Cannabis sales declined in BC in the first three months of 2024 compared to the last three months of 2023 but still showed year-over-year growth.

Sales through the Province’s direct delivery program also shrank for the second quarter in a row from their highest point in Q2 2023.

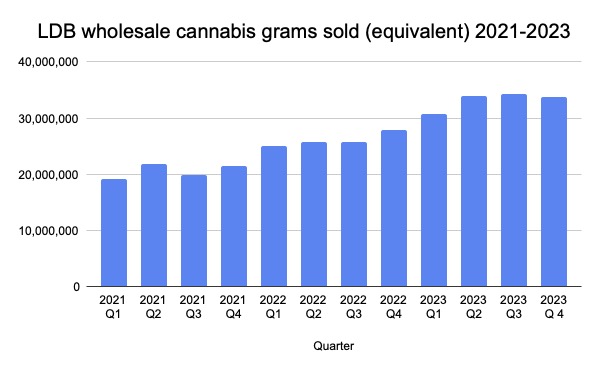

Wholesale grams of cannabis sold in BC (from the LDB to retailers) in January, February, and March 2024 were up 20.9% compared to the same period in 2023. Wholesale sales dollars were also up 10.3% compared to the previous year.

All figures are for wholesale sales through the LDB, including direct delivery.

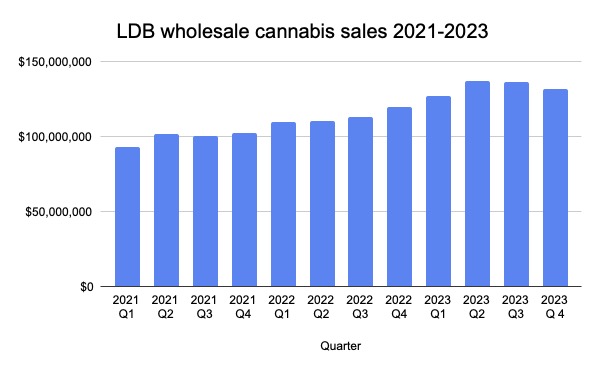

Despite this year-over-year increase, wholesale dollars on cannabis sales through the Liquor Distribution Branch (LDB) declined slightly in the most recent quarter compared to the two previous quarters.

Wholesale cannabis sales were $132 million in Q4 2024, down from $136.7 million in Q3 and $137.1 in Q2.

This decline is due to the continued lower cost of cannabis, again down in the most recent quarter to a new low of $3.92 for all cannabis and $3.21 for dried flower.

The number of retail stores in the province increased again in the most recent quarter, up to 501, a net increase of five from the previous three months at the end of 2023. The Metro Vancouver area gained five stores compared to the previous quarter (Zone 1), Vancouver Island (Zone 2) gained four, the interior lost four, while northern BC stayed steady with 66.

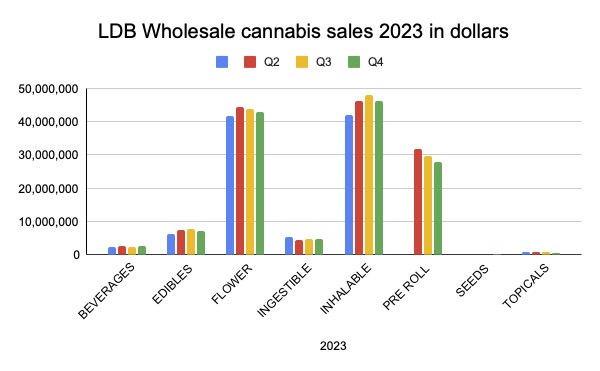

Dried flower and pre-rolls are still the majority of sales in dollars sold (32.5% and 21.1%). However, for several quarters in a row now, inhalable extracts, including products like vape pens and extracts and infused pre-rolls, have been higher than dried flower sales alone, at 35% of wholesale sales in Q4 2023.

Sales of 3.5 gram SKUs of dried flower declined by 33.2% year-over-year (YOY) and 24.8% by grams sold. They declined from the previous quarter as well. Meanwhile, 7, 14, and 28 gram SKU sales increased YOY by 50.9%, 32.6%, and 15.1%, respectively.

Despite these YOY gains, sales of 7 gram SKUs declined slightly from the previous quarter, though 14 gram SKUs remained stable from Q3 2023, and 28 gram SKUs increased slightly.

Edibles were 5.4% of total sales in Q4 2023, cannabis beverages were 1.9%, and topicals were a half percent. The most popular beverages continue to be carbonated drinks by a wide margin (89% of units sold). The most popular edibles continue to be gummies/chews, also by a wide margin (91.2% of units sold).

Disposable vape pens continue to show significant market growth, with $2.4 million in sales in Q4, showing a 91.9% YOY increase and a 72.2% increase in units sold. Despite this increase, disposable vapes accounted for just 5.2% of sales and 6.2% of units sold in this category.

The province sold about 10,000 more disposable vape pens in Q4 compared to Q3. Vape cartridge sales showed modest increases both YOY and compared to Q3.

With just over 1 million units sold in Q4 2023, “other inhalables”, which includes infused pre-rolls, showed considerable YOY growth in sales and units sold (37.9% and 30.9%) but declined slightly from the previous quarter.

This category was also the highest percentage of units sold in the most recent quarter, compared to 40.8% for cartridges.

Resin and rosin sales increased 41.8% (sales) and 53.8% (units sold) YOY and showed modest increases from the previous quarter, while shatter stayed relatively level YOY and wax decreased by 100% (to zero).

BC sold just over seven thousand units of cannabis seeds in the first three months of 2024.

In the topicals category, sales of balms increased by 41.4% YOY and 18.1% in units sold, while declining for both from Q3. Creams, lotions, massage oils, lubricants, and other topicals continued declining YOY and quarterly.

Bath products had a 9.1% increase in sales YOY but a 19.7% decrease in units sold. Sales and units sold in this category were much higher in Q3, potentially related to holiday shopping.

Direct Delivery

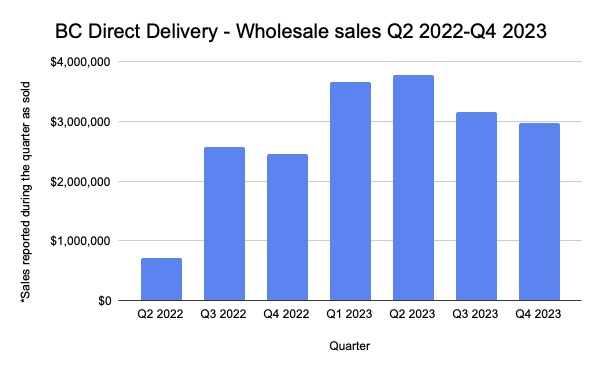

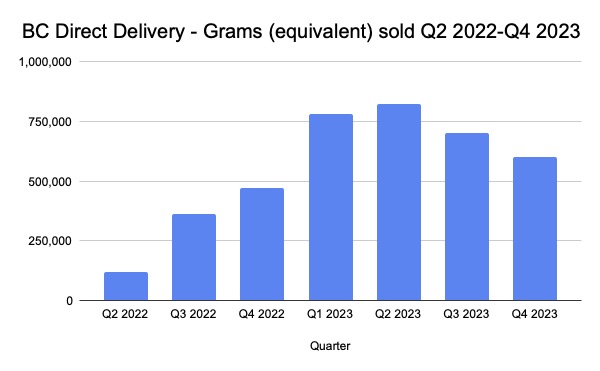

Sales through BC’s direct delivery program, which allows certain BC producers to ship products directly to retailers rather than going through the Province’s central distribution warehouse, showed the second consecutive decline in wholesales and grams sold (and equivalent).

There were 602,525 grams sold through this distribution model in Q4 2023 and $2,978,775 in wholesale sales. This is down from 702,478 grams sold in Q3 ($3,167,450) and 821,718 grams sold in Q2 ($3,777,539), the high water mark in both categories since the program began in Q2 2022.

Bucking the trend in overall sales, though, the price per gram of dried cannabis flower sold through direct delivery increased to $4.42 a gram compared to $3.93 per gram in Q3 and $4.18 per gram in Q4 2022.

Flower and pre-rolls are the majority of sales in this sales channel by sales and units sold.

Direct delivery sales of edibles and beverages showed a 90% increase YOY, with a fourth quarterly decline with 2,705 units sold in Q4 2023, compared to 3,439 in Q3, 3,806 in Q2, and 5,209 in Q1. Despite these declines, in terms of dollars sold, this category still increased in the first three months of 2024 compared to the previous three quarters.

Dried flower sales increased slightly from Q3, but were lower than in previous quarters. The province sold more units of pre-rolls in Q4 2023 compared to the previous quarter, but brought in less in sales.

No plants were sold through direct delivery in the first three months of 2024, compared to 102 sold in the first three months of 2022. There were 236 cannabis plants sold through direct delivery in Q2 2023 (July-Sept) for a total of $5,741. In Q1 2023, there were 2,342 cannabis plants sold for $58,597. The LDB has no sales figures for plants in Q3 2023.

The full quarterly report can be read here.