market-players to adhere to.

ORen Shuster, International Medical Cannabis

“Canada definitely shows a path, but it isn’t the most ideal one,” stated Deepak Anand, CEO for Vancouver-based Materia. He added, “Nations such as Israel and others have the opportunity to use Canada as a springboard but make amendments to create the perfect framework.”

Oren Shuster, a Tel Aviv-based CEO of International Medical Cannabis (IMC), said that the Canadian model works well and lays out parameters. “Overall, Canada’s legal cannabis market hinges on a robust regulatory framework with very clear definitions, roles and responsibilities for market-players to adhere to,” said Shuster.

Dessy Pavlova, a Toronto-based advocate and cannabis industry marketer, said that Canada’s model is favorable because the bill is not the final framework for cannabis. She noted that current regulations do what was intended to reach the government’s initial goals, which included limiting the dangers of the illicit market and keeping cannabis away from youth.

“It’s a good system, not a perfect one, but a great starting point and foundation to find solutions to retail, medical and product development with regulations and accountability in place,” added Pavlova.

Shuster added that varying provincial laws around retail licensing and sales confuse rules, but regulations on the federal level are “clear and all-encompassing.” As such, he considers it a “no-brainer” for other nations to look at Canada’s model.

The framework’s impact on the medical market left mixed results among Canadians.

Ashleigh Brown, a medical advocate as well as founder and CEO of the medical-based women’s empowerment group SheCann, supports the model’s consideration of the medical space. “I think that one of the things Canada did right was to maintain separate medical and recreational streams,” said Brown.

Brown also credited the Canadian model for its planned revisions within the first five years of the program–with the first reviewing the program’s framework and a second in October 2023, which allows regulators and stakeholders to assess how adult-use impacted the medical market.

Others felt different. Toronto-based cannabis PR professional and advocate Alex Krause believes that a decentralized framework is a crucial reason patients have been deprioritized. He considers this concern the most glaring error in the current system, alongside the nation’s long-running inclusivity problems, which have plagued the market since its launch.

Concerns In The Current Canadian Regulatory Framework

Far from perfect, the Canadian model does present concerns at home and for nations considering going down a similar path.

Materia’s Anand said that nations must consider regional differences when crafting legislation. He cited laws around marketing and branding as one area worth reconsidering, which Israel appears to be doing.

Several sources spoke of concerns from a decentralized regulatory system that allows for variations on the provincial and territorial level. “This creates some challenges for local players who want to have a national presence as it requires them to work with multiple local regulators both on provincial and municipal levels,” said IMC’s Shuster.

Dr. Mohan Cooray, president and CEO of East York’s Cannalogue, touched on a range of concerns in the Canadian market, including high costs and a saturated market in many parts of the country.

“Licensing authorities, due to self-preservation, are blindly issuing licenses to join a battlefield filled with oversupply and insufficient demand to face doom in a Canadian tundra suboptimal to grow cannabis,” added Dr. Cooray. Other issues concerned him, noting that home grow lacks oversight concerning its four-plant per home caps, which can impact the market’s performance and demand.

Dr. Cooray also said the government lacks enforcement on the illicit market–a long-running issue for most legalized markets worldwide.

Despite the market issues, most believe that Canada’s regulatory framework serves as a foundational element other nations can use, with modification, to expand access to their nation. For now, Israel appears full steam ahead on its legalization efforts, which could lead the country and Mexico in a race of sorts to see which will be the third nation to legalize adult-use cannabis.