While the beginning of cannabis legalization in Canada was characterized by a surplus of product, many in the industry now say that trend has been shifting to a shortage in recent months.

This is good news for cannabis growers, as it means having more leverage on the market, putting brokers and third-party processors in a less-than-ideal position for potentially the first time.

Jacquie Trombley, director of sales, marketing, and product development at Agmedica Bioscience Inc. in Ontario, says she has seen a significant shift in 2024 from a buyer’s market to a seller’s market.

There’s been a significant shift to 100% cash up front and we’re getting it! Before the product leaves our facility.

Jacquie Trombley, Agmedica Bioscience Inc

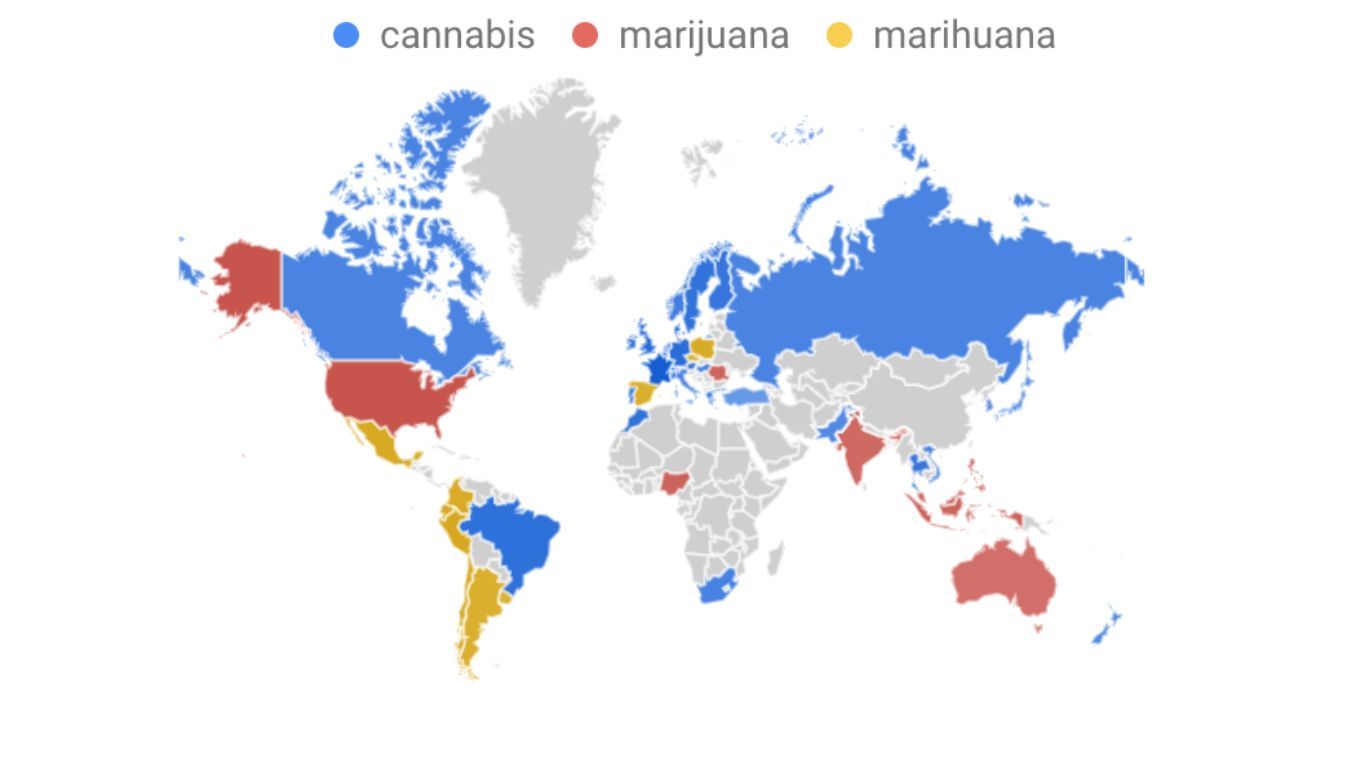

Agmedica sells in Canada’s medical and non-medical markets, both under their own brands and in the B2B market, and exports to international markets.

“Historically, we would usually have at least some inventory in our vaults, but right now the majority of the requests we receive for product go unfilled,” explains Trombley. “We get asked for product pretty much every day, and we cannot meet the demand.”

This is in part because of the increasing demand of the export market, she says, but it’s also the result of the number of cannabis producers closing up shop. Some struggling producers who might have been desperate to move products at a discounted rate are now out of the market, and, over time, this benefits those who have been able to stick it out.

This is reflected by the increase in price for not only top-quality flower, but also the rise in price for smalls and trim, which generally aren’t making their way to the international markets.

“Pricing has come up dramatically,” she continues. “We used to sell A [grade] flower for what we’re selling B [grade] flower for now. B flower and trim pricing has probably doubled.”

Another big turn, says Trombley, is payment terms for growers who are selling to processors, something that is arguably more impactful than the price increase, where various consignment deals and terms have been common for growers in the first few years of legalization, meaning full payment might not have been provided for some time after product had sold in a provincial market.

“We are no longer offering terms to B2B domestic buyers because you just might not get your money,” she continues. “There’s been a significant shift to 100% cash up front and we’re getting it! Before the product leaves our facility.”

This is a big deal for small growers who are struggling to keep the lights on.

“Right now, I think some of those smaller companies absolutely can demand cash up front right now, or at least improved payment terms.”

Steve Clark, founder of the Canadian Cannabis Exchange, says the issue is something many in the industry have been discussing this year.

“We are seeing domestic supply shrinking in a number of ways,” says Clark. “The closures of growing facilities and reduction of square footage of canopy in Canada. The companies who were producing for their own internal supply in these facilities have flipped from net sellers to net buyers, (further taking supply off the market), and the pull from export into intensive markets is reducing overall flower availability.”

Michael Gorenstein, president and CEO of the Cronos Group, another cannabis company that sells domestically and in international markets, made similar comments on a recent quarterly report earnings call.

“We’ve really seen a huge shift in the supply dynamics where we’ve had significant oversupply in the past,” said Gorenstien.

Although he says he still believes there is a large supply of low-quality cannabis flower in the market, this isn’t necessarily a product with much market demand. Quality cannabis, he says, is a different story.

“As we said in the past, there’s a difference between available cannabis inventory and available inventory that’s sellable as quality flower,” continued Gorenstien. “While there’s plenty of the former, there is now a shortage of high quality desirable flower that is sellable to consumers in Canada.”

The company’s most recent quarterly report also noted: “We are anticipating shortages in raw materials and may be unable to obtain adequate supplies of raw materials in a timely manner and at commercially reasonable prices.”