Safari Flower, an Ontario-based cannabis producer, received CCAA protection on January 12, listing over $55 million in liabilities.

The Safari Flower Group says it intends to use the restructuring process to effect a reverse vesting orders (RVO) transaction with one of its secured lenders that can be used as a way to inject cash into a company.

Next Edge General Partner (Ontario) Inc., in its capacity as general partner of NE SPC II LP, will be providing a DIP loan.

Reverse vesting orders can be used to assist in recovery in complex insolvencies in Canada, especially in instances where traditional alternatives of asset sales or restructuring plans are not effective or practical.

Brigitte Simons, CEO of Safari Flower Company, says the goal is to restructure the company’s inherited debt, emphasizing that they are still growing and selling cannabis.

“Safari elected for a secured debt restructure of our indoor grow facility and Niagara land footprint after setting goals in 2023, achieving them, and putting them in front for valuations against a timeline of a Sales Initiated Solicitation Process and a CCAA end point.”

“Safari will be backed by our secured lenders in the CCAA to support the company through a healthy balance sheet and it’s international sales growth agenda. The CCAA program enables us to focus on our mission and our employees that carry the path forward for Safari’s global craft and medical cannabis flower products.”

With a 59,000-square-foot indoor facility located in Fort Erie, Ontario, the Safari Flower Group holds international certifications that permit the company to supply cannabis to the European, Israeli, and Australian medicinal cannabis markets.

Safari Flower Co. received EU-GMP certification in December 2023.

“We are thrilled to have built a foundation on quality systems and developed professional talent to deliver cannabis to the stringent safety standards that patients demand in trust, the EU-GMP certification, a testament to our unwavering dedication to quality and compliance,” Simons said at the time. “This achievement reinforces our commitment to ENUA’s brand providing a medicinal variety of cannabis flower by small batch grows.”

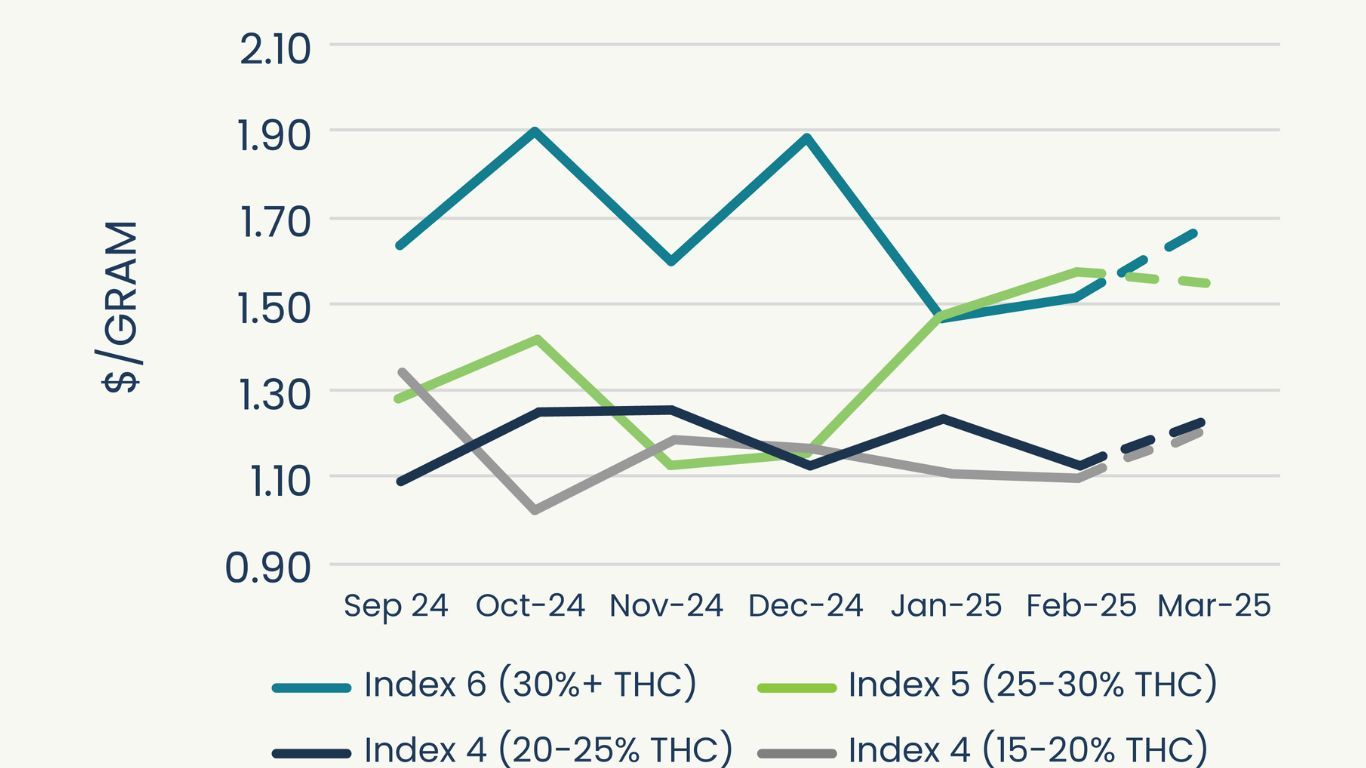

Safari was cash-positive at its year-end in 2021 but has not been able to maintain profitability according to Insolvency Insider, noting that Safari attributes this to the price compression in the Canadian market.

The cannabis industry in Canada has experienced significant financial challenges. At least 72 cannabis companies filed for some form of creditor protection in 2023, according to listings by Insolvency Insider Canada, which focuses on the Canadian insolvency market.

Note: This article has been updated to include current comments from Brigitte Simons.