The Canada Revenue Agency assessed nearly 350 million in excise tax revenue from cannabis sales in the first two years of legalization, according to a report from the CRA.

The CRA report provides details on spirits, wine, and beer, as well as cannabis and provides information on the amount of excise duty assessed minus any approved refunds for excise duty remitters on those products. All numbers are also rounded to the nearest thousand.

Information for cannabis excise taxes is divided into several categories:

- Dried/fresh cannabis flower

- dried/fresh cannabis-non flowering plant material

- cannabis seeds

- cannabis plants, and

- cannabis extracts (including “edible” cannabis oil).

For fiscal year 2018-2019, the first year of legalization, the CRA assessed $71,922,000 for cannabis duty on dried/fresh cannabis flower and $19,534,000 for cannabis extracts, including edible/ingestible cannabis oil, for a total of $91,563,000.

For fiscal year 2019-2020, the CRA assessed $229,697,000 for cannabis duty on dried/fresh cannabis flower and $25,743,000 for cannabis extracts, including edible/ingestible cannabis oil, and $1,182,000 for cannabis edibles, for a total of $256,622,000.

Cannabis extracts, edibles, and topicals became legal in October 2019, with sales for most products not beginning until early 2020. Prior to this, the only legal cannabis products were dried/fresh flower, ingestible/edibles cannabis oil, seeds, and plants.

The total assessed value from both years is $256,724,000.

Figures on excise taxes assessed for cannabis seeds, plants, non-flowering plant material, and cannabis topicals are not listed for “confidentiality purposes”.

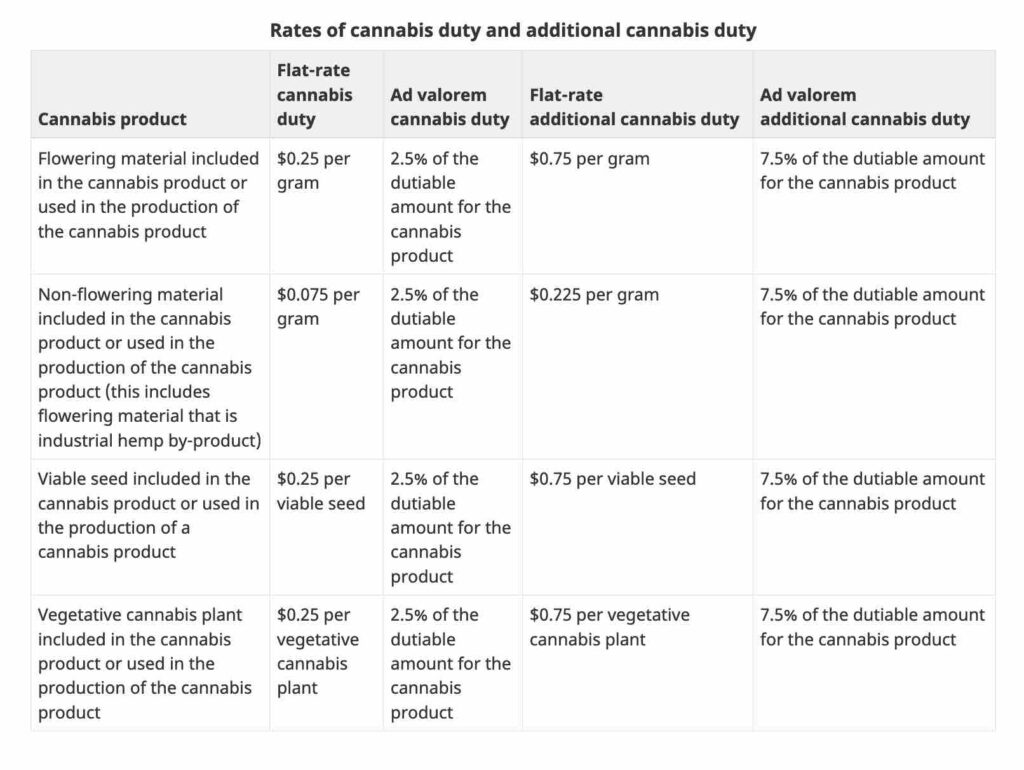

There are two types of cannabis duty on cannabis products produced in Canada. One is a flat-rate duty imposed at the time the cannabis products are packaged for consumer sale. The other is an “ad valorem” cannabis duty imposed on packaged cannabis products at the time the products are delivered to a purchaser such as a provincially-authorized distributor or retailer, or a final consumer (such as with direct-to-consumer sales through the medical system).

The first flat-rate cannabis duty is determined based on the inputs used to produce the cannabis product. The ad valorem cannabis duty is determined based on the dutiable amount of the cannabis product.

The cannabis duty payable is the greater of the flat-rate and the ad valorem cannabis duty, with the lesser of the flat-rate and ad valorem cannabis duty being relieved at the time the greater cannabis duty becomes payable.

There is also an additional cannabis duty imposed in respect to some provinces (Alberta, 16.8%, Nunavut 19.3%, Ontario 3.9%, and Saskatchewan 6.45%).

The amount of this additional cannabis duty payable is the greater of the flat-rate and the ad valorem additional cannabis duty, with the lesser of the flat-rate and ad valorem additional cannabis duty being relieved at the time the greater additional cannabis duty becomes payable.

For the above listed specified provinces, there is also a further amount payable, referred to as an adjustment to the additional cannabis duty.

Many cannabis producers have been expressing frustration with the high rate of taxation of cannabis flower, calculated at either $1 per gram or 10%, whichever is higher. One-quarter of this goes to the federal government, while three-quarters go to the provinces (all provinces except Manitoba signed an agreement with the federal government on cannabis tax revenue sharing).

As the average price of dried cannabis flower in Canada continues to drop, wholesale prices into provincial markets can range from around $5-8 a gram, meaning producers can be paying as much as 20-25% or more in their sales to excise taxes.