The biggest challenge facing Canadian cannabis companies entering the export business is getting certified under Good Agriculture Collection Practice (GACP) regulations and the Good Manufacturing Practice (GMP) guidelines, four experts tell StratCann.

Receiving the clinical and pharmaceutical seal of approval is required by countries importing cannabis, and is different from the Good Production Practices (GPP) regulation that governs domestic sales, the experts explained.

Many companies underestimate the time and the expense involved in getting the certifications, according to Atiyyah Ferouz, CEO and founder of consultancy firm AgCann.

“It can take years to validate your process and qualify your products for market entry, and that’s not including things like stability.”

Jeff Abbott, Northern Green Canada

“We give them a timeline of 12 to 18 months, and we give them a price point in the six figures, and they’re usually taken aback,” Ferouz said about her clients.

Australia, Germany, Israel, Argentina, the UK, and the US are the biggest importers of Canadian cannabis, according to Health Canada data from October 2023.

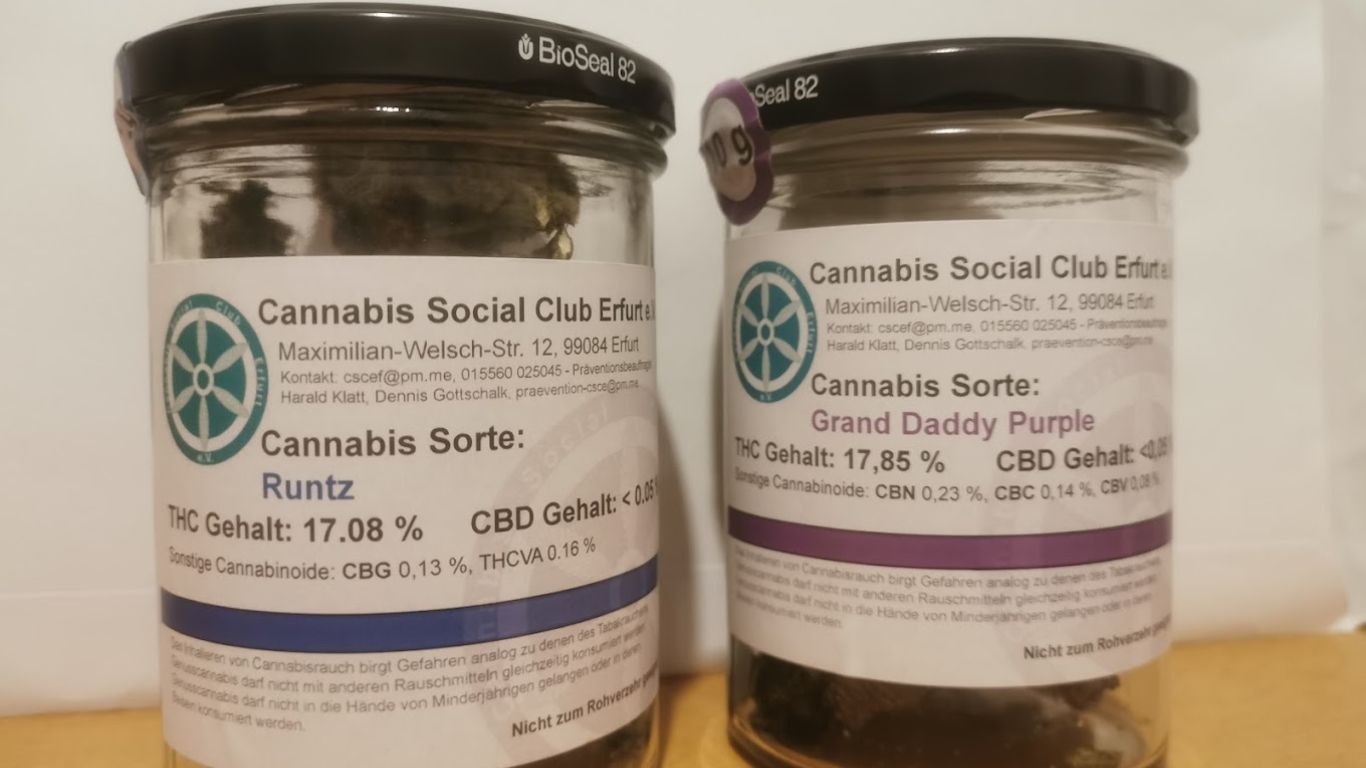

Germany legalized the possession of 25 grams of cannabis for recreational use and three homegrown plants by people over the age of 18 on April 1, the Associated Press reported. The country will allow adults to join non-profit cannabis clubs to purchase a maximum of 25 grams per day on July 1.

According to Jeff Abbott, head of product development at producer Northern Green Canada, Germany has the most significant regulatory hurdles of any cannabis-importing nation.

“It can take years to validate your process and qualify your products for market entry, and that’s not including things like stability,” Abbott said, explaining that Germany’s quality control and assurance program includes cultivar-specific stability standards to provide shelf-life data.

When Northern Green scales up a new genetic formula, they must undertake a country-specific stability run on a cultivar using two or three batches over three months, giving the product a six-month shelf-life, Abbott said.

Companies must then receive individual export permits per country, per amount of flower, and per potency from Health Canada, Abbott continued, and those must correspond with import permits from the country of destination.

The number of applications and permits issued has been increasing annually, with 1,805 permits issued in 2023, 1,421 in 2022, 1,267 in 2021, 1,213 in 2020, and 272 in 2019, according to Health Canada.

Jeff Black, CEO of producer GlassHouse Botanics, said export permits for Germany last for three months, while export permits for Israel are for six months.

“In that time they’re trying to decide do they still want it or not,” Black said of importing companies.

Permits from Health Canada are now typically given out three weeks after the application although one of their recent ones took five weeks, according to Kayla Mann, chief revenue and financial officer at organic grower Habitat Life. (Editor’s note: This section has been edited to more accurately represent Mann’s comments.)

Data from Health Canada shows the amount of permitted and endorsed, or actual cannabis, that left the country has trended upwards.

However, the number of permits and actual cannabis exported has dramatically fluctuated.

All the experts StratCann spoke with said those fluctuations were primarily due to ebbs and flows in scheduled shipments, and were not indicative of drop-offs and surges in demand.

But Ferouz pointed out that Australia changed its regulatory requirements for importing cannabis to the stricter GMP practices from GACP regulations as of July 1, 2023, forcing Canadian exporters to pivot.

“I think that might have been part of the drop-off that you saw,” she said.

Israel launched an anti-dumping investigation into Canadian cannabis exporters on January 18, 2024, and specifically addressed ten different Canadian cannabis producers.

Experts said they hadn’t seen any impacts on exports from the investigation and were divided on whether or not dumping was a market-wide issue.

“I have had many Australian clients complain to me that they’re getting what they have called, in their words, ‘absolute garbage’ from Canada, product that’s clearly over a year old that someone has repackaged,” Ferouz said.

Large-volume licensed producers in Canada have a substantial amount of aging cannabis inventory, pointed out Abbott.

This allowed those companies to sell their product at a loss in an attempt to recuperate operating costs.

“The standards set by the government of Israel have allowed a more lenient approval for international producers when compared to countries such as Germany or New Zealand which require EU-GMP certification.”

Black and Mann said they were unaware of a dumping problem in the Canadian cannabis export market.

The surplus of cannabis in 2023 is now gone, Black said, and the dumping allegations may be tied to cannabis from Canada being cheaper.

“I don’t see any collusion or anything saying ‘we’re gonna dump all our bad stuff in Israel at bargain pricing’,” he noted.

Health Canada’s data also illustrates a substantial difference between the amount of cannabis permitted for export and the amount that ends up leaving the country.

In August 2022, the amount of cannabis permitted for export increased while the amount actually exported decreased, and in November 2023, the reverse happened.

Cannabis exporters will regularly acquire large numbers of permits ahead of expected shipments to enable seamless travel across borders, experts explained.

Exports of cannabis oil, on the other hand, hit their peak in November 2022 and have never recovered, Health Canada data shows.

Cannabis oil exports have fluctuated since legalization and have not trended upward over time, unlike dried cannabis. This is because cannabis oil remains a lesser-known product outside of Canada, Abbott explained.

“It’s very niche when it comes to tinctures, especially low potency tinctures, it’s just been a very variable segment of the market for anybody who’s exporting.”

Ferouz agreed with Abbott, adding that not many facilities in Canada have GMP certification for oil.

Exporting cannabis is a lifeline for businesses seeking to avoid domestic excise taxes and sell higher degrees of volume due to lower international competition, experts agreed.

“For most Canadian cannabis companies to become profitable, or to maintain profitability, they need to be looking at the export market because of the ridiculous oversaturation in our domestic market,” Ferouz said.

Black pointed out that cheaper water and electricity in Canada, coupled with a more developed domestic market, gives domestic companies a leg up internationally.

The value of cannabis exports has increased to $160 million in 2022-2023 from $8 million in 2019-2020, according to Health Canada.

Mann said the exporter relies on their import partners, partially because exported product can’t be brought back into the country. “It’s still very high risk, and things are changing rapidly in each of the countries that we’re able to export to now.”

~ William Koblensky Varela is a reporter, editor, and journalist