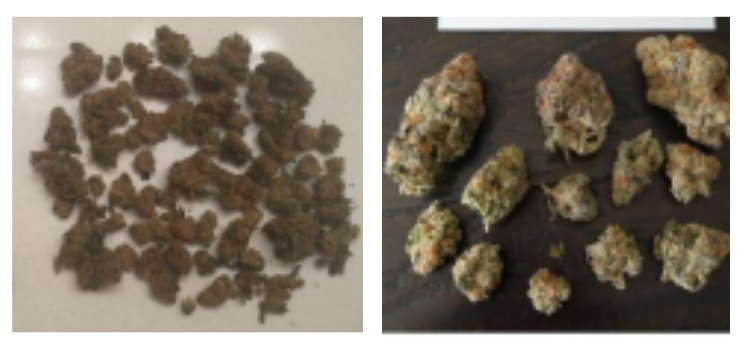

After nine and a half years of purchasing cannabis from Canadian Licensed Producers, one thing has remained stubbornly constant: inconsistencies and a high probability of disappointment when buying dried flower products.

It should come as little surprise to a struggling industry that many consumers still refuse to partake in when, for the entire period since legalization, it has lacked the most obvious measure that would aid it in building consumer confidence: letting consumers see and smell what they are buying at point-of-sale, through a bulk distribution/deli-style retail channel.

Any experienced cannabis enthusiast can attest that “the nose knows”. If one has any level of appreciation for cannabis at all, they know the joy and/or dissatisfaction of holding a recently opened bag/jar up to their nose and taking a deep inhale.

Prepackaging-only regulations prevent upfront visual and aromatic assessment, forcing consumers to rely on overly-weighted tertiary factors, such as THC and other numbers on a label, an LP’s backstory, appealing packaging, salesperson’s recommendations… everything and anything other than the actual product in front of them, that they are about to buy.

The current Canadian legal in-person recreational retail experience offers no substantive advantage over an online store. Meanwhile, in jurisdictions outside of Canada that do allow legalized deli-style retail, its impact can be measured by improved consumer demand and experience.

For instance, Oregon’s legal system offers pre-packaged flower products and deli-style retail. The market shows a clear preference (~95% of retail stores offer bulk flower products) toward deli-style “craft” (higher quality) dried flower products from smaller/micro/craft producers.

Limiting the Canadian market to pre-packaging hinders not only consumers but also those smaller/micro/craft producers. Tipping the scales in a market drowning with bought-out shelf space, filled with lower quality, mass-produced flower, hidden inside eye-catching opaque packs featuring inflated numbers at rock-bottom prices.

Prepackaging-only increases logistical costs and environmental impacts for all involved, as smaller packs take up more shipping space to transport fewer products. It prevents other possible ‘green’ initiatives, such as the possibility of reusable/refillable containers that could reduce plastic waste at a retailer-end consumer level. Prepackaging-only hinders product flexibility, as pack size impacts provincial tenders/acceptance, as well as movement through retail stores.

A Consumer Perspective

I just want to find the same dried flower product, in the same brick-and-mortar retail location, in different pack sizes. A consumer looking for a smaller pack to sample first may have to choose a full or half ounce, or vice versa, to want an ounce and buy 8 x 3.5g packs, each carrying a premium price instead of potential bulk savings.

So far, prepackaging-only has demonstrated little to no evidence in preventing diversion, with recent retail store robberies linked to people reselling those stolen packs. There’s no reason a bulk distribution system also can’t maintain similar levels of control over inventory tracking. Bulk wholesale packs can still be excise stamped. Nothing changes anywhere along the distribution chain, where someone is counting packs, and a calibrated scale is a small investment to retailers who opt into carrying bulk products.

While bulk distribution won’t solve all of Canada’s cannabis industry’s problems, its impact would be significant. It would provide a solid base to improve/build consumer confidence, shift the focus away from numbers on a label, and boost the bottom lines of smaller/micro/craft LPs.

~Surley Semantics is a long time cannabis consumer and Twitter pundit and can be found at @Surlysemantics