Ontario expects to bring in $145 million in federal excise taxes for legal cannabis for 2020–21 and another $80 million for the Ontario Cannabis Store according to the province’s 2020-21 First Quarter Finances.

The province’s 2019–20 budget plan projected $70 million in federal excise tax revenue and 10 million for the OCS, the province’s online retail cannabis store and distributor.

The province’s 2018–19 Budget Plan projected $35 million in federal excise tax revenue and a deficit of $40 million for the OCS, covering the initial startup costs of both the distributor and retailer, as well as the handful of OCS stores planned under the previous Wynne government.

Previously, Ontario said that if their portion of the federal excise duty on recreational cannabis over the first two years of legalization exceeds $100 million, the province would provide 50% of the surplus only to municipalities that did not opt-out of hosting retail stores.

The Federal government has agreed to provide 75% of the federal excise tax to provinces.

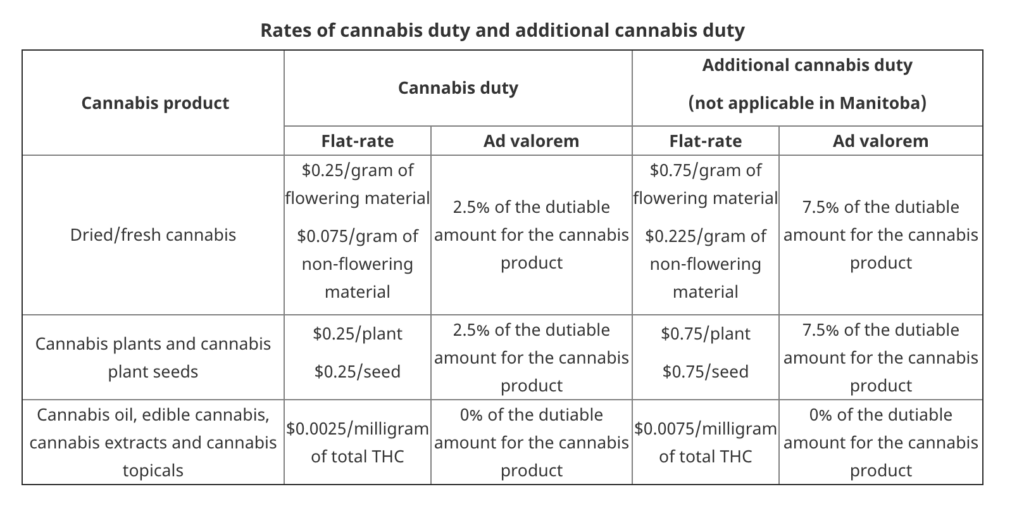

The federal excise rate for cannabis products are calculated at a flat rate of $0.25/gram of flowering material and $0.075/gram of non-flowering material. $0.25/plant or plant, and $0.0025/milligram of total THC for Cannabis oil, edible cannabis, cannabis extracts and cannabis topicals, as well as a 2.5% ad valorem, or in proportion to the estimated value of the goods or transaction for Dried/fresh cannabis and Cannabis plants and cannabis plant seeds.

Ontario has an additional 3.9% the additional cannabis duty required when packaged and stamped cannabis products are delivered to a purchaser.

The federal portion of Canada’s cannabis excise duty was $32 million from April 2019-March 2020. Another $128 went to the provinces and territories.