The SQDC plans to shift from adding new cannabis stores to adding even more new products and refining the consumer experience to continue gaining market share over the coming years, says the President and CEO of Quebec’s cannabis corporation.

The provincial cannabis distributor and seller is also looking to work with industry to help identify those new products that can fit within the province’s strict regulations.

Jacques Farcy, who took up the role of President and CEO of the SQDC last October, says that while past growth for the company has primarily been due to the continued addition of new stores—20% growth last fiscal year, and 21 new stores for a total of 87 as of press time—the next few years will see the introduction of new programs to better understand consumer demands and continue to take market share from the illicit market.

Although Quebec has fewer than 100 stores, they have captured about the same market share as its neighbour Ontario, which had more than 1,000 retail stores at the end of last year. Online sales were slightly higher in Quebec as well, around 6% compared to 4% in Ontario.

Shift from new stores to new products

“We do not see that in the future adding more and more stores will create more and more capture of the legal market,” offers Farcy. “At one point, we will see that there is a kind of saturation of the ability to capture the market by opening new stores. We feel like around 100 is right for the first step.

“But then there is another discussion, which is within those stores, what kind of product are we offering, how can we serve customers, how can we make sure that we’ve got the right pricing policy in order to make sure we are still powerful in capturing the market?”

“We first need to rethink a little bit the way we operate our stores.”

And while Quebec has some of the most austere product restrictions in Canada—no high potency extracts or vape pens, strict limits on edibles, Farcy says they are open to working with industry to find creative solutions for new, innovative products that can still fit within the province’s sometimes narrow limits.

One example he points to is the recent inclusion of Cinnamon and Blackcurrant Bites, the first proper cannabis edible (and so far only) to be sold in Quebec. Traditional candies and cookies are not allowed. Primarily made of dates and hemp hearts and sunflower seeds and with 2.5 mg THC per serving, the edibles were deemed as not appealing to children.

“Quebec is having a specific approach in Canada,” explains Farcy. “Compared to other provinces, I think we are much more dedicated to health and everything we do is based on our mission. We’re working hard in order to make sure we take customers from the illegal market and migrate them to the legal market, to the SQDC.”

“We’ve developed that product with the industry based on our regulations and the way we want to do things. So it sometimes takes a little bit longer to get there, but we feel like this is a very sustainable approach that can please the customers… but can also respect the (regulations).

“So rather than saying we do that or we don’t do that, more and more in the future we will think in terms of how we can do what we are supposed to do in order to fulfill the customer needs in a specific way that is true to our nature.”

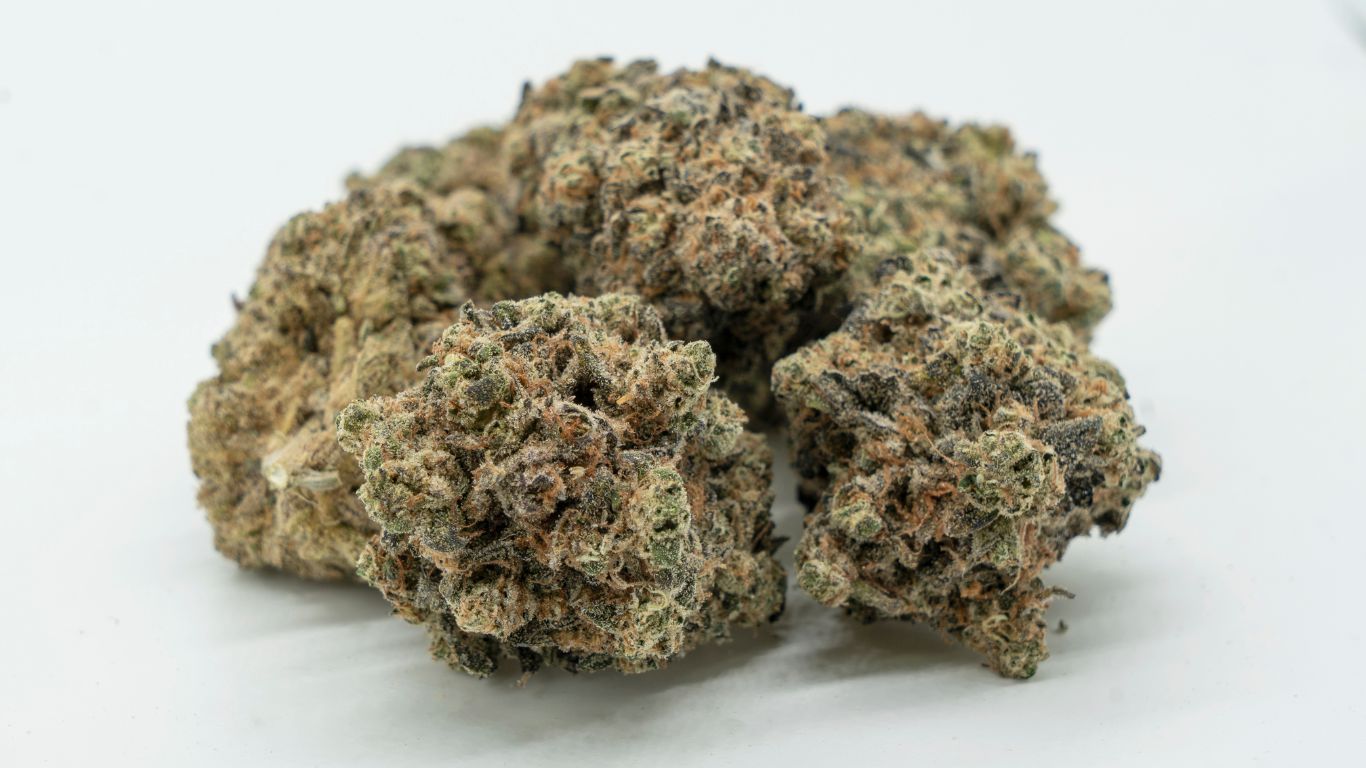

In addition to the cannabis bites, the province has also brought in kief and hash that is under the province’s 30% THC limit. It currently lists about 50 different hash SKUs, as well as a half dozen kief listings and one infused pre-roll, and a CBD isolate.

Another way to better gauge customer demands, he says, is through a new program that will be hitting shelves in some select stores in September. The “nursery” program will allow the province to bring in new, limited-run products to better understand what kinds of products they should then supply all their stores with.

“The idea is to have a subset of our stores to act as a test market in which we will launch new products so that customers’ selections can help us identify what customers prefer,” he explains. “We’ll know in those nursery stores the products that are really appealing to customers, and then deploy it in the rest of the network.”

These newer products will then phase out older existing products and product categories not doing as well.

“We are very happy with where we are and we also understand that there are still a lot of things to do,” says Farcy, in regard to the first three and a half years of legalization. “Just because we are happy with where we are doesn’t mean we think the job is done. There are still a lot of things to put in place in order to make sure that we will be the retailer chosen by (cannabis) customers. “

Some other ways the SQDC is trying to enhance the consumer experience is expanding their express delivery service beyond just Quebec and now including new regions such as Trois-Rivières, Shawinigan and Quebec City—or 54% of the province’s population.

The provincial distributor and retailer has also significantly increased its variety of flower, extracts (oils and capsules), as well as beverages.

The express delivery service the same day in the evening, which was previously offered to approximately 35% of the population Quebec, was extended this year to new cities such as Trois-Rivières, Shawinigan and Quebec. The service express delivery is now offered at 54% of Quebecers. Customers within the regions where it has been 63% opt for this delivery method.

Quebec also introduced the “Cultivé Québec” product category in 2021 which allows customers to distinguish, among the products offered, those that are composed of cannabis grown mainly (65%) in Quebec.

Initially only applying to dried flower, the program has now been extended to include ground cannabis products, prerolls, hashish and kief. The crown corporation closed its fiscal year 2021-2022 with 42% of the total weight of cannabis sold at the SQDC bearing the identifier Cultivé Québec/Cultivated Quebec.

The SQDC had products available from 17 different Quebec LPs at the end of 2021, but Farcy emphasized that they are open to products from producers in all provinces.

The retailer estimates that it has captured about 58% of the total cannabis market in Quebec, a figure Farcy says he thinks could reach around 80% by the end of its next three-year strategic plan for 2024-2027. But meeting consumer demands will be key, he says.

“I think we will be around two-thirds by the end of this strategic plan. In the long run, if we do a good job and understand customers, we could reach something like 80% at the end of our next strategic plan, but this is only my best guess.”