The campaign to bring more awareness to the high level of taxation faced by cannabis companies in Canada has recently released a white paper intended to highlight the issues and the work they are currently doing behind the scenes.

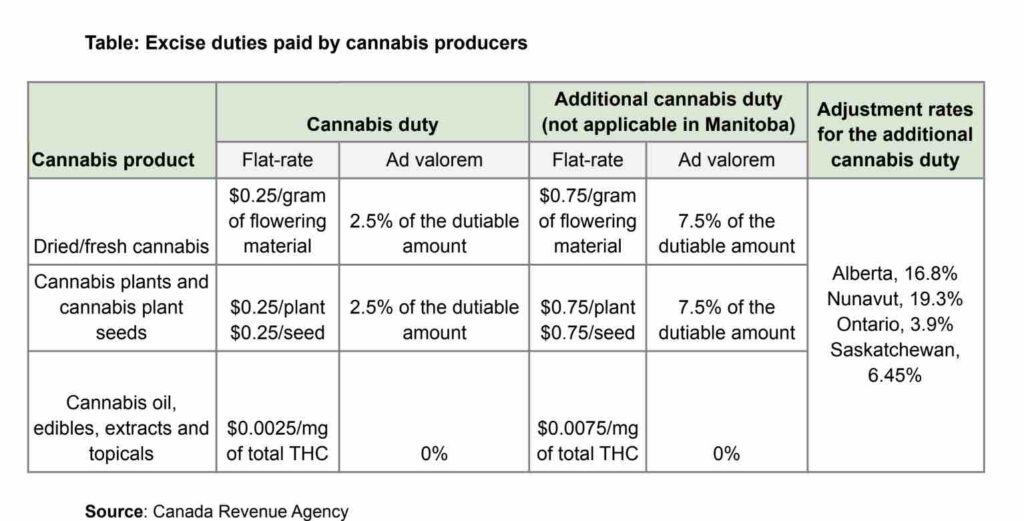

The 40+ page white paper from StandForCraft.com is an extensive report highlighting the issues cannabis producers face—especially small, craft producers—in remaining financially viable while paying at times upwards of 25-35% in federal excise taxes.

Dan Sutton, who has been leading the Stand For Craft movement for around a year now, says the issue is gaining traction with policymakers. The paper itself was shared with government at all levels earlier this week and then released to the general public.

“Policymakers are really the core audience for this, but we want the public to see what we’re doing,” explains Sutton.

With cannabis being legal for over three years in Canada now, Sutton says there’s enough data to begin truly looking at the current taxation issue and how it’s affecting the overall viability of the legal industry.

“The difference between what’s going on now and what was going on even six months ago, is people are realizing there’s something wrong with how we’re going about taxing cannabis businesses. A lot of companies are going out of business, no one’s really making a healthy amount of survivable income in the craft segment. So it’s time to take another look at it, especially now with three years of data.”

The issue is also gaining traction in US states like California, where the industry faces similar challenges. Sutton says he’s heartened by the fact that the recent federal budget in Canada has noted that Innovation, Science, and Economic Development Canada is committed to hosting an industry table to look into the issue, as well.

“I think that is the target forum where this is really going to get the air time it deserves, so that is the next key beachhead. Let’s open this up from not just industry insiders, to actual policy analysts who see what is going well with excise taxes and what is not going well, so we can better serve craft businesses.”