Canada has a higher proportion of younger cannabis users and female cannabis users than the US, according to cannabis data platform Headset.

The recently released data compares sales figures from Ontario and Alberta, as well as eight legal US states, against trends from 2021 to 2023.

The eight legal US states surveyed were Washington, Oregon, Michigan, Nevada, Massachusetts, Arizona, Colorado, and California.

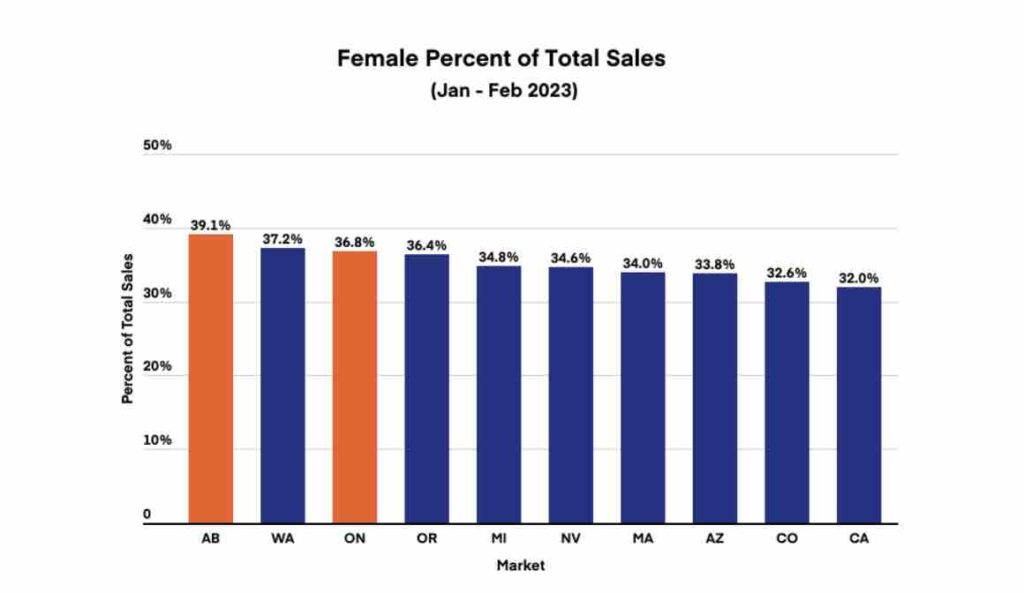

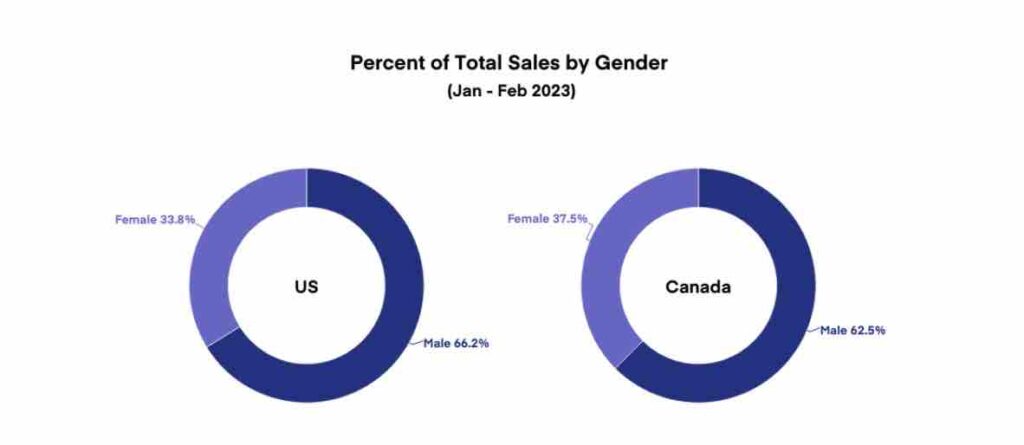

Millennial and Generation Z consumers accounted for over 72 percent of all tracked sales in Canada compared to 63 percent in the US. While males are still the majority of cannabis consumers in both countries, the two Canadian provinces Headset analyzed showed a 37.5 percent market share for females compared to 33.8 percent in the United States when comparing sales in February 2022 and February 2023.

Canada’s female representation in total sales also grew faster (1.2 percent) year-over-year compared to its US counterparts (0.26 percent) between January 2021 and December 2022.

These figures were not evenly distributed in both countries, though. While female participation in the cannabis market has increased in both countries, overall US figures were held back by declines in Oregon and, to a lesser degree, Colorado, and Arizona. Conversely, Nevada, California, and Massachusetts saw modest increases.

Alberta also saw a very small decline in market share from female customers (0.1 percent), while Ontario saw a 0.7 percent increase.

Despite those small declines, Alberta had the highest level of female cannabis market participation of all the surveyed jurisdictions at 39.1 percent, followed by Washington State at 37.2 percent and Ontario at 36.8 percent.

Males continue to dominate the concentrates and dried flower product categories, while female consumers hold a greater market share in topicals, tinctures and sublinguals, and edibles compared to every other product category.

Age differences

Millennials (age 27-42) continue to make up the majority of cannabis consumers in both countries, with a 50.3 percent market share in the two Canadian provinces and a 46.2 percent market share in the eight US states surveyed.

Canadian cannabis consumers trend slightly younger than American consumers. Gen Z and Millennials (11-42) make up more than 70 percent of the market share in Canada, compared to 63 percent in the US. Gen X and Baby Boomers (43-77) make up a larger portion of the market in the US than Canada, with 37 percent of the market compared to 27.9 percent in Canada.

While Millennials dominated sales in both countries, Gen X was the fastest-growing demographic, eating into the Millennial market share.

In the US, Gen Z’s share of total sales has grown by 11.3 percent in February 2023 compared to February 2022, from 15.1 percent to 16.8 percent of sales. In Canada, Gen Z’s share of total sales grew from 20.6 percent to 21.8 percent.

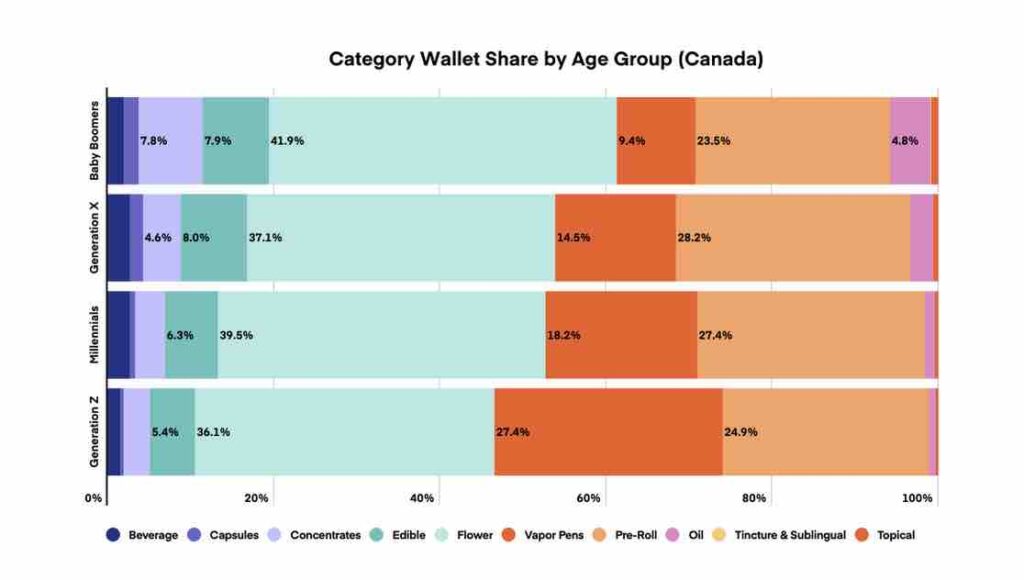

In both countries, older consumers (Gen X and Boomers) tended to prefer a greater variety of products and tended to prefer more “wellness” focussed cannabis products compared to younger consumers. They also showed a greater affinity for edibles than their younger counterparts.

Millennials love their vape pens

In the US, younger consumers (Gen Z and Millennials) were more likely to consume vape pens and concentrates and less likely to consume dried flower. In fact, for Gen Z consumers, vape pens were slightly more popular than dried flower when excluding cannabis pre-rolls from the dried flower category, a first for any age group.

Consumers in Canada showed similar trends, although concentrates and vape pens do not hold quite the same market share as the US, with dried flower still the dominant product category across all age groups.

However, in Canada Boomers showed the highest market share for concentrate consumption, something Headset attributes to so-called “edible extracts” which began to make a splash in the market from late 2021 before Health Canada sent notice to end production in early January 2023.

While edibles enjoyed a significantly smaller market share in Canada than the US, Boomers also consumed the largest portion of cannabis oils among all age groups in Canada at 4.8 percent of sales, followed by Gen X and Millennials.

The eight legal US states surveyed were Washington, Oregon, Michigan, Nevada, Massachusetts, Arizona, Colorado, and California.