This article covers the average price of Canadian legal cannabis over time with respect to package size and province listed.

We start by looking at how the number of brands and companies listing whole flower products in Canada has increased since 2018.

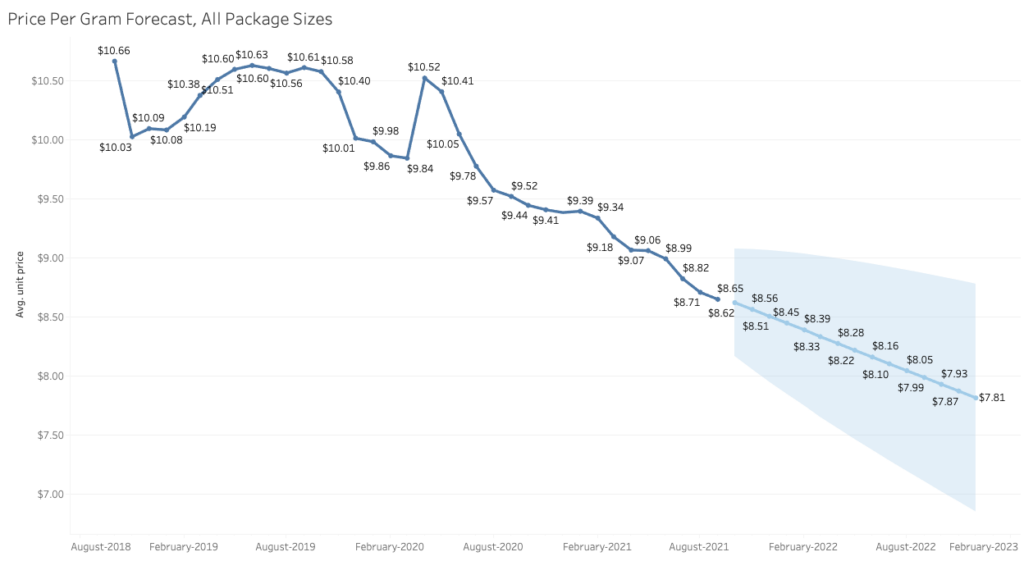

We’ll check how much the average price per gram of dried cannabis has decreased from the start of legalization in October 2018.

Then we’ll show how the mixture of available package sizes has changed, and how the influx of bulk packages affects the average price. We’ll compare listing counts relatively for each package size and compare the total amount of cannabis listed with respect to size.

We also look at average prices between the package sizes and calculate average bulk discounts for major package sizes. Then we’ll break down average prices and bulk discounts for each province.

Finally, we’ll use the legal data to create forecasts for average prices in 2022 and contrast these averages from historical averages as set by groups of listings from Canada’s illicit cannabis market.

Data Method

Data was derived on a daily basis from listings placed in about 1,000 stores in Canada, including provincial web stores, plus brick-and-mortar stores. The data has been aggregated on a monthly or quarterly basis for this analysis.

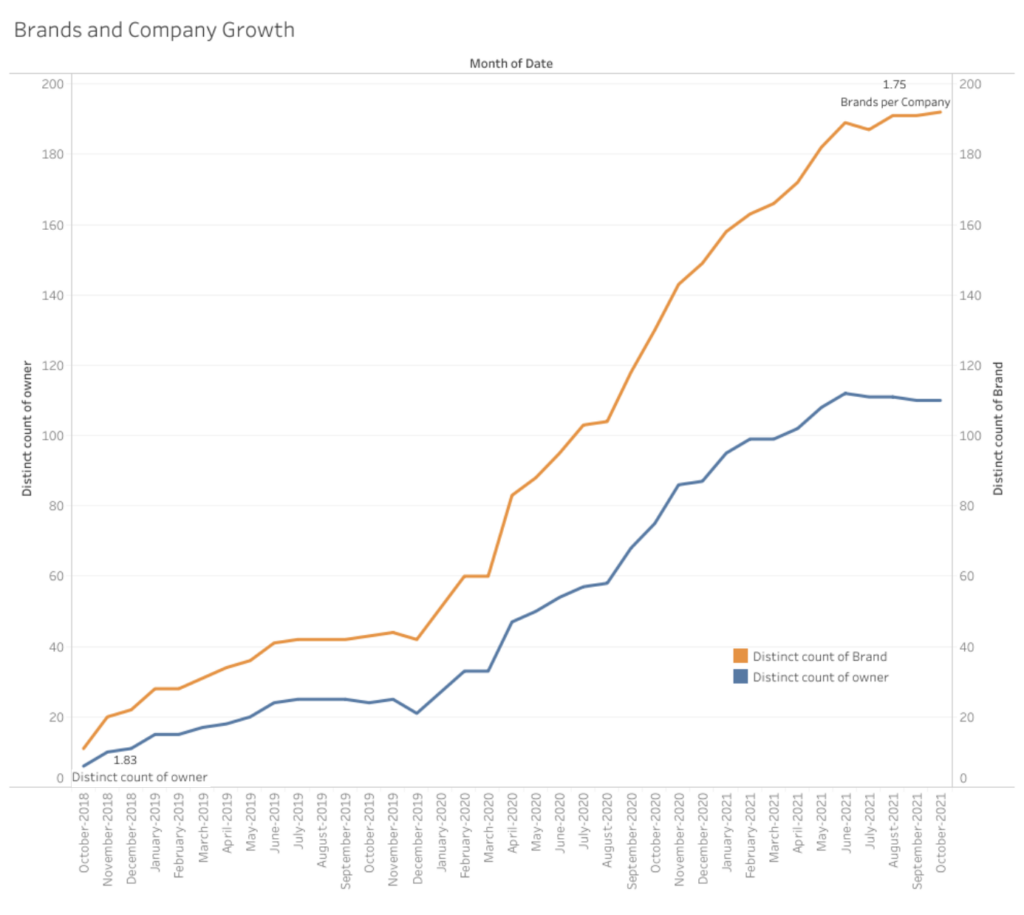

Brands and Companies

There are 1.75 dried flower brands per company that own them, about 20% less than the ratio observed at the start of legalization in October 2018 (1.83 brands per company).

The number of companies with active listings has increased from 10 in October 2018 to 112 in October 2021. The number of active brands grew from 21 to almost 200 over the same term.

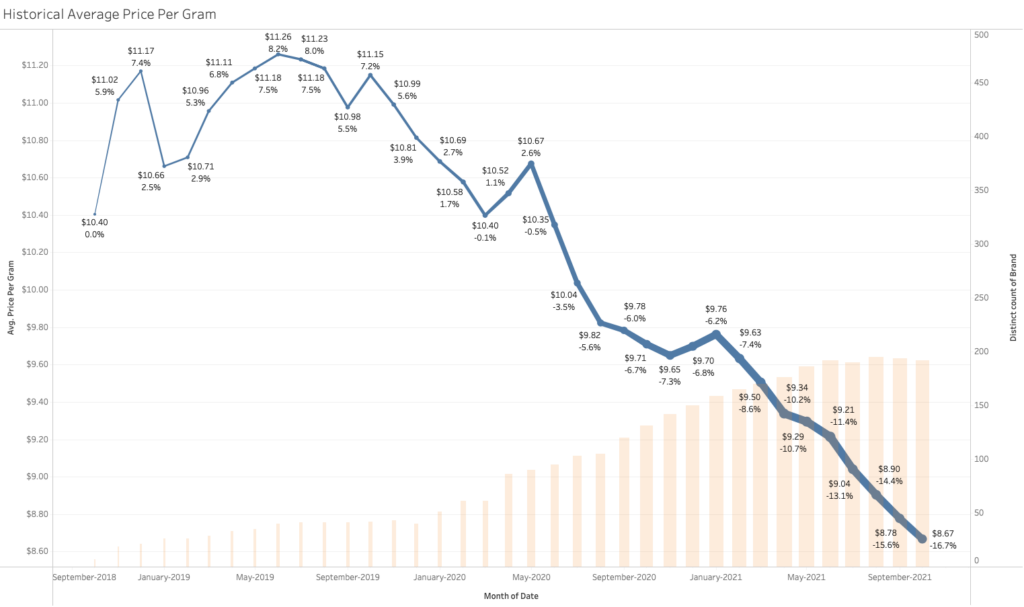

Average Price Per Gram

The average price of dried flower has decreased by over 16% since the start of legalization, from $10.40 per gram in October 2018 to $8.67 per gram in October 2021.

The high at $11.26 per gram was observed in June of 2019. Since then the price has decreased about 25% to $8.67 per gram, which is the lowest average value observed yet.

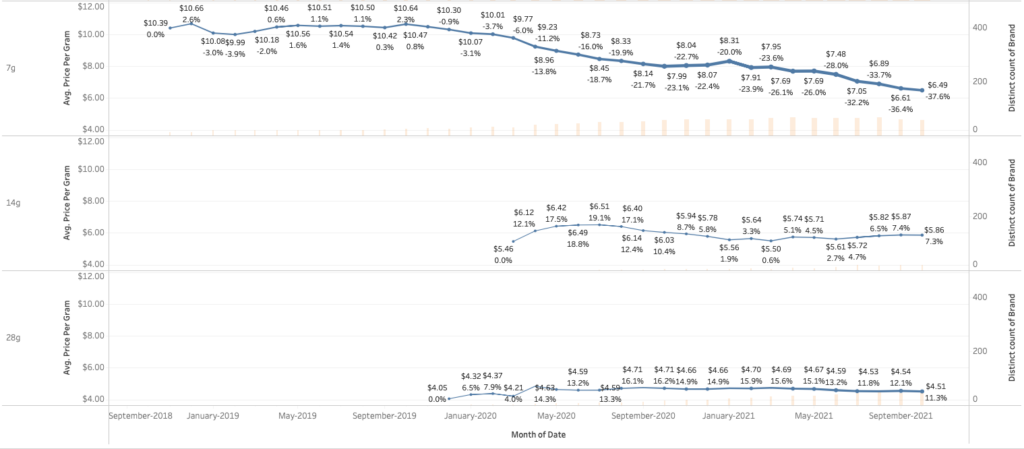

Average Price Per Gram by Package Size

Next, we’ll look at average prices over the traditional package sizes for whole flower cannabis; 1, 3.5, 7, 14 and 28 gram packages.

Fewer brands are listing one-gram packages of whole flower. In April 2021, we found 54 brands listing a one-gram package. By October 2021, the number of brands listing this package size decreased to 32.

The average price of dried flower in the most commonly listed package size (3.5g) has decreased only 5%. The peak average price for the 3.5g package size was $11.66 per gram ($40.81 total) which occurred in June 2019. Since then the average price has decreased about 15%, to $9.88 per gram ($34.58 total).

Bulk Packages

In 2021 the increase of bulk packages in the market has caused a decrease in the average price of dried flower overall.

Ounce and half-ounce packages became available in late 2019, with ounce packages being the most commonly listed amongst the two.

Ounce packages were first listed by a single brand in December 2019. The number of brands listing an ounce package has grown to 46 in October 2021.

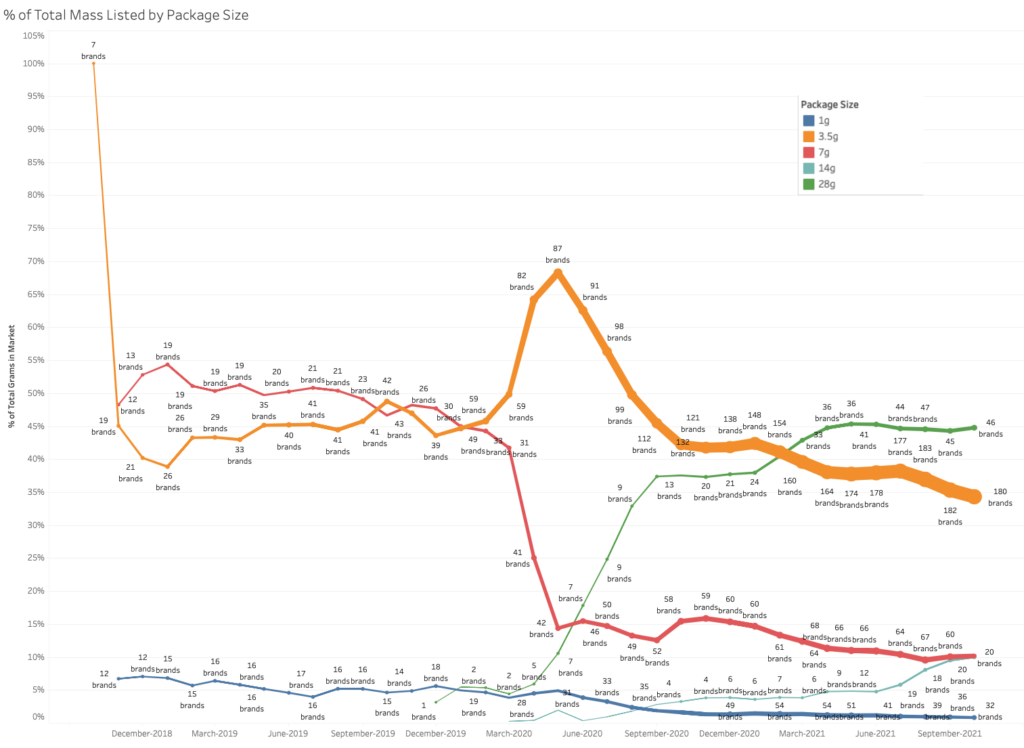

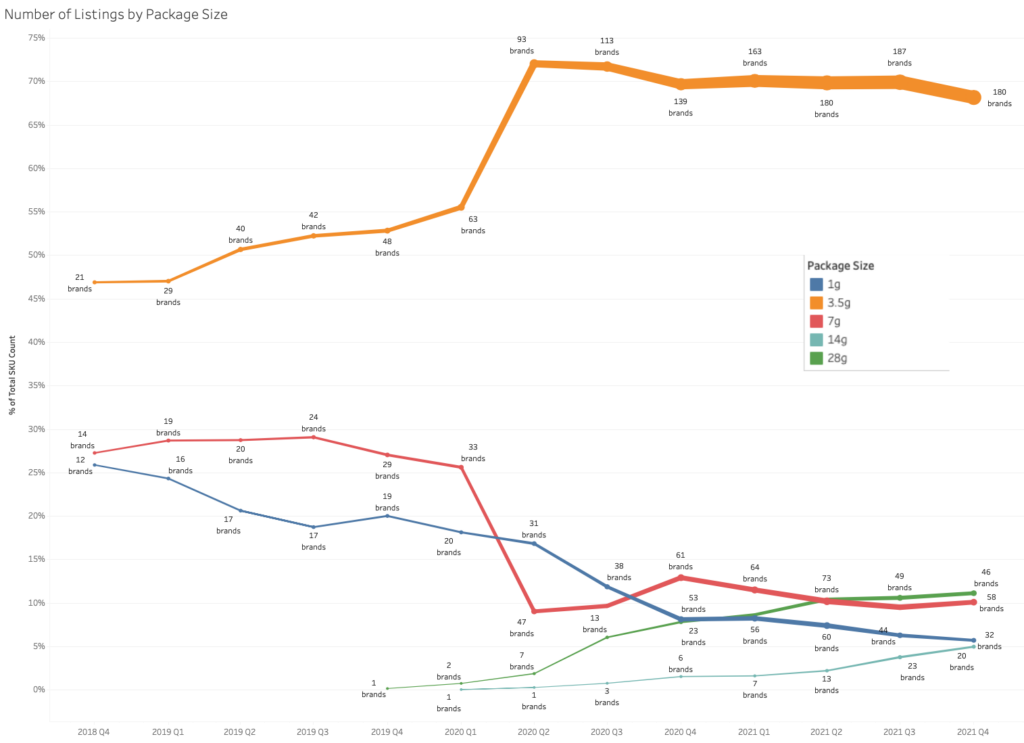

Available Package Sizes as a Percentage of Total SKUs

The amount of bulk packages has been increasing since late 2019. To show this, we’ll look at the number of listings relatively.

Since January 2021, half-ounce packages have increased from nearly 0% of SKU count to 6% of SKU count. Ounce packages have increased from 1% of SKU count to 11% of SKU over the same term.

Package Size as a Percentage of Total Mass Available

While there are more 3.5g packages in the market (as per above), there is more mass listed in 28 gram packages.

From a mass perspective, since the start of this year, most of the whole flower cannabis listed is contained in an ounce package, overtaking the most commonly listed package size, the 3.5g package.

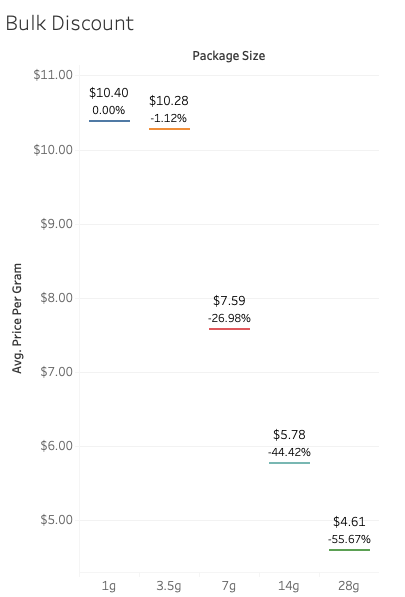

Average Bulk Discounts

On average, consumers can expect over a 50% discount when purchasing an ounce (over the cost of a 3.5g package).

Similar discounts can be expected at the 14-gram package size, but there are fewer brands that list this size.

Quarter ounce purchases come at a 27% discount over the smallest package size (1g) and a 25% discount over a 3.5g package.

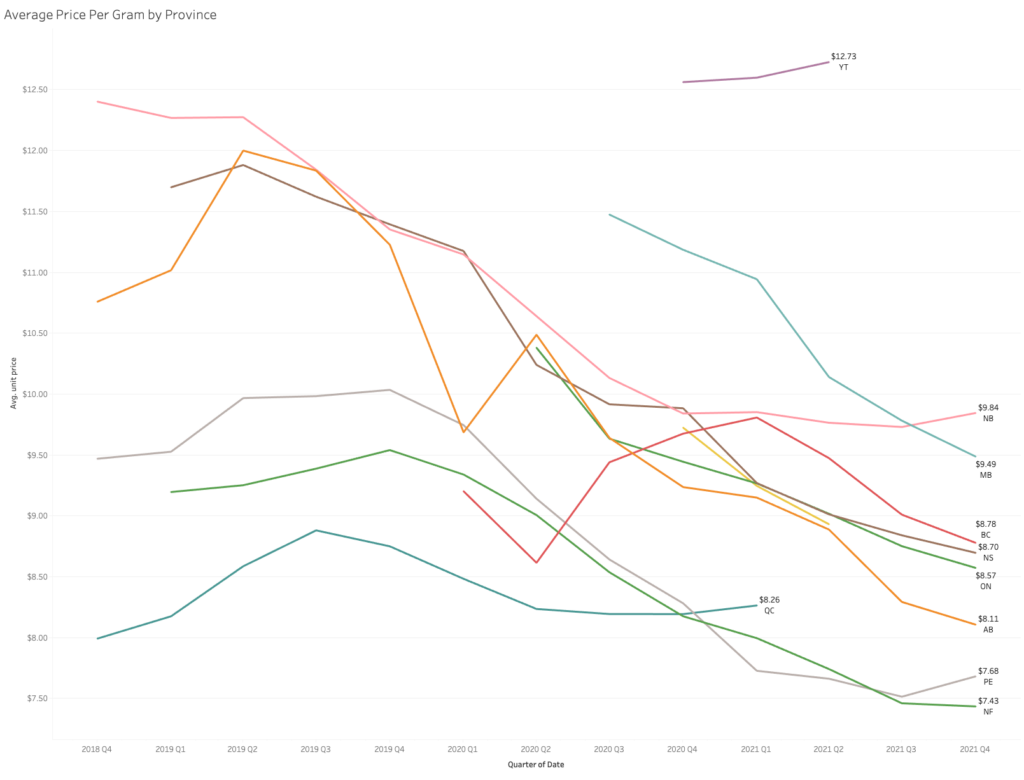

Provincial Averages

Yukon Territory has the highest average prices for cannabis. Manitoba, Nove Scotia, and New Brunswick are also above the average price per gram.

We observe the lowest average prices in Newfoundland and PEI at $7.43 and $7.68 per gram, respectively.

Yukon has the largest bulk discounts (69%). Quebec has the smallest average bulk discount (50%).

Average Price Forecasts

Extrapolating from previous values we can forecast prices for the 2022 year.

The average price will continue to decrease in the next year, largely due to the brands offering larger package sizes and not price compression. Breaking down the forecast by package size shows little predicted decrease.

One-gram packages are forecasted to average $9.87, higher than the October 2021 average ($9.66 per gram).

Eighth or half quarter (3.5g) packages are predicted to average $10.03 per gram ($35.12), higher than the October 2021 average ($9.88 per gram). Which is below the average observed over illicit listings for 3.5g packages placed from 2017 to 2021 ($10.29 per gram, $36.02).

Bulk Packages

The disparity between current legal averages and historical illicit averages in bulk packages could be attributed to the companies offering the packages. From above, about 200 brands offer a 3.5-gram package, but only 40 offer an ounce. About a fifth of whole flower brands offer an ounce package consistently, and these brands tend to be owned by bigger companies who already have lower than average prices.

Few smaller or boutique producers offer bulk packaging currently, so the legal average tends to be more representative of prices from larger companies. When we contrast this package size to listings from the illicit market, which includes a range of small and boutique producers, we’ll see the average price is higher with a better mix of representation.

Half ounces are predicted to average $5.86 per gram ($82.04), which is equal to the current October 2021 average and below the average for illicit listings for 14g packages placed from 2017 to 2021 ($7.74 per gram, $108.36).

Ounce packages are estimated to average $4.55 per gram ($127.40), which is within 1% of the current average of $4.51 per gram. This is below the average we observe for illicit listings for 28g packages placed from 2017 to 2021 ($7.02 per gram, $196.56).