A new review of Health Canada’s cost recovery program for cannabis licence holders found the organization recovered less than half of the cost of administration of the cannabis licensing program in the first four years of legalization.

While Health Canada brought in just over $160 million in fees from 2018-2022, the cost of managing application screening fees, security screening fees, import/export fees, and annual regulatory fees was more than $430 million.

The review, shared this week by Health Canada, looked at the effectiveness of the cost recovery program. The program was a recommendation from the federal cannabis legalization and regulation task force and is common in other industries in Canada.

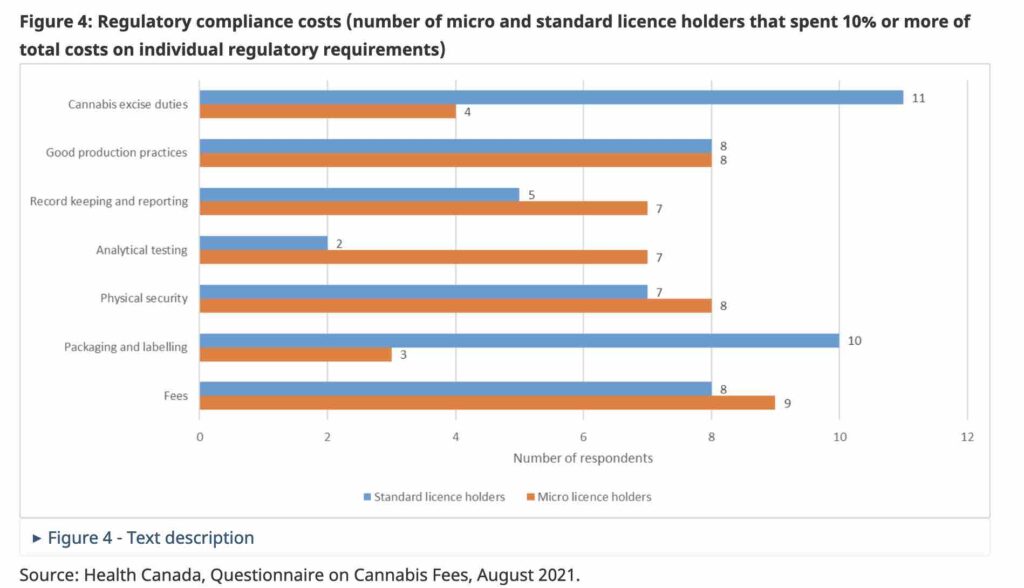

The review also notes that micro licence holders say they are more negatively impacted by regulatory fees, security requirements, and paperwork compared to larger standard licence holders.

The program has been increasing its ability to cover costs each year since legalization, with only 4.5 percent recovered in the first year of legalization, then jumping up to 45.8 percent in the second year, 26.5 percent in the third year, and 65.8 percent in the fourth.

Excluding 2018-2019 because it was only a partial fiscal year for the legal cannabis market, the Government’s cost recovery rate from 2019-2020 to 2021-2022 was 46.2 percent of total cannabis regulatory program costs.

Application screening fees brought in about $2.5 million, security screening fees more than $11 million, import/export fees were about $1.8 million, and the annual regulatory fees were nearly $145 million.

As of April 1, 2022, the application screening fee for standard cultivation, standard processing, and sale for medical purposes classes of licence applications was $3,527. The fee was discounted to $1,765 for micro-cultivation, micro-processing and nursery classes of licence applications.

As of April 1, 2022, the security clearance application fee was $1,781 for all relevant licence holders, which includes cultivation, processing, nursery and sales for medical purposes licences which are subject to fees. Industrial hemp licences, research and analytical testing licences, and manufacturers or importers of health products containing cannabis, do not pay fees.

As of April 1, 2022, the import/export permit fee was $658 for all relevant licence holders.

For the annual regulatory fee, standard cultivation, standard processing and sale for medical purposes classes of licences are subject to a rate of 2.3 percent of cannabis revenue or $23,000, whichever is higher.

For micro-cultivation, micro-processing and nursery licence holders, the rate is 1 percent of cannabis revenue up to $1 million (and 2.3 percent on any revenue over $1 million), or $2,500, whichever is higher. The ARF rate for micro and nursery class licences is discounted between $13,000 and $20,500 per year compared to the ARF rate for standard class licences.

The goal of the annual regulatory fee is to recover the total costs of administering the federal cannabis regulatory program, which is not covered by transactional fees.

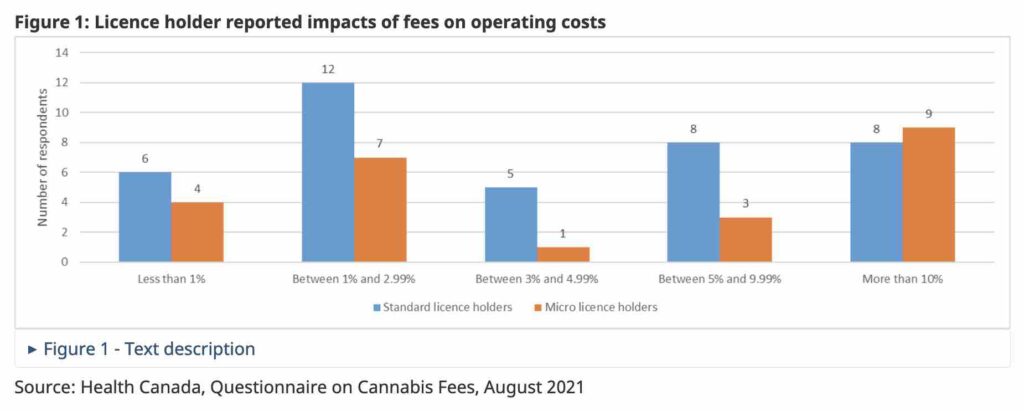

In their survey about the cost recovery program, Health Canada sent out 642 questionnaires to licence holders between August 2021 and March 2022. They received 72 responses. Two responses were from nurseries, 27 were from micros, and 42 were from standard licence holders.

The report found that the regulatory fees, compliance, and federal excise taxes have a greater impact on smaller producers like micro licence holders, given the economies of scale.

Micros were more likely to report spending more than 10 percent of their costs on security requirements compared to standard licence holders, despite having fewer security requirements than standards.

The same was true for record-keeping, with more than one-quarter of micros (26.9 percent) reporting spending more than 10 percent of their total costs on the record-keeping and reporting, compared to only 13.5 percent of standard licence holders.

Analytical testing was another area where micros reported spending a more significant portion of their total costs compared to standard licence holders, with 28 percent of micro licence holders spending more than 10 percent of their total costs compared to just 5.1 percent for standard licence holders.

(Note: Due to the small respondent size of nursery licence holders, Health Canada has used the term “micro” to represent micro and nursery licence holders.)

Timelines for security clearances, which go through RCMP and have long been a sticking point for applicants, continue to be a problem as well, said survey respondents.

Licence holders said these fees were another barrier to profitability, although they were only a small portion of total operating costs. While one-fifth (20.5 percent) of standard licence holders said these fees represented over 10 percent of their total operating costs, almost twice as many micros (37.5 percent) reported the same.

Most respondents to the survey (63.9 percent) said the application screening fee was reasonably priced given the service provided, while 60 percent said the same for the import and export fee. Just under half (47.7 percent) said the services provided for the security screening fee were worth the cost, while only 41.8 percent said the annual regulatory fee was.

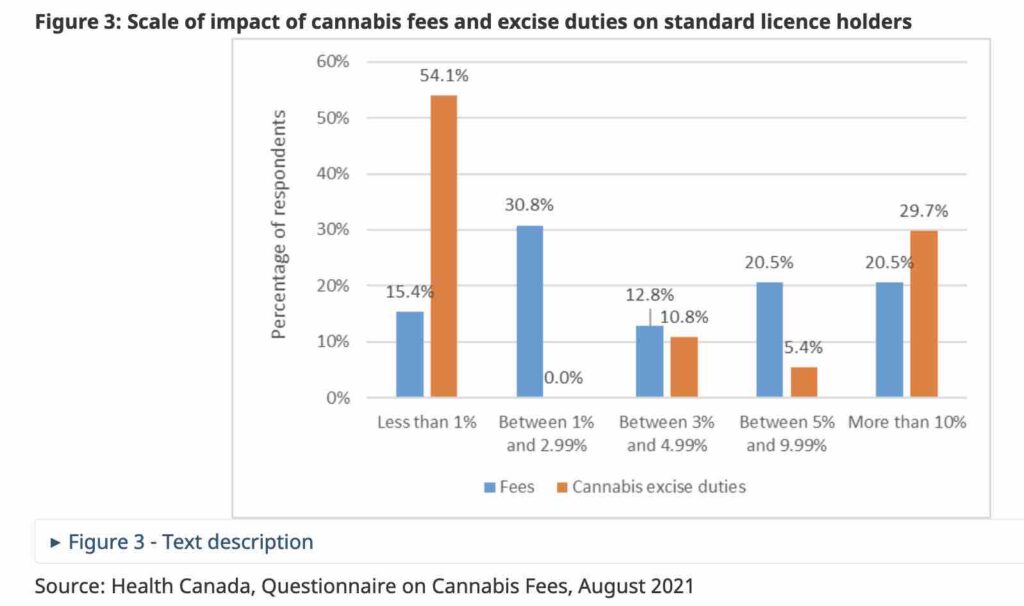

Although not specifically within the regulatory fee scheme, the survey also asked licensed holders about excise duties on cannabis products.

Just over half (54 percent) said the federal excise tax (which generally works out to $1 per gram of dried cannabis and $0.01 per mg of THC on extracts, edibles and topicals) represents less than 1 percent of their total costs. Another 30 percent said it represents more than 10 percent of their total operating costs. The report also notes that these fees are applied to all cannabis producers, regardless of their profitability. Newer producers may sell cannabis, but it can take several years to see any revenue from those sales.

Three-quarters of cannabis excise taxes go to the province, while Ottawa keeps one-quarter.

The cannabis excise tax is applied when producers sell cannabis into a provincial market or through the medical program. Cannabis producers have long expressed frustration with the high level of taxes on cannabis, which can be upwards of 30 percent of sales revenue for producers. Currently, wholesale prices for dried cannabis flower in Canada can range from less than $1 per gram to around $4 or $5.

Another issue, according to survey respondents, is getting into most provincial markets, arguing that provincial cannabis boards are favouring low-cost, high-THC products. Issues such as payment schedules, recall insurance, and return policies were also commonly noted challenges here, as was access to capital.

Health Canada says this review, along with the current legislative review of the Cannabis Act, will help inform the government as to the progress of legalization as it enters its fifth year.