New changes to cannabis regulations in Germany could be good news for Canadian cannabis exporters, say some in the industry.

A new research project could allow for cannabis to be sold in retail stores in up to 25 different German cities, supplied by authorized cannabis wholesalers in the country.

The program will allow applications for retail, adult-use, and non-medical cannabis sales in partnership with German municipalities and supply partners, with a focus on research.

Because the program is built around scientific research, it will also avoid EU and UN restrictions that would otherwise prevent the import of cannabis from outside of Germany, says Finn Age Hänsel, managing director and founder of Sanity Group GmbH, a cannabis-focused company based in Berlin. Similar to EU and UN rules, Health Canada only allows the export of cannabis for medical or research purposes.

Sanity Group operates as a wholesaler in Germany’s medical cannabis market, as well as partaking in a similar retail pilot project in the Netherlands. As such, Hänsel says he’s already in the process of securing supply deals with different international cannabis brands, from suppliers ranging from their partner Organigram to independent Canadian producers like Cake and Caviar, Lyonleaf, and Miracle Valley, and US brands like Kalifa Mints and Alien Labs.

Sanity Group announced the completion of an investment from Organigram’s Jupiter Fund earlier this year.

Hänsel says there’s a demand in the market for both value-priced and craft products, noting that this is an opportunity for any Canadian craft growers who want to see their products sold through the pilot project.

“To be honest, because I am an enthusiast myself, I would rather work with smaller companies who really have an eye on quality and are craft cannabis producers compared to working with large companies,” says Hänsel.

“I like some of the large companies. We let Organigram invest because we like them. But in general I think we are a company who [prefers] the smaller growers.”

The research side of the project, he explains, will require customers to register with the company and fill out surveys on their consumption habits at six-month intervals. This research will be collected over two years in a five-year project, seeking to better understand the public health impacts of such a model.

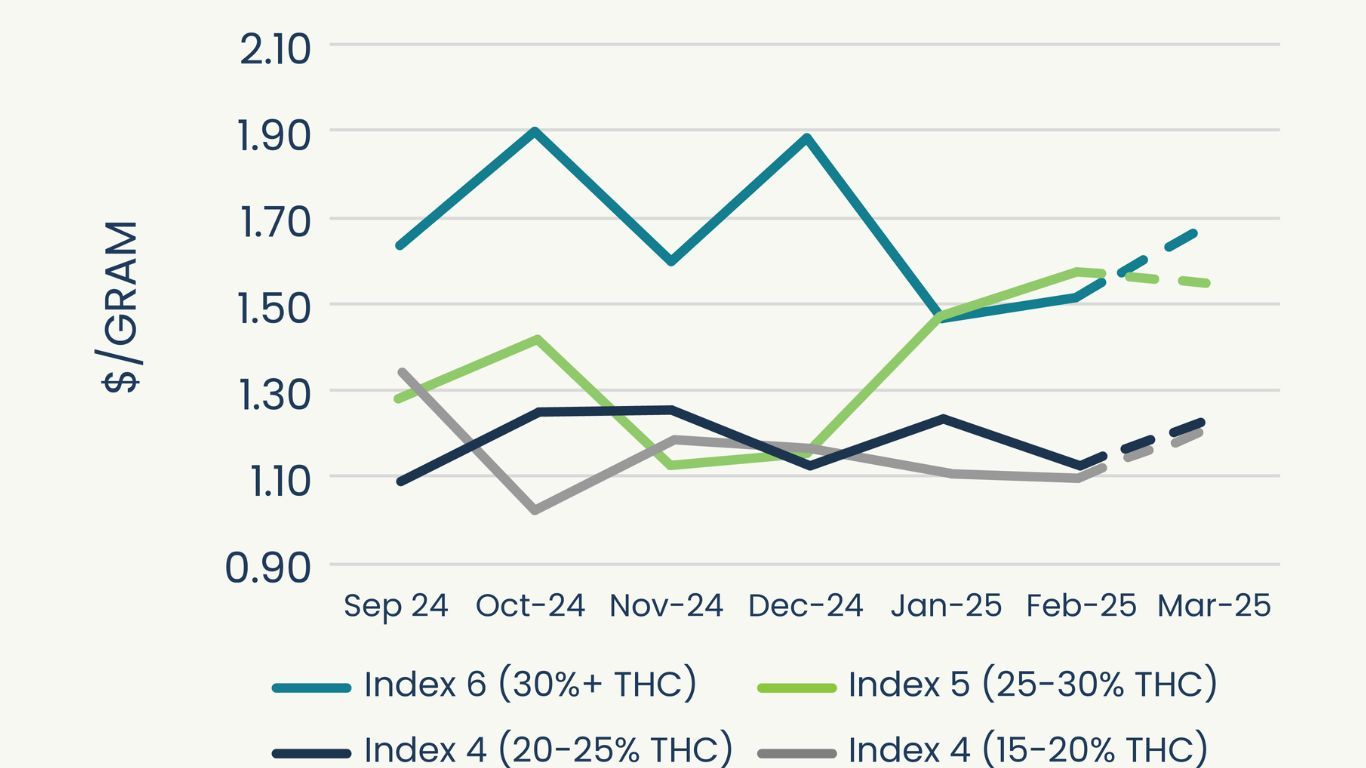

The research will be in coordination with local universities and the municipalities in which they are located. Cities will also receive €0.50-€1 per gram of cannabis sold from the stores under their purview. He expects cannabis to be sold for around €10 a gram, which he says is similar to typical black market prices. One Euro is about $1.50 Canadian.

Deepak Anand, a Canadian industry consultant who assists cannabis companies with exports, also sees significant potential for Canadian growers if the pilot project is successful.

“If this is couched as a scientific research project then it would meet the definition of medical or scientific purposes. Why I think this is important for Canadian companies is this would allow them to sell cannabis for both medical and scientific purposes. So I think it opens up and expands the reach of our market.”

Although Hänsel is unsure what types of cannabis products they will be allowed to sell in their stores, if licensed, he hopes to offer dried flower and edibles, with a focus on seeing if survey respondents report moving from mixing cannabis with tobacco to using cannabis only, or even shifting from inhalation to edibles.

The change was announced on December 11, when the German Federal Office for Agriculture and Food (BMEL) was tasked by the German Parliament (the Bundestag) with appointing the responsible body for processing research applications on consumer cannabis and industrial hemp.

The regulation that has now been issued—the Consumer Cannabis Science Responsibility Regulation—requires the Federal Office for Agriculture and Food to examine relevant research applications and monitor the approved projects.

This moves this specific type of work away from the German Federal Institute for Drugs and Medical Devices (BfArM), which remains the responsible authority for research into medical cannabis.

Germany legalized cannabis in March 2024. The law came into effect in two main phases: the first phase, which allowed for personal cannabis cultivation and possession, came into force on April 1, and cultivation clubs were allowed in July.

Phase two was supposed to allow for a medical sales model, but shifting domestic politics appears to have slowed that process down. That delay caused the German Parliament to create this new enactment that will allow the retail cannabis pilot project.

Because the new pilot project was created as an enactment of parliament rather than as legislation, Hänsel says a new government could stop the project, but he does not believe any applications already approved and initiated can be stopped.

His own organization plans to apply very soon, and facing several months of application process and site selection and other logistical issues, he encourages others to do the same.

“If you don’t get the applications in December, it will be very tight to be approved before the new government has formed.”

Featured image sourced from Sanity Group / Grashaus Projects – www.grashausprojects.ch ©