The Government of Canada recently released newly updated sales and inventory figures for the cannabis industry, highlighting changing trends as the industry continues to mature. The new numbers are up-to-date through June 2024.

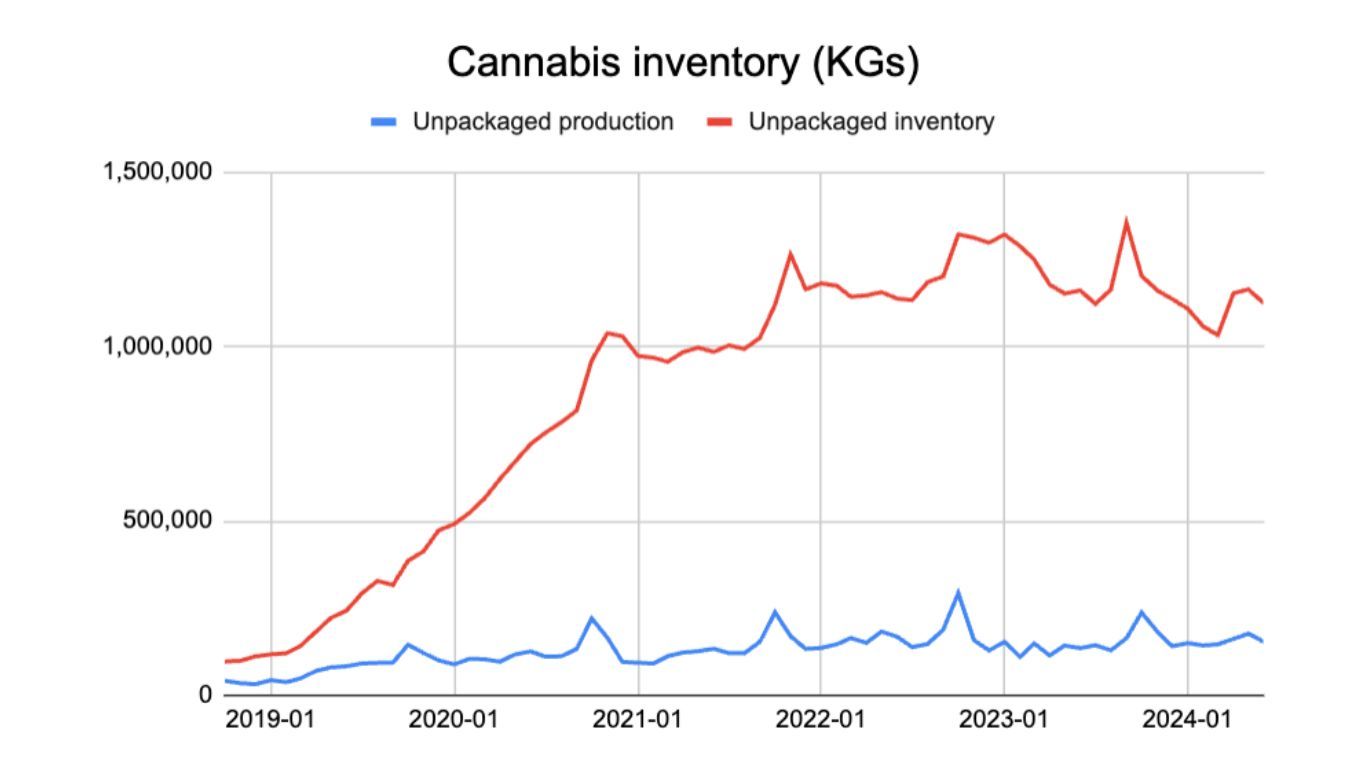

Inventory of unpackaged dried cannabis increased in April and May after six months of declines but dropped again slightly in June. Unpackaged dried cannabis still in production has remained relatively steady for some time now, with annual spikes in October due to outdoor cannabis harvests.

Packaged inventory of dried cannabis with cannabis producers has remained relatively level since early 2022, with some seasonal fluctuations.

Edible cannabis packaged inventory increased slightly in recent months, while sales of cannabis edibles have shown month-over-month increases in the first six months of 2024. Packaged inventory of cannabis edibles with provincial distributors and retailers has been slowly increasing since the end of 2022, as have sales.

Packaged inventory of cannabis extracts was lower in April, May, and June 2024 compared to the three previous months, while sales of cannabis extracts have increased month over month since February 2024, following a decline from a spike in sales in December.

Packaged inventory of cannabis topicals has remained relatively steady for several months while sales show similar stability, except for a slight decline in March. Packaged inventory of cannabis topicals with provincial distributors and retailers has been declining since a peak at the end of 2022, except for a small spike around Christmas 2024.

Packaged inventory of cannabis plants with provincial distributors and retailers jumped significantly in April, May, and June 2024, as did sales.

Packages of cannabis seeds saw a significant spike at the end of 2023, while packaged inventory with provincial distributors and retailers has been declining since a high water mark at the end of 2021, with a brief spike at the end of 2023.

Packaged inventory of cannabis seeds with Federal licence holders fluctuated significantly in 2023 and increased in the first few months of 2024.

The total building area for cannabis production has also continued to decline from a peak of 4.8 million square meters in November 2021 to 2.9 million as of June 2024. Federally licensed indoor production space for cannabis has also continued to decline from a peak of 2 million square meters in November 2020 to 1.3 million in June 2024. Licensed cannabis processing space has remained relatively steady for several years, from a peak of 526,726 million square meters as of May 2021 to 341,682 in June 2024.

Total approved outdoor production space reached a peak of 713 hectares in December 2021. There were 601 hectares approved as of June 2024.

Retail sales of cannabis in Canada (non-adjusted) show a summer peak at $475.5 million, up slightly from $469 million in August 2023. Sales in October 2024 were $456.3 million, up from $451.2 million in the previous month.