It is everyone’s favourite time of the year – tax season! While patients are no strangers to medical expenses, many are unaware of the fact that cannabis can be claimed under certain circumstances. Along with glasses, dental work, and prescription medications, cannabis purchased through a licensed medical provider can be claimed on personal taxes.

According to TurboTax, cannabis use has become a significant part of Canadian medical care, and as such is considered an allowable medical expense. “Cannabis is in fact tax-deductible. To claim it as a medical expense, you must meet certain requirements laid out by the CRA,” says Bryan Tritt, Senior Communications Manager at Intuit Canada.

To be considered medical use, Tritt shares that treatment needs to be authorized by a Health Canada approved list of medical practitioners, which are determined provincially. This means that cannabis purchased at adult-use retail stores cannot be claimed as a legitimate deduction, even if used for medical reasons.

“It doesn’t matter if it’s a sativa or indica, the important thing is that you are purchasing marijuana products supported by your medical document and that you are purchasing it from a licensed seller at which you are registered, says Tritt. “Marijuana, its seeds, oils and other products purchased for medical reasons are all allowable.”

Health Canada states ‘related products purchased for medical purposes’ as part of detailing claimable expenses. Some people interpret that to mean consumption devices like pipes, bongs, and papers are permissible. Sorry to break it to you but the government isn’t going to give you a tax break on your rolling papers.

Devices that are used for consumption are not listed as allowable medical expenses under the CRA’s regulations. While certain vaporizers are eligible for tax deduction benefits—like the Mighty Medic or Volcano Medic 2—generally speaking, consumption items are not included. While there is no penalty for including ineligible items, they are not deductible and will be rejected by CRA.

Believe it or not, the medical expense tax credit is one of the most overlooked non-refundable tax deductions. If you are a patient that uses cannabis, purchased through a licensed seller and authorized by a Health Canada approved medical professional, you are eligible to claim it on your taxes.

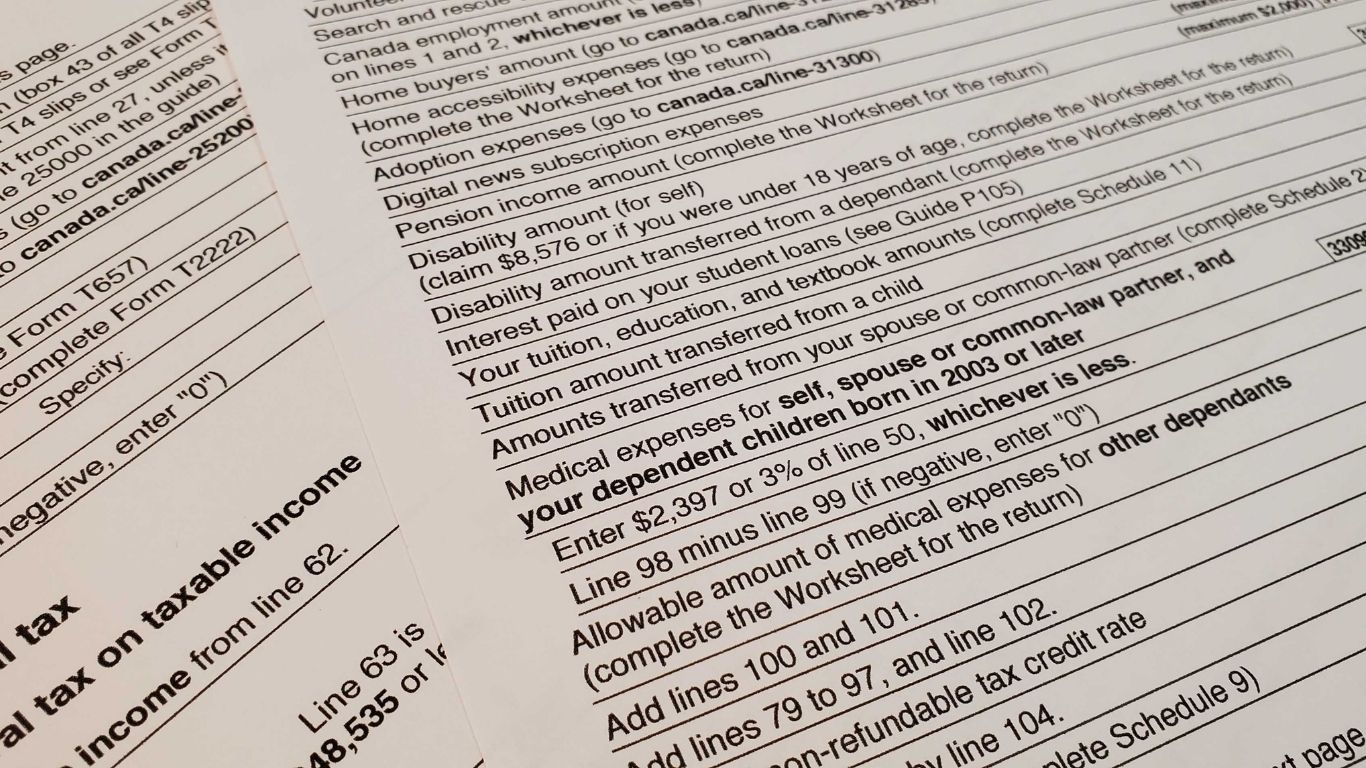

Editor’s Note: This article previously contained a quote saying you can only claim up to $2,397 or 3% of your net income. That is incorrect. You can claim the total of the eligible expenses minus the lesser of the following amounts: $2,397 3% of your net income.