Products like shatter, wax, budder, live rosin and more are beginning to appear on select shelves in legal stores across the country

While products utilizing cannabis concentrates like vape pens have been incredibly popular and prolific as part of the new wave of ‘cannabis 2.0’ products that became available last October, other extract products like “solventless” hashes and rosins, as well as solvent-based extracts like shatter, wax, and budder, for example, have been very slow to reach shelves.

For example, BC’s online cannabis store listed the first live rosin in all of Canada on December 31, 2019, a product from Whistler Medical. It quickly sold out despite a $150 a gram price tag, as well as a kief product in January. Legal hash appeared in Quebec’s provincial retailer on April 20, 2020, and many similar products have made their way to many provincial retail shelves in Canada.

However, none of the more refined products like shatter, resin, rosin, diamonds, and other more niche extract products that are wildly popular in the black market have made it to legal space up until recently.

A few companies, though, say they are poised to fill that niche very soon.

Producers

Alberta’s Stigma Grow released three new extract products in selected markets over the past several weeks, starting with their cured badder in April and more recently with their live resin caviar and live resin badder. Prices start around $80 a gram and go up to about $100 a gram.

“I think it’s an opportunity for the legal cannabis space to offer what is of interest to legacy consumers, and offer it in a way that is a traceable, regulated product that they can trust and is accountable.”

Daffyd Roderick, Ontario Cannabis Store

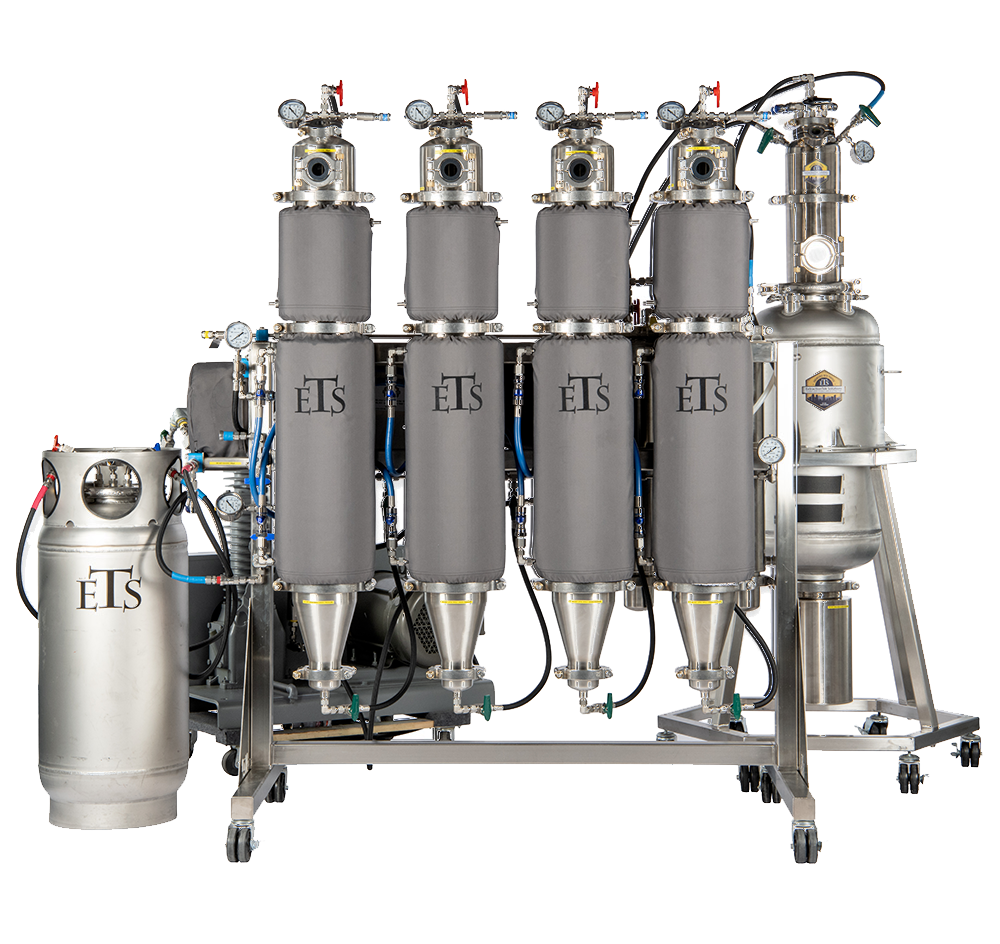

Stigma utilizes a closed-loop butane extraction process to produce their extracts, which they say is the first of its kind on the market. Using only flower for their runs, not trim, Stigma uses product they have grown in-house along with flower from three partners to produce their extracts.

Travis McIntyre, the CEO at Stigma Grow, says his team has spent several years doing research on these products and spent the last year building out their extraction system. This is part of why it’s taken a little longer to get these products out, compared to other “2.0” products like vape pens, edibles and solventless extracts.

The Alberta grower and processor acquired cannabis extractor Full Spectrum Labs and constructed what McIntyre says is a complex, safe, tested, state-of-the-art, closed-loop system to ensure these products can be made without any danger to employees or the building itself.

“That takes a little bit longer than just throwing in a CO2 machine or an ethanol machine into a room,” says McIntyre. “There’s a lot of automation, a lot of capital input, a lot of research and development to make it safe so that we can make these products inside a building. Fire systems had to be upgraded, all kinds of things people might not think of.”

“(It) takes a little bit longer than just throwing in a CO2 machine or an ethanol machine into a room. There’s a lot of automation, a lot of capital input, a lot of research and development to make it safe so that we can make these products.”

Travis McIntyre, Stigma Grow in Alberta

McIntyre says now that they have their first run of products, provinces have been very eager to bring it to retail shelves. They are starting with their own province of Alberta, as well as Saskatchewan and Nova Scotia, but says his team has been in talks with several other provinces and territories who will be receiving the product soon.

These types of extracts will be key in helping bring in consumers from the black market, he says.

“These are clean, safe, doseable products,” adds McIntrye. “We pride ourselves on being very consistent, so consumers know what they’re getting. You can’t hide anything with these kinds of products. It’s a pure, clean product.”

“We definitely want to transition those customers over,” he continues. “The customer base is there, we just hope we’re doing a good job of transitioning consumers from the illicit market to the legal market and that they can continue to enjoy, at a good price, what they’ve enjoyed for years now.”

Stigma is also working on a few other products like shatter that they hope to release soon, once they satisfy their own concerns with ensuring the products are able to handle shipping and storage.

“We definitely want to transition those customers over. The customer base is there, we just hope we’re doing a good job of transitioning consumers from the illicit market to the legal market and that they can continue to enjoy, at a good price, what they’ve enjoyed for years now.”

Travis McIntyre, Stigma Grow

“We’re still under final testing for our shatter,” he adds. “Shelf stability testing is a major part, with how products are handled once they leave our facility. There’s no refrigeration, no temperature control whatsoever, so we have to make sure that we have a product that is shelf stable and we can go forward with a product that can last for years if needed. That’s why we have released the products we did, two in the live category and one in the cured category, because we had done the testing on those three products, we felt we could get that to market and start filling consumer demand.”

Fireside Cannabis is another brand currently shipping a shatter product to Alberta, and is in talks with several other provinces including BC, Ontario, PEI, New Brunswick, and Saskatchewan. Fireside, a brand connected to Ontario-based cannabis producer ABcann Medicinals, expects their first variety of shatter, made from their Wappa variety of flower, to make it to shelves in Alberta in the coming weeks, followed by an OG Kush and Glueberry later this summer.

The company says they also expect to have their first wax shipping out to several provinces by later summer.

Dani Minard, the Commercial Manager at VIVO Cannabis, the parent company of ABcann Medicinals which owns the Fireside brand, says she thinks part of the reason it’s taken a little longer to get these kinds of products out, compared to products like vape pens or edibles, is because it’s a more specialized product that requires significant refinement to get right.

“I think they take a little longer to perfect and they are a product that isn’t for everybody, so it’s definitely a niche market,’ says Minard. “It should be viewed as a high end spirit in that it takes a lot of R&D to prepare a premium product. And I think there’s going to be a lot of scrutiny from consumers and I think a lot of the larger LPs aren’t going after that immediately because it is such a smaller subsection of the market.”

Minard ads that she thinks these types of concentrates will really help bring in the kinds of avid consumers who have perhaps not opted in to the legal market yet. She says Fireside has been using only high quality flower as inputs, not trim or other fillers, to help ensure the end product is of the highest quality.

“This is where, in my opinion, you’re going to see a lot of people who use the black market who maybe haven’t purchased in the legal market yet. Now they can come into a store retailer that they might have never visited before because they want to see what a legal concentrate like shatter will be like.”

“That’s why we’ve taken our time to work out the kinks in our shatter production. We know that we only get one shot with the connoisseur audience people who have been consuming shatter for years. If they don’t like the product, they are not going to come back. If new legal consumers try our shatter, they might also be more apt to try our dried flower or our vape offerings, so I think it’s going to help bring consumers into the Fireside portfolio.”

While many of the larger LPs have so far focussed on mass producing vape pens or edibles, increasingly, newer and smaller licence holders are also entering the market who are looking to focus exclusively on small batches of extracts.

“We’re going to have to educate them on our product because it’s going to be so different than what is currently out there. We want them to understand why the connoisseur would want these products.”

Cody Coulson, Coulson Cannabis in Ontario

Ontario’s Coulson Cannabis, licensed earlier this year, is focussing their processing licence entirely on utilizing ice water extraction, sifting, and mechanical pressing. Because many of these products are still relatively new to the legal market, owner Cody Coulson says he thinks it will be a learning process to inform consumers and provincial buyers about these kinds of products.

“We’re going to have to educate them on our product because it’s going to be so different than what is currently out there”, says the company founder. “We want them to understand why the connoisseur would want these products, so that is definitely what we need to be doing sooner rather than later.

“The markets that I look up to are places like Oregon and California where the quality of the extracts is amazing. I think that’s completely missing from the culture here right now. But I think that’s one of the beautiful things about legalization – the culture it can bring in. So hopefully that happens in the coming years.”

Distributors and Retailers

Daffyd Roderick, a spokesman for the Ontario Cannabis Store, says he expects there to be good demand for these products, which he expects will reach the Ontario market in the coming weeks.

“Our retailers know that we are actively trying to source these products, and they are definitely interested in hash and rosin and shatter and other extracts and I think it’s an opportunity for them to educate their customers on these new products, as well.”

Daffyd Roderick, Ontario Cannabis Store

“We know these products are obviously of interest to cannabis consumers,” says Roderick. “We determined that through more than 200,000 surveys completed through OCS.ca, as well as looking at the illegal market. We looked at the illegal sites and what they offer, and there’s clearly a demand. And there’s also clearly a market for regulated, Health Canada-licensed, traceable products like these in the legal market, especially in these high potency categories.

“So there’s consumer interest, there’s a market out that’s already being served through the illegal market and we would like to convert those purchases to the legal market for a whole range of benefits for themselves as well as for society.”

“Our retailers know that we are actively trying to source these products” he adds, “and they are definitely interested in hash and rosin and shatter and other extracts and I think it’s an opportunity for them to educate their customers on these new products, as well.”

For their part, retailers that StratCann spoke with say they are hearing a demand for concentrates of all kinds from their consumers, but as with any new product, there are always unknowns about what they will ultimately buy.

Ryan Roch of Lake City Cannabis just outside Calgary, Alberta, says he hears consumers asking for products like shatter and budder and has ordered some of the new products from Stigma from the provincial distributor, and is interested to see what demand will be like.

“It’s really hard to gauge interest for new products,” says Roch. “There’s a bit of a novelty to it, some will want to be the first to try it. But I try not to hold my breath because you really never know.”

Crystal Gooding, a Product Specialist for FOUR20 Premium Market, a retail chain with about a dozen stores across Alberta, says she is excited to start to see these products reach their shelves.

“They have taken a while to arrive but we are thrilled to see them emerging in the market as we were told pre-legalization that these items may never be approved by Health Canada,” she says. “There is definitely a demand for these products and a small percentage of customers have been inquiring for several months. These products may not be appealing to all customers, due to their high potency, but there will be a segment of customers that are very excited that they can now purchase these products from Alberta retailers.

With any new product, though, there is a need to educate consumers as well as retailers, which Gooding says her team at FOUR20 has been hard at work on.

“Making sure our teams are equipped to discuss and educate our customers on health and safety in regards to new products is very important to us, so we may assist in the customer having the best and safest experience possible,” says Gooding.

“The unique challenge is how quickly these new products arrive to market and retailers are often not aware until they are available to order, which is directly followed by the need to learn about them before the products arrive at our stores,” she continues. “We have brought in different types of dab rigs and wax pens and are excited to, once again, test what will be in demand to consume these new extracts.”

“I honestly thought more people would be asking us when shatter would be coming, but we actually don’t get a lot of that. But the hash, especially, has been flying off the shelves. People are constantly asking for it.”

Mike Babins, Evergreen Cannabis in BC

Mike Babins, of Evergreen Cannabis in Vancouver, BC says that while he hasn’t seen any of the solvent-based extractions on the market yet, he knows there is a demand there. He also notes that the solventless extract products currently available like hash, rosin and kief have been selling well.

“I honestly thought more people would be asking us when shatter would be coming, but we actually don’t get a lot of that” says Babins, the co-Founder of Evergreen, Vancouver’s first licensed non medical cannabis store. “But the hash, especially, has been flying off the shelves. People are constantly asking for it. There are even some very, what I would call connoisseur dabbers, who have traveled from very far away to buy it from us.”

He also says the provincial buyer seems focused on working with retailers to get the kinds of products their customers are asking for. But they are still limited by what is available in the market.

“They do listen to us,” continues Babins. “The core team at the BC LDB do know their stuff, the buyers do understand cannabis and do understand from a user’s point of view. They are trying to get products that consumers want.”

“The core team at the BC LDB do know their stuff, the buyers do understand cannabis and do understand from a user’s point of view. They are trying to get products that consumers want.”

Mike Babins, evergreen Cannabis, BC

One of the challenges with any new product, he says, is getting the word out to consumers, who often aren’t aware of the reality of the legal market. While new products are important, he says he also thinks one of the challenges is changing consumer perceptions which aren’t necessarily an accurate reflection of the realities of the current market.

“I dont think it’s actually price and quality. I think it’s believing half truths being spread based on what was available a year and a half ago. It’s misinformation. When we first opened, prices were high and the product was dry, but the province has been asking better questions and the growers are getting better. But the quality right now, most people who actually try the products, they come back and say ‘Hey, I’m sold’.”

Rodderick, from the OCS, says he does think price and quality are important factors in those consumer perceptions, though.

“I think it’s an opportunity for the legal cannabis space to offer what is of interest to legacy consumers, and offer it in a way that is a traceable, regulated product that they can trust and is accountable,” he says.

“I think we’ve seen that in the last six months, the legacy consumers are not necessarily biased against legal, it’s that they want a good product at a fair value and we’ve really been driving that. If you look at the products and price points we’ve been offering, and I think that’s where consumers will make the choice, and on value. And value is not just about price, but about quality and safety and traceability.”

“This isn’t something I think a new or inexperienced consumer is necessarily going to dive into right away,” adds Roderick. “I think most people purchasing these products are going to be comfortable with them initially.”