If Alberta is the wild west and Ontario a bureaucratic capital, things move relatively smoothly in the Maritimes when it comes to cannabis retail.

All three provinces of New Brunswick, Nova Scotia, and Prince Edward Island opted to establish publicly run cannabis retail stores when cannabis was legalized, although New Brunswick is currently seeking to sell off their public regime, with an RFP currently issued for a private entity to take the reins*.

With a total population of roughly 1.9 million across the three provinces, the Maritimes accounts for roughly half the population of Alberta and roughly a seventh of the population of Ontario. In 2019 the population of New Brunswick was roughly 775,000, Nova Scotia roughly 971,000, and Prince Edward Island 157,000.

All three provinces have brick and mortar publicly run cannabis retail stores – New Brunswick has 20 stores, Nova Scotia has 13 stores (with another 13 scheduled to open before April 2021), and Prince Edward Island has 4 stores. With 37 total physical stores open across the Maritimes today, 13 more on the way, a soon-to-be private regime, and online purchasing opportunities with home delivery, Maritimers have a relatively robust cannabis retail market.

This piece, the latest in a series on retail cannabis across Canada, takes a look at the retail cannabis scene in the Maritimes to get a feel for what’s moving, how new Cannabis 2.0 products impacted business, the potential of reaching market saturation, how sales are going, and how COVID-19 affected operations.

From Legalization to Today

For Cannabis New Brunswick (Cannabis NB), the process has been exciting, interesting, and “challenging at times as one would expect with a new industry”, according to Tom Tremblay, a press relations specialist with Cannabis NB, who noted that they offer “some of the lowest legal prices in Canada”. (However, according to a Global News analysis of retail prices across six provinces last November, New Brunswick usually had the highest price point, in one case specifically 3.5 grams of dried flower from 7ACRES cost $39.10 in PEI and $56.99 in New Brunswick.).

Having recently launched Cannabis NB Express – a pay online, pick up in-store service – Tremblay said that as the industry continuously evolves their team is “always watching closely” to see what can be done to add “more value to New Brunswickers.”

The only issue at the outset of legalization for the Nova Scotia Liquor Corporation (NSLC) – the provincial legal cannabis retailer – was securing a reliable and consistent supply of products, according to Beverley Ware, a communications advisor with the NSLC. “We don’t have those issues anymore. That was the case for the first few months, and it wasn’t unexpected, because of course, this is a brand new industry.”

Since then, the industry has matured and settled, both in terms of supply and price, says Ware, adding the NSLC is now “seeing pretty strong sales.”

At Prince Edward Island Cannabis (P.E.I. Cannabis), it’s been an “absolute thrill ride” since legalization, said Zach Currie, director of cannabis operations, adding that as a Crown corporation there is a “much more intimate” relationship with the government than other retailers experience, specifically working closely in terms of crafting government policy as it relates to cannabis retail.

“It’s the leverage with our experience in beverage alcohol, given the close relationship we have with [The Prince Edward Island Liquor Control Commission]…that we’re always looking to continuously improve as we move forward.”

What’s Moving?

As is the case in both Alberta and Ontario, the most popular product category in the Maritimes is dried flower, and unsurprisingly, consumers are also seeking to buy it in bulk.

“Dried flower continues to be our most popular category,” said Tremblay of Cannabis NB. “Ounces of dried flower are a newer size format and continue to grow in popularity as new offerings become available.”

“Dried flower high in THC that’s about 15% and up, that’s by far our most popular product, and that’s been the case literally since day one, in all of our stores and online,” said Ware of NSLC’s sales, adding that dried flower “very high” in THC accounts for more than 80% of total sales.

We have managed to expand our list of licensed producers in order to try and address those shortages, and the subcategories assisted to some extent, but as with [cannabis legalization], a large portion of it I expect will just be maturing of the industry as more licensed producers get their license to sell.

Beverley Ware, communications advisor with the NSLC

When the NSLC began offering 28 gram formats with higher THC contents it proved to be extremely popular with customers due to its lower per gram price point and because it allows customers to make fewer trips to the store (which has proven both more popular and as recommended by health authorities during COVID-19), says Ware.

“Dried flower, that’s the hero format,” said Currie referring to P.E.I. Cannabis’ sales, pointing out that while dried flower hasn’t been displaced as the top seller after the introduction of Cannabis 2.0 products, that pre-rolls are a consistent seller while large format options aren’t what customers are exclusively seeking.

Currie believes that bundling different products at competitive prices in a larger format option would help to both adhere to the government’s need to displace the illicit market while also ensuring customer satisfaction can be met.

Cannabis 2.0 & New Products

Supply issues for Cannabis 2.0 products were an issue raised by both Cannabis NB and the NSLC, but the situation stabilized for both some time after their introduction.

The introduction of the 2.0 product line was popular and helped grow the portfolio of Cannabis NB, although availability was gradual and supply stabilized gradually according to Tremblay. While vape products are the largest growing product category, concentrates are also garnering customer interest.

The NSLC anticipated supply issues with Cannabis 2.0 products due to their experience with the supply issues that accompanied cannabis legalization, and while initially they were only able to offer vape products, soft chews, chocolates, mints, and teas, they’ve since added cold beverages to the mix.

“We did anticipate that there will be supply issues, just like there was in the first phase, and that proved to be the case,” said Ware. “We have experienced issues with…securing a reliable and consistent supply of the products the customer wants.”

Being a new industry with products requiring complicated testing and timelines to get products approved and to market, it’s not surprising there are sometimes supply delays according to Ware, noting that by expanding their licensed producer roster they’ve been able to address supply shortages to a certain extent.

“We have managed to sort of expand our list of licensed producers in order to try and address those shortages, and the subcategories assisted to some extent, but as with [cannabis legalization], a large portion of it, I expect will just be maturing of the industry as more licensed producers get their license to sell,” she said.

The NSLC also found that some of their stores sell out of soft chews and chocolates at faster rates than others.

The government of P.E.I. prohibited the sale of vape products which require an electronic smoking device, and as a result, it’s obviously hampered those specific Cannabis 2.0 sales according to Currie, but he added that edibles and beverages have been “basket builders” which have facilitated longer term stability.

Home delivery hasn’t been tremendously popular with customers – with the exception of COVID-19 – says Ware, which is why the NSLC decided to add the upcoming 13 soon-to-be-opened stores to its roster.

————–

Key result trends for the fourth quarter (December 30, 2019 – March 29, 2020) compared to the fourth quarter last year (December 24, 2018 – March 31, 2019) were:

• Online sales represented 1.4% of sales for the quarter compared to 3.5% last year.

• In store sales represented 98.6% of sales for the quarter compared to 96.5% last year.

• Dried flower sales increased 22.5%, up by $1.9 million.

• Accessories sales increased 80.4%, up $0.2 million.

• Extracts sales decreased 1.7%, down by $0.02 million.

• Seeds sales decreased 88.2%, down by $ 0.02 million.

• Concentrates represented 12.0% of sales for the quarter at $1.7 million.

• Edibles represented 4.0% of sales for the quarter at $0.6 million.

Cannabis NB reports unaudited fourth quarter and year end results – 2019-2020

————–

Market Saturation

When asked about market saturation, Tremblay of Cannabis NB said that while expansion is certainly a possibility, that for now, “the fact we offer a home delivery service in addition to our Express in-store pick up option and well distributed stores across the province, accessibility and availability is reasonably good.”

The NSLC had Narrative Research conduct a survey in March and April of 2019 about consumers and their cannabis purchasing habits, and the results showed 25% of adult Nova Scotians purchased recreational cannabis, 41% who purchased recreational cannabis did so solely through the NSLC and 40% purchased from both the NSLC and other sources which the NSLC says results in “81% of recreational cannabis users purchasing from the NSLC”. Additionally, almost one in five customers had been purchasing cannabis for six months or less which they say suggests “a relatively high level of new users”.

“It’s our mandate to provide a safe and secure supply of recreational cannabis to Nova Scotians and part of fulfilling the terms of that mandate is to make sure that it’s accessible to all of Nova Scotians, no matter where they live,” said Ware.

A primary reason customers purchased cannabis from the NSLC included convenient store locations, while a key reason customers purchased from the illicit market was convenient access.

Home delivery hasn’t been tremendously popular with customers – with the exception of COVID-19 – says Ware, which is why the NSLC decided to add the upcoming 13 soon-to-be-opened stores to its roster.

“Once they’re up and running, then we look at what we may do going forward from there in terms of any additional stores…”

We have ourselves at probably 40% to 45% of the market share right now, so we’re looking at at least double that with the existing demand that’s there right now.

Zach Currie, director of cannabis operations P.E.I. Cannabis

The market is nowhere near saturation, according to Currie of P.E.I. Cannabis, whether you consider either legal or illicit sales. “I still think there’s a large percentage of the market share that’s being done in unregulated streams.”

“We have ourselves at probably 40% to 45% of the market share right now, so we’re looking at at least double that with the existing demand that’s there right now.”

Currie thinks there is an opportunity to expand their network of retail cannabis stores but noted that he thinks P.E.I. Cannabis is doing a good job at providing cannabis to customers as a small island province with “room for further commercial development” which provides an opportunity to “shift more folks over to the regular legal channels.”

Sales

Cannabis NB sales have been steadily improving, according to Tremblay, with the most recent quarterly results showing a 1.4 million-dollar profit, representing a 78.7% increase from the same quarter from last year, as well as the prior eight periods all being profitable.

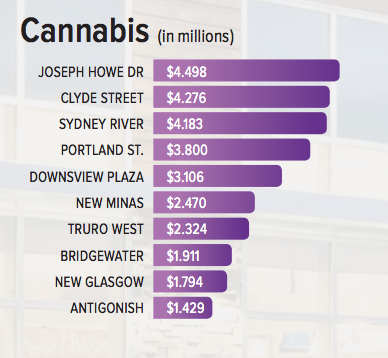

The NSLC released their fiscal year end reporting in June, which showed that the first full year of cannabis sales accounted for $71 million in sales. Product prices have dropped 8% since last year, which according to Ware is an indication “both of the maturing of the industry” and that product prices are settling into an acceptable range for consumers.

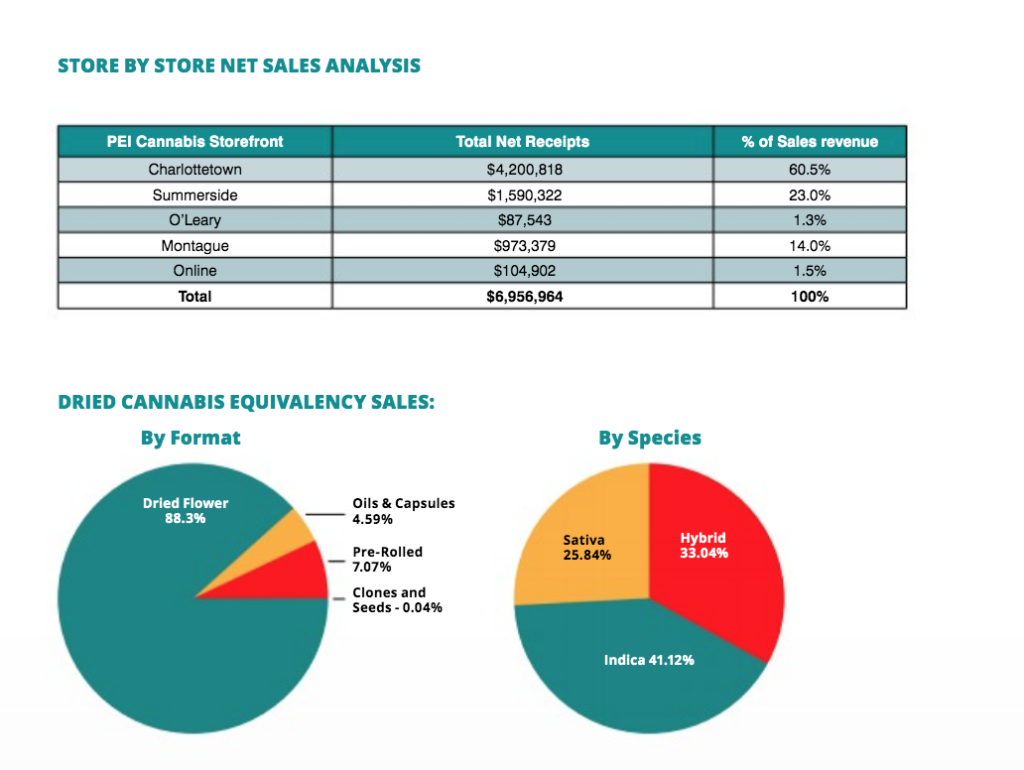

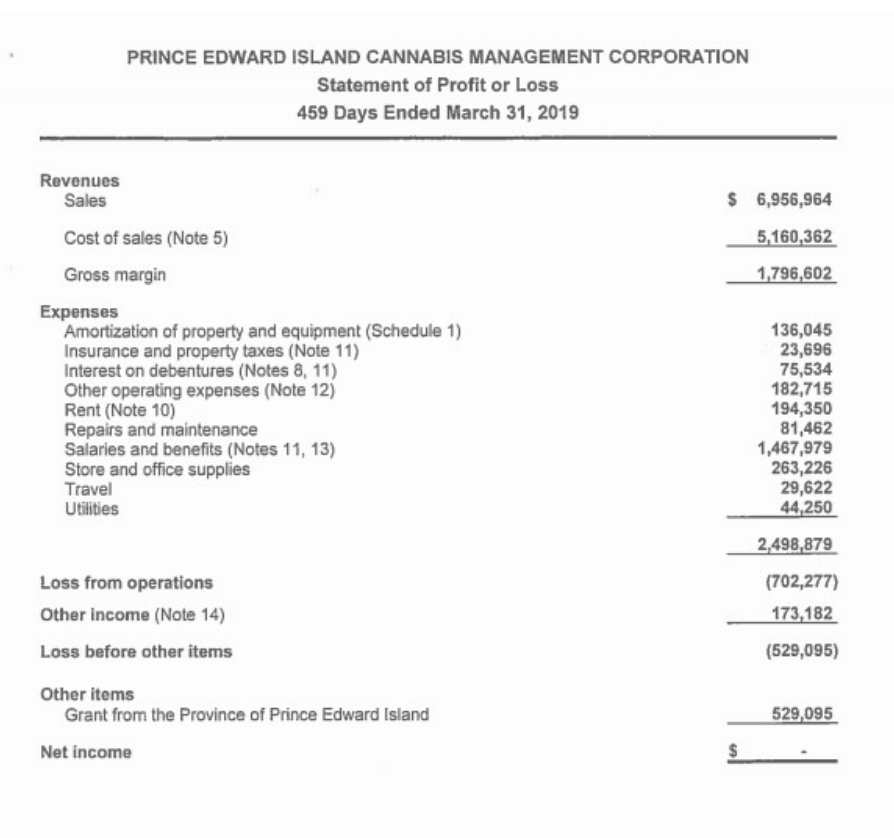

P.E.I. Cannabis saw their sales very close to their budgetary projections, which Currie credits to their preparatory work leveraging both existing documentary data and sales data from legal U.S. jurisdictions.

“There was so much data, including the data that was presented from [Deloitte, CIBC, or the Canadian Parliamentary Budget Office],” he said. “When we overlay those data points with some of our census data and population assessments, I think we had a 2% budgetary variance from what we had initially forecasted out for fiscal 2019. Bang on.”

It’s about how quickly now we go from that initial dent to facilitating a secondary shift and getting folks who are perhaps even a little bit more loyal to the unregulated streams over to us as their preferred provider…sales have been reasonable for sure, but a lot of opportunities are still out there.

ZACH CURRIE, DIRECTOR OF CANNABIS OPERATIONS P.E.I. CANNABIS

P.E.I. Cannabis’ second fiscal year was “very close again” and a little over double the sales of five and a half months of the previous year.

“It’s about how quickly now we go from that initial dent to facilitating a secondary shift and getting folks who are perhaps even a little bit more loyal to the unregulated streams over to us as their preferred provider,” he said. “…sales have been reasonable for sure, but a lot of opportunities are still out there.”

The COVID-19 Curveball

Cannabis NB remained open amid the COVID-19 pandemic but temporarily closed their main sales floors and served customers through Express pick-up windows.

“Once we felt we had a good operational plan in place we reopened the sales floor,” said Tremblay. “It is possible to correlate the stay at home order and a lift in sales, however by looking at our previous financial reports by period, Cannabis NB was already seeing an increase in sales month to month long before the pandemic started, and the growth trajectory for sales and profit have been fairly consistent.”

We did a lot of preparatory work while we were closed with the anticipation that it would be a short term closure, but it ended up being a little bit longer than we had initially anticipated.

As it related to navigating the online storefront, it was a huge increase in our sales volumes…[and] with that increase in sales numbers came a lot of opportunities for us to understand some of our vulnerabilities online, as it relates to mitigating product availability.

ZACH CURRIE, DIRECTOR OF CANNABIS OPERATIONS P.E.I. CANNABIS

For the NSLC there was a lot of fear, questions, and anxiety, felt both by customers and employees alike at the outset of the pandemic, according to Ware.

In terms of the actual impact on sales, the NSLC saw cannabis sales increase 27%, which Ware suggests account for the fact customers were concerned stores would temporarily close during the pandemic.

“In those early days, a lot of rumours of course will go on social media about potential closures, and that would gain steam, so we were working really hard to reassure customers that we would be keeping our doors open and that our priority would be to do that safely, but to still ensure that they had access to a safe supply of cannabis,” she said.

Once customers accustomed to changes, sales patterns settled, but Ware noted that customers are continuing to buy larger volumes of products to “ensure that they don’t have to come back to our stores as often.”

Navigating the changes of COVID-19 was particularly challenging for P.E.I. Cannabis because their storefronts were closed for a period of nine weeks, causing consumers to rely on the online storefront exclusively.

“We did a lot of preparatory work and preliminary work while we were closed with the anticipation that it would be a short term closure, but it ended up being a little bit longer than we had initially anticipated,” said Currie. “As it related to navigating the online storefront, it was a huge increase in our sales volumes…[and] with that increase in sales numbers came a lot of opportunities for us to understand some of our vulnerabilities online, as it relates to mitigating product availability.”

Currie compared cannabis to both alcohol and pizza in the sense that customers typically want it “then and there”, whether to celebrate an occasion to supplement a social experience, and for P.E.I. Cannabis, this meant “trying to get orders out as quickly as we could…”

“If nothing else, [COVID-19] was really a solid opportunity to improve on the online storefront and get ready for reopening,” he said. “Now that we have been reopened…it’s rebounded a little quicker than I had thought it perhaps would.”

[*Note: Tom Tremblay said Cannabis NB is not involved in ongoing RFP discussions and that Cannabis NB remains “focused on the health and safety of our team members, continuous improvement of the business, optimizing the offering for our customers and generally offering the best value to New Bruswickers.”]