A recent study in the Journal of Studies on Alcohol and Drugs examined cannabis consumer preferences as they relate to choosing where and what to purchase.

The study shows that cannabis consumers in Canada are willing to pay more for a higher quality, legal flower with an emphasis on high THC.

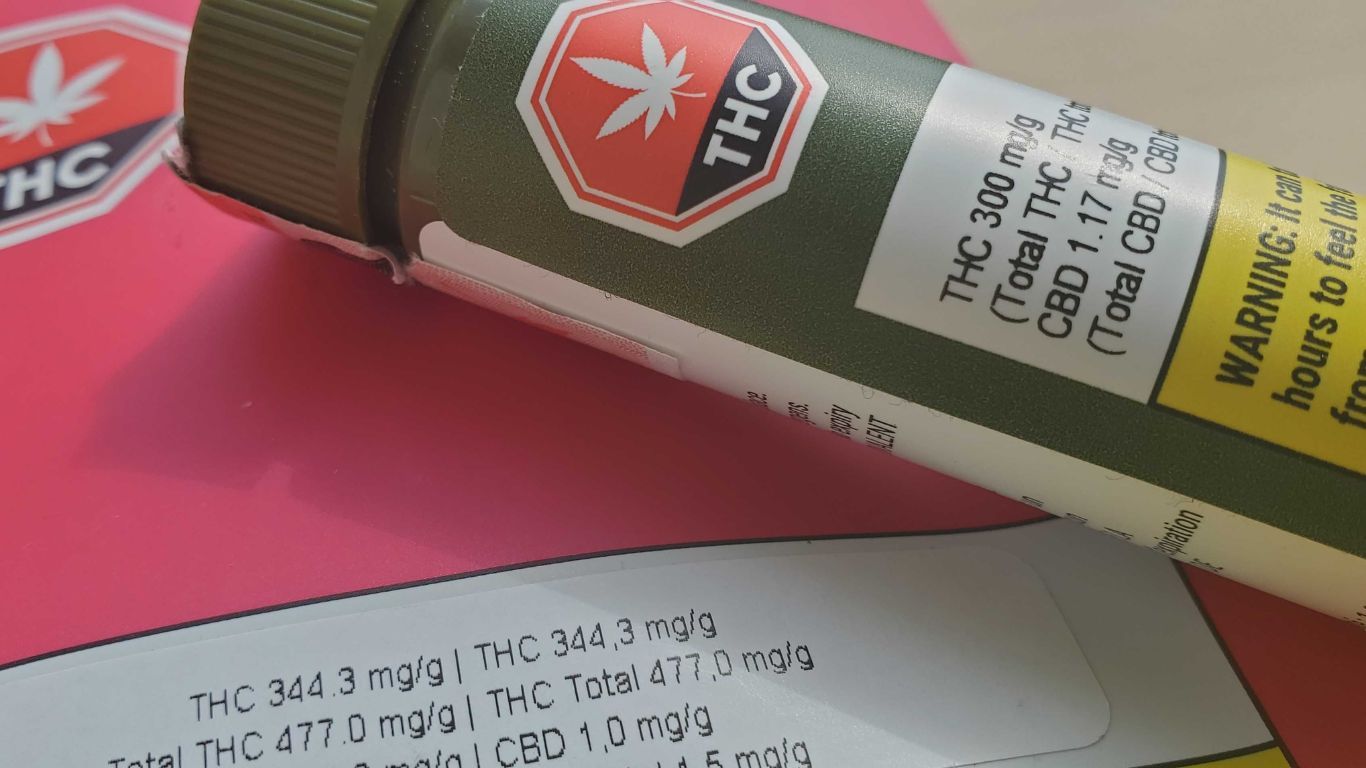

However, their motivations have less to do with price and more to do with THC potency and package and label information.

Those with more loyalty to the legal market tended to prefer pre-rolls and were more likely to be less frequent consumers. In contrast, more high-volume consumers preferred larger-volume packaging and were more likely to care about THC potency and price.

Researchers highlight that the results show a balancing act for regulators with public health regulatory goals, while also allowing for product types and packaging that will appeal to consumers more likely to turn to the unregulated to meet their needs.

Three types of consumers

The study divided respondents into three mostly distinct groups and had them rate purchase preference for cannabis flower based on characteristics like THC potency, moisture level, price, packaging, legal status, and recommendations.

The first group, about 30 percent of the 891 total participants, based purchases on a preference for high THC (+25 percent) and price. These tended to be more long-time consumers who use cannabis regularly and were more likely to have an ideological preference for unlicensed sources.

The second group, about 40 percent of all respondents, were more likely to make purchasing decisions based on product type and the amount of information on the label. This group preferred larger packaging and whole flower over pre-rolls and tended to put more importance on proper moisture level than the other two groups.

The third group, 30 percent of the respondents, were also most motivated by packaging type but instead had a preference for pre-rolls over other dried flower SKUs. While most consumers didn’t rate legal cannabis as a high priority in purchasing decisions, this group gave it more importance than the first two groups. This group also tended to consume less often than the other two and were more likely to report starting or restarting cannabis use after legalization.

“When all other attributes were held constant, participants were willing to pay about $15 more for 3.5 grams of dried flower packaged in a bag compared to pre-rolled packages, $8 more for dried flower that had a medium moisture content compared to low, $34 more for 3.5g of dried flower that was 25%+ THC compared to 10-14.9% THC, $19 more for detailed package information compared to no detail, and $9 more for a product that was regulated by Health Canada compared to no regulation.”

All three groups didn’t give much weight to recommendations, including online reviews, family and friends, or retailers. The first group gave more importance to online reviews, the second group had a slight preference for family and friend recommendations, and the third group tended to be more motivated by retailer recommendations.

Although there was some crossover in reporting groups, most tended to fit into just one category. Overall, consumers placed a low priority on recommendations. They were willing to pay more for dried flower than pre-rolls, more for flower that wasn’t overly dried, more for high THC flower, and more for detailed product information on the label.