There is a lot more to selling cannabis in Canada than just taking your harvest to market. Each province and territory has its own approach to managing how cannabis is bought, sold, and even consumed within its boundaries. Some provinces take a very strict hands-on approach, a few take a more friendly direction, but each has its own nuances that growers and processors, residents and visitors must navigate.

Below is an overview of each of these jurisdictional approaches to the retail and distribution models, as well as fees and taxes imposed across Canada.

ALBERTA

Distribution Model

Albertans can buy cannabis products from private retailers that receive their products from Alberta Gaming, Liquor & Cannabis (AGLC). Licensed retailers are the only stores that can sell cannabis, with cannabis retailers able to sell cannabis online. These retailers cannot sell cannabis if they also sell alcohol, tobacco or pharmaceuticals.

Fees

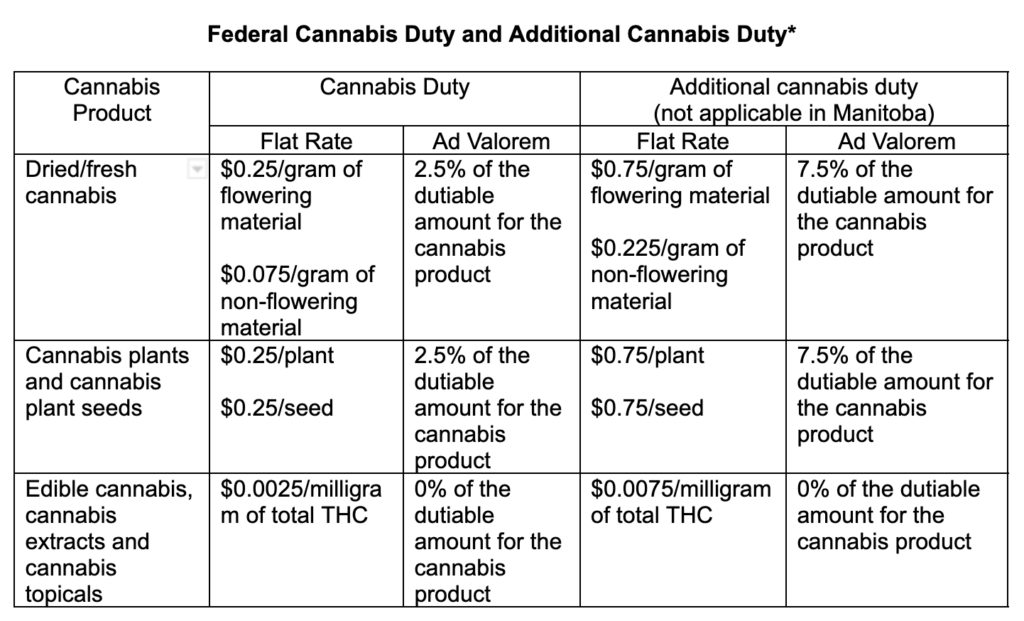

Alberta has an adjustment rate for additional cannabis duty on packaged and stamped cannabis products of 16.8%. Alberta has no provincial sales tax, charging only 5% GST.

Starting February 25, 2022, the AGLC introduced a 6% markup on all wholesale purchases of cannabis by Alberta retailers. At the same time, the 2% public education fee applied to licensed producers was eliminated.

In Alberta, the general liability insurance coverage requirement is $2 million for seeds, $5 million for dried flower, and $10 million for everything else. Micros are exempted from recall insurance.

Alberta has a one-time SKU listing fee of $1,500, which is under review. A 2% damage fee is taken on every order. Shipment errors are subject to a $1,000 fine. Product is shipped at the same price no matter where it’s going.

The provincial security clearance, known as the Cannabis Registration Representative application, costs $3,000. This is paid upfront, on a retainer basis. Some funds could be reimbursed if the process moves more quickly than anticipated. However, as is more common, additional fees can be charged should the process be longer than expected. As well, although security resubmission is required every six years, the government can demand resubmissions at any time, with the same fee requirements. For more details on this process, go here.

Product call schedule

Every month, Alberta has a new product submission deadline for one of three groups of product categories, with SKU creation coming one month after, and an estimated PO date two weeks after that. The three product category groups are: dried flower and pre-rolls; vapes edibles/beverages; and concentrates/extracts topicals. These roll over every three months. Seeds are only ordered once, in January. An example of the schedule structure can be found here.

BRITISH COLUMBIA

Distribution Model

BC has a wholesale cannabis distribution model governed by The Cannabis Distribution Act (CDA). Under the Ministry of Finance, BC’s Liquor Distribution Branch (LDB) has a General Manager and CEO responsible for administering the CDA, subject to direction from the Minister.

For retail, the province has a hybrid public-private model. The BC Liquor Distribution Branch (LDB) operates standalone retail stores, as do private retailers, both of which procure their products from the government. Online sales are from government-owned BC Cannabis Stores.

Fees

The LDB applies a 15% mark-up on the landed cost of cannabis. British Columbia’s combined GST/PST is 12%, with the exception of vaping products (devices, cartridges, parts and accessories, cannabis e-juice), which are subject to 20% PST, with a combined GST/PST of 25%.

Retail stores are subject to a one-time $7,500 application fee, a first-year licensing fee of $1,500, and annual renewal fees of $1,500. Some cities in BC have by-laws requiring retail fees. For example, the annual fee in Vancouver is $5,000 (formerly $13,500).

Product call schedule

The LDB maintains an open product call, and product submissions are evaluated on an ongoing basis. However, the LDB issues a winter-season product call for the temporary introduction of seasonal products during the winter season (October to December).

Information about the LDB’s vendor registration and product registration processes, and the winter season product call, is available on the LDB’s vendor portal. If a licensed producer wants to access the vendor portal, they can email [email protected] to request access.

MANITOBA

Distribution Model

Manitoba Liquor & Lotteries Corp. (MLLC) sources and distributes recreational cannabis to private retailers in Manitoba. All cannabis must be purchased from MLLC. MBLL also coordinates with licensed producers to provide direct to retail store product delivery model. Licensed producers can direct ship themselves or through a third party.

Fees

Manitoba does not impose listing fees on suppliers. It is in the process of repealing the six percent Social Responsibility Fee (SRF) it charges to retailers. The province charges 5% GST on recreational cannabis and 13% GST/PST on medical cannabis.

Product call schedule

In Manitoba, licensed producers may list a product whenever they wish, as MBLL does not have a regular call schedule. The only time they would issue a call for listings is if there was a gap in the catalogue where suppliers were not proactively meeting the retailers’ needs.

NEWFOUNDLAND & LABRADOR

Distribution Model

In Newfoundland & Labrador, cannabis is sold through private retailers licensed by the Newfoundland and Labrador Liquor Corporation (NLC), which acts as regulator and distributor. NLC controls the possession, sale and delivery of cannabis, and sets prices for cannabis products.

All Newfoundlanders and Labradorians can buy online from NLC at ShopCannabisNL.com.

Products are shipped directly from NLC’s Distribution Centre in St. John’s. Products are typically delivered within 1 to 2 business days, with some exceptions.

Fees

Newfoundland & Labrador charges 15% HST.

The province works on a consignment model and charges a nominal cost-of-service fee, currently 2.25% of landed cost (as defined in the NLC Cannabis Pricing Policy), effective April 1, 2023. Suppliers are charged this fee to cover warehousing, distribution, and inventory management costs. The fee may be adjusted annually and/or as deemed appropriate by NLC to cover warehousing and distribution costs.

The cost of shipping from the online store is $9.00 + HST.

Product call schedule

For the fiscal year, the call schedule is as follows.

+ January. Spring OTO product call. Launch April/May.

+ March/April. Full product call and review. Launch June/July.

+ June. Fall OTO product call. Launch September/October.

+ August. Holiday OTO product call. Launch November/December.

+ October. Full product call and review. Launch December/January.

To reference this schedule, including the category review process, go here.

NB. With some exceptions, across Canada licensed providers (LPs) selling their cannabis products wholesale (to another licensed producer or a provincially-authorized distributor) are not subject to PST.

NEW BRUNSWICK

Distribution Model

The province’s Cannabis Management Corporation oversees sales, with the New Brunswick Liquor Corporation (known as “NB Liquor”) operating the cannabis retail operations via its subsidiary, Cannabis NB. Cannabis NB includes online sales. New Brunswick is migrating from a government-owned and operated retail model to a hybrid public-private model, as in BC.

Fees

New Brunswick charges 15% HST.

For online sales, Cannabis NB charges a $7 flat rate for shipping to the end consumer. Same-day delivery is $11. Orders over $150 have free delivery. New Brunswick has a social responsibility fee of 2% of the pre-HST invoice value of any cannabis product purchased by CNB. This amount is withheld from each payment made to a supplier.

Cannabis NB charges for onboarding, handling, maintenance, and administration of cannabis products and accessories. Short, late, and inaccurate shipments can be subject to fines up to $5,000, with products possibly returned at the supplier’s sole expense and risk of loss.

Data inaccuracy fines are in the $2,000–$5,000 range, with $250 per instance of data administration fees. Non-compliant packaging can be subject to a $5,000 fine. CNB also reserves the right to charge a supplier a reasonable fee for inspecting and handling unsatisfactory products. Suppliers must have $5,000,000 in liability insurance.

A supplier may request 14-day payment terms by contacting [email protected]. Expedited payments will be processed for a fee equal to 3% of the pretax purchase order invoice.

Product call schedule

Cannabis NB is currently revamping the new product listing process, along with PO terms and product requirements.

NORTHWEST TERRITORIES

Distribution Model

The Northwest Territories Liquor and Cannabis Commission (NTLCC) regulates the distribution, purchase, and sale of cannabis in the NWT. Legal cannabis is only available in the NWT through NTLCC-approved vendors and/or the NTLCC-approved online store. In total, there are six retail stores in the NWT.

Fees

Northwest Territories charges 5% GST.

Call schedule

There is no published call schedule.

NOVA SCOTIA

Distribution Model

In Nova Scotia, the sale and distribution of cannabis is restricted to one provider, the Nova Scotia Liquor Corporation (NSLC). Cannabis can be purchased at designated NSLC physical stores or the NSLC online store. To order cannabis online, customers are asked to enter their date of birth to enter the site and then must show ID to the carrier when the cannabis is delivered.

Fees

There are no unique fees for LPs in Nova Scotia. HST is 15%.

Product call schedule

Nova Scotia currently doesn’t have a published product call schedule for LPs, but it plans to publish one later in 2023. The anticipated schedule will include two annual product calls—one in the fall and one in the spring. The fall product call will be open to any licensed producer for new products that will hit the market in the spring. The spring call will be limited to existing LPs for new products that will go to the market in the fall.

NUNAVUT

Distribution Model

At present, the retail market for recreational cannabis in Nunavut is made up of a single licensed private retailer in Iqaluit, under a licence from The Nunavut Liquor and Cannabis Commission.

Fees

Nunavut charges 5% GST. In Nunavut, the total adjusted cannabis duty on packaged and stamped cannabis products is 19.3%. This is the highest in Canada. Retailers in Nunavut are charged a $2,000 application fee.

Product call schedule

There is no product call schedule, per se, in Nunavut.

ONTARIO

Distribution Model

As partners of the Ontario Cannabis Store (OCS), LPs are required to enter into a Master Supply Agreement (MSA) with the OCS as part of their onboarding process. The Ontario Cannabis Retail Corporation, operating as Ontario Cannabis Store (OCS), is a Crown corporation that manages the online retail and wholesale distribution of recreational cannabis. This legal monopoly distributes to consumers and to privately operated brick-and-mortar retailers.

Fees

In Ontario, the total adjusted cannabis duty on packaged and stamped cannabis products is 3.9%.

While the OCS does not charge LPs additional ongoing fees, there are other financial requirements for working with OCS, including general liability insurance. Upon signing an MSA, LPs must provide a Certificate of Insurance, which shows that they have Commercial General Liability coverage of no less than $15M per occurrence. Based on LP feedback, OCS waived the product recall liability insurance requirement as of November 17, 2022.

Ontario charges 13% HST on recreational cannabis. Qualified medical cannabis receives an 8% PST rebate, resulting in payment of only the 5% GST.

The MSA includes a Data Subscription Agreement. The Data Program provides LPs with supply chain and/or market information, such as unit sales and warehouse inventory levels, to help facilitate their product forecasting and to enable greater fulfilment service levels. The Data Program currently comes with an annual fee of $2,500 plus: an amount equal to 0.2 percent of each Purchase Order sent to the OCS (Level 1), an amount equal to 0.3 percent of each Purchase Order sent to the OCS (Level 2).

With Level 1 access, LPs gain insight into their products’ sales performance across Ontario. With Level 2 access, LPs can access data pertaining to their competitors’ products to help determine relative market share and explore market opportunities. Attributes include an inventory snapshot and data on unit/dollar sales at an SKU level, with various ways to filter and visualize data.

In Ontario, a Cannabis Retail Manager Licence is $750 for the first two-year term, with a two-year renewal fee of $500, and a four-year term costing $1,000.

A Retail Operator Licence is $6,000 for an initial two-year term, with a two-year renewal fee of $2,000 and a four-year term costing $4,000.

Retail Store Authorization is $4,000 for the first two-year term, with a two-year renewal fee of $3,500 and a four-year renewal fee of $7,000.

These fees are all under the purview of the Alcohol and Gaming Commission of Ontario (AGCO), not the Ontario Cannabis Store (OCS).

Product call schedule

The OCS product call schedule is a complex process. Currently, the OCS issues product calls four times each calendar year: in spring, summer, fall and winter. The OCS warehouse delivery window and rolling launch dates are updated once Purchase Orders (POs) are issued for each call.

Each of the four calls has ten steps: publications of assortment needs bulletin; pre-submission form deadline; feedback from pre-submission; submission deadline; NTP sent; NTP received by OCS; PO issuance; launch of OCS catalogue; last arrival into OCS warehouse; and anticipated product launch. The schedule can be found here.

PRINCE EDWARD ISLAND

The Prince Edward Island (PEI) Cannabis Management Corporation, which operates as PEI Cannabis, has the exclusive right to purchase recreational cannabis, and to conduct retail sales. There are four stand-alone stores on the island.

Distribution Model

In PEI, adult-use cannabis is sold through four (4) stand-alone PEI Cannabis retail stores. There is an online sales storefront (peicannabiscorp.com) with direct-to-home delivery. The PEI Cannabis Management Corporation oversees the operation of cannabis retail locations and the e-commerce platform.

Fees

Prince Edward Island charges 15% HST.

The province’s standardized mark-up structure is applied against the excise exclusive mark-up base to determine retail prices. There is a system for inventory buy-backs, also known as Return-to-Vendors (RTVs). If a product being returned is treated as unsaleable, it will be added to the PEI Cannabis quarterly unsaleable consolidation and will be subject to chargeback conditions. For more information on RTV policies, go here.

PEI does not charge listing fees but does offer 12 merchandising periods for LPs to participate in programs at a cost. This is a complex program, with details available here.

Product call schedule

PEI currently doesn’t have a product call schedule.

QUEBEC

Distribution Model

The Société Québécoise du cannabis (SQDC), a subsidiary of the Société des alcools du Québec (SAQ), Québec’s Liquor Commission, is the only authorized retailer of recreational cannabis in Quebec. All cannabis retail stores are owned and operated by the provincial government.

Fees

Quebec charges 14.975 GST/QST. The additional duty rate in Quebec for the ad valorem duty is 7.5%.

Product call schedule

Quebec has two product call cycles, each lasting six months. The province also has a product call program for small batch products, called Petite Lot or Project Petits lots de fleurs séchées, that allows for new lots of cannabis under 40 kg and new to the Quebec market.

SASKATCHEWAN

Distribution Model

Saskatchewan has a competitive private model for the wholesale/distribution and retail sale of recreational cannabis. Private and online stores are regulated by the Saskatchewan Liquor and Gaming Authority.

Fees

Saskatchewan charges 11% GST/PST. In Saskatchewan, the total adjusted cannabis duty on packaged and stamped cannabis products is 6.45%.

For retail, a permit application fee is $2,200. The annual permit fee is $3,300 if the cannabis retail store is located within a city; and $1,650 for all other cannabis retail stores.

Licensed providers must pay a registration application fee of $550 and an annual registration fee of $1,650, initially payable at the time of application.

Product call schedule

LPs ship directly to retailers. As a result, product calls are unique to the requirements of each store.

YUKON

Distribution Model

The Yukon Liquor Corporation (YLC) purchases recreational cannabis products from licensed producers as the wholesaler. The YLC then sells to licensed cannabis retail stores, which in turn sell to consumers.

Fees

Yukon charges 5% GST. There are no fees for licensed producers wishing to sign a supplier agreement with the YLC.

The initial application fee for retail is $2,050, and the renewal application fee is $1,550. There is also an annual licence fee of $2,150, which renews on April 1. If the licence is not issued on April 1, the fee will be pro-rated from the month it is issued to March 31.

Product call schedule

The Corporation shares inventory lists three times per week with the Yukon’s licensed private retailers, and hosts weekly calls.