The President and CEO of the SQDC says the agency needs to continue improving customer experiences in order to expand its reach into the illicit market.

After growing its retail network to nearly 100 stores, Jacques Farcy, who has been at the head of the SQDC since late 2021, sees the agency’s challenge is to ensure Quebecers are aware of the variety of products the provincial retailer carries.

The CEO has made this his mission since first taking the reins, sharing similar goals with StratCann in 2022. Since then, sales have not expanded—a trend playing out across much of Canada—as the market appears to be slowing after an initial rapid expansion.

Consumers in Quebec bought $601.9 million worth of cannabis in 2022 during the fiscal year ended March 25, 2023, compared to $600.5 million in the previous year. The estimated share of the total market the province captured declined slightly, from 58.5% in 2022’s annual report to around 56% this year.

Despite that small decrease, according to Quebec’s most recent annual survey on cannabis, fewer consumers bought from illegal suppliers compared to the year prior, meaning while few people use the illicit market, those who do are purchasing more. The SQDC’s target for 2022-2023 was to capture 75% of the total market.

Approximately 67% of cannabis consumers obtained cannabis at least once from the SQDC in 2022, similar to the rate in 2021. Among consumers aged 21 and over, around 44% purchased their cannabis exclusively from the SQDC, while approximately 22% said they obtained their cannabis only from sources other than the SQDC.

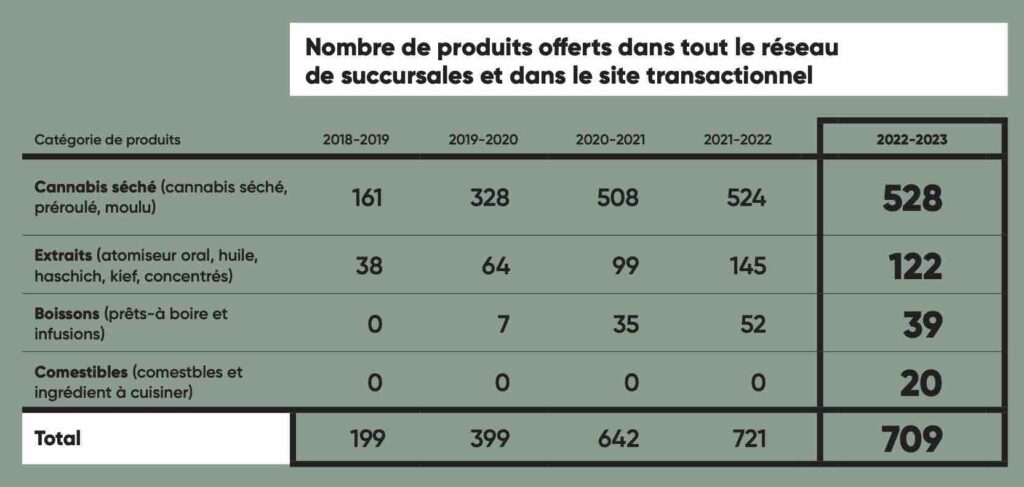

One of the challenges Farcy says the SQDC is trying to address is that many consumers are unaware of many of the products the store carries. Although Quebec has more restrictions on products than other provinces, such as no high potency extracts or vape pens, they have introduced kief, hash, and a handful of edibles for the first time.

He says the market plateauing is an expected development, and now the agency is focusing on better serving customers within the existing footprint rather than expanding it.

“It’s time now to reconsider the way we do things, and enhancing the network or the number of stores is not a winning strategy for the future,” Farcy tells StratCann. “Now that we have 98 stores, we need to make sure that we satisfy our customers more within our stores. We need to put more energy there.”

In addition to new products, the province has also expanded its delivery service. About 20% of the province can now have cannabis delivered within 90 minutes of ordering from the SQDC’s online store, and same-evening service is available for about half of the province—something he says was just “a dream” a year ago.

The inability to sell all the products that consumers want is another challenge, he admits, as is the prevalence of illicit online sites that consumers may not know are illegal. Although Farcy expects to see the agency make more inroads with consumers still buying from the illicit market by informing them of newer products and the variety of prices—from a low of around $3 a gram to higher quality products at nearly $20 a gram—capturing all of the market will not be possible.

“That’s the reason we cannot claim that we will capture 100% of the market in the next three years, because there are these products that would be illegal.”

“The other thing that is important is what is legal in the minds of customers,” he adds, referring to illicit online stores.

“Customers don’t necessarily understand that buying on a website outside of Quebec, by nature, is illegal. We can’t really blame them for not understanding, because we have not made enough information available around those grey zones. And illegal markets are very clever with their approach.”

“It’s really important that we do as much as we can to not keep this confusion alive.”

Still, he sees many opportunities the SQDC is already taking to refine that shopping experience and better educate customers about what is available. One example he gives is some new store designs that provide employees with a better chance to engage with customers on the floor rather than just behind the counter.

He acknowledges the next few years will be a harder fight than the first several years of legalization, but sees many opportunities for continued success.

SQDC annual report 2023

The Société québécoise du cannabis (SQDC) sold $601.9 million worth of cannabis in 2022 according to the agency’s most recent annual report.

This amounted to $94.9 million in revenue from sales for the fiscal year ended March 25, 2023. The SQDC also brought in an additional estimated $137.8 million in consumption tax and excise tax, for a total of $232.7 million to the Quebec government, which directs the funds to prevention and cannabis research.

Website sales were also down slightly, from $36.2 million in 2022 to $34.1 million at the end of March 2023.

The SQDC sources products from 48 active suppliers, 54 percent of which are based in Quebec. Forty-one percent of the total volume of cannabis sold in Quebec carries the Quebec Grown identifier, meaning it is mostly grown in Quebec.

Ten new branches of the SQDC opened in the 2022-2023 fiscal year.