The price of cannabis continues to decline in BC, while the number of cannabis stores increases.

The BC LDB’s newest quarterly report, from October through December 2022, also shows the popularity of edible extracts, which saw sales of more than $1 million, and more than $2.5 million in sales through BC’s Direct Delivery program.

Wholesale sales also increased from the same time last year by 13 percent to more than $113 million from the equivalent of more than 25 million grams of cannabis.

Cheaper eighths, bigger SKUs

Consumers are moving to larger SKU formats for dried flower, especially the 14-gram and, to a degree, 28-gram.

Although declining, eighths still remain popular. Sales figures show consumers shifting to lower-priced eights, with significant growth in the under $3 a gram category, while sales of the over $5 per gram eighths decreased.

Fourteen-gram SKUs saw significant growth in all price ranges, with modest growth in the 28-gram SKUs. There was also significant growth in the one-gram SKUs while 7-gram SKUs declined.

Sales for dried cannabis overall continued to decline as well, as other products have entered the market. Sales for dried cannabis were just over $40 million in the last three months of 2022, a slight decline from the previous quarter’s $41 million and a 7.3 percent decrease compared to Q3 2021’s sales of more than $43 million.

Cannabis pre-rolls

As opposed to dried flower, sales of pre-rolls saw a modest four percent increase in year-over-year sales with more than $24 million. This, however, represented a slight decline from the previous quarter’s sales of more than $26 million.

Sales for infused pre-rolls increased much more, though. Sales were up by more than 500 percent compared to the same three-month period in 2021 to almost $10 million.

Inhalable cannabis extracts

Sales of inhalable extracts like vape pens and concentrates saw a massive jump to more than $34 million, a nearly 70 percent increase from the same quarter in the previous year, and an increase from the $29 million sold in the previous quarter. This category also includes infused cannabis pre-rolls.

Vape carts and disposable vape pens both increased significantly in YOY sales, with disposable pen sales increasing by nearly 200 percent compared to the same period in 2021. The previous quarter saw a more than 200 percent increase in YOY sales, as well.

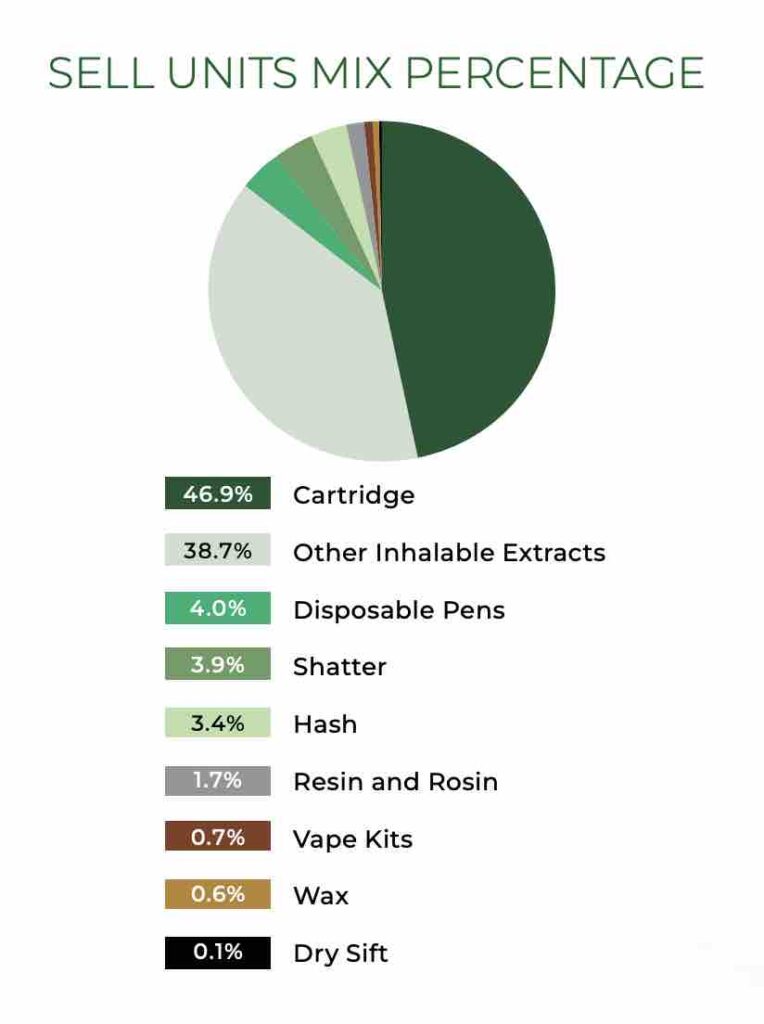

Vape carts are the most popular of the inhalable extracts, with about 56 percent of total sales, followed by infused pre-rolls at 29 percent, shatter at four, hash, disposable pens, and resin and rosin at around three percent each, followed by wax, vape kits, and dry sift all under one percent of total category sales.

Sales of resin and rosin increased modestly, as did hash, while shatter and dry sift declined. Cannabis wax sales exploded as more products arrived on the market, with a more than 330 percent increase in YOY sales, although only a small increase in sales compared to the previous quarter. Still, wax sales represent less than 1 percent of sales in this category.

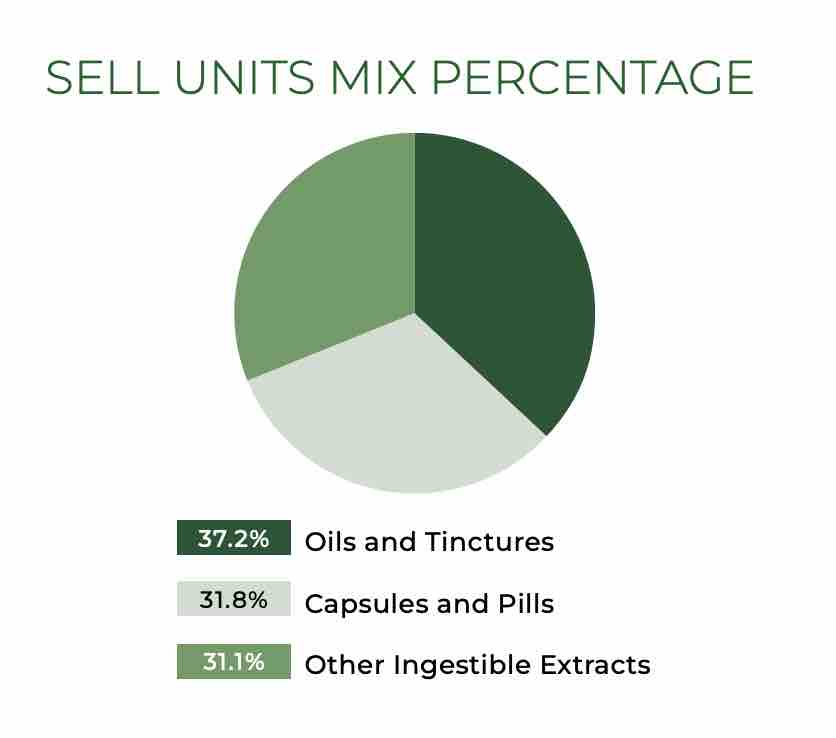

Ingestible Extracts

Another notable increase in popularity was for so-called edible extracts, with more than $1 million in sales in just three months. This was a 300 percent increase from the last three months of 2021 as well as an increase from the previous quarter’s sales of $437,689 in Q2 2022.

Health Canada has been pushing back at these products, arguing they are non-compliant because they contain more than the 10 mg THC per package limit under federal regulations. At least one producer admits to receiving a stop order in January.

Edibles

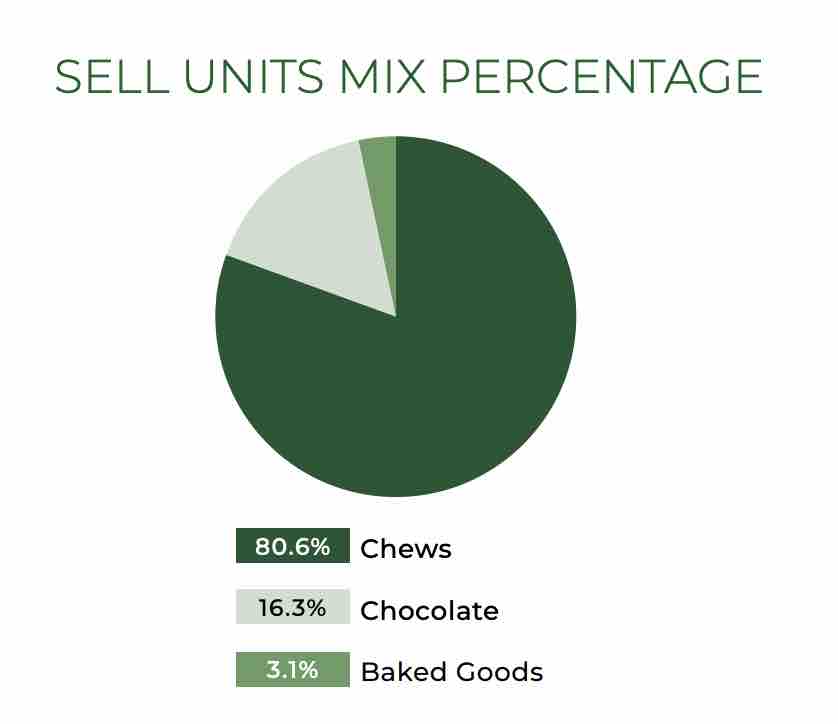

Sales of edibles, while still a small portion of all cannabis sales, also saw a modest 14 percent compared to the same time last year, for a total of more than $6 million.

Cannabis chews/gummies dominate the category, accounting for 86 percent of sales, followed by chocolate at about 12 percent and baked goods at about two percent.

Cannabis beverages

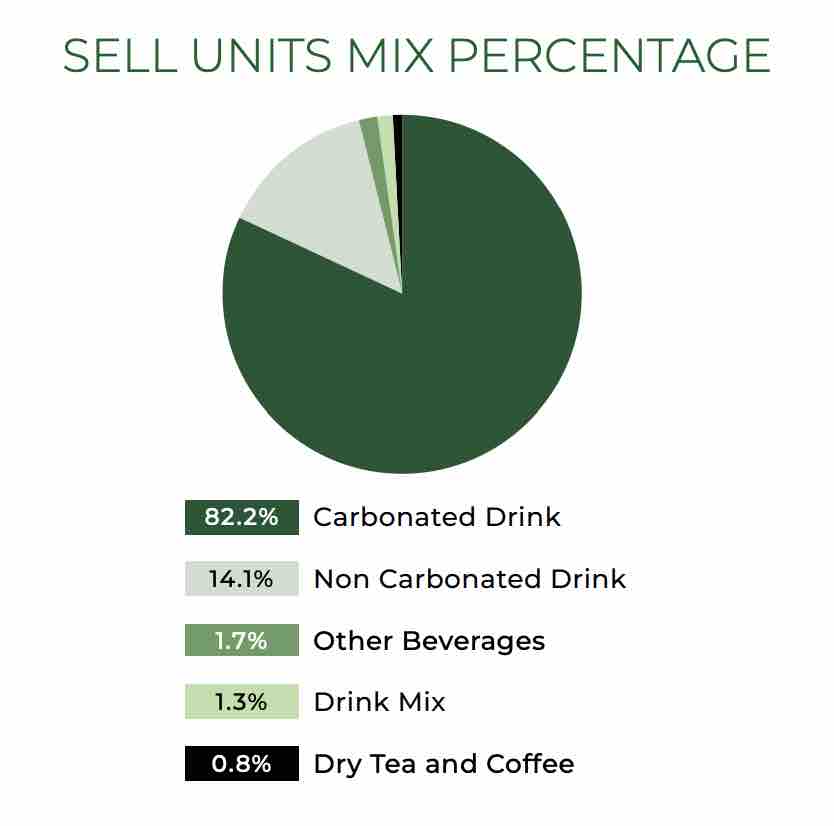

Cannabis beverages also saw an increase in year-over-year sales, with over $1.8 million sold from October-December 2022. This is a slight decline from sales of $1.9 million in the previous Q2 2022 period that covered sales in July-Sept, likely due to seasonal purchasing habits.

Carbonated cannabis drinks are the biggest seller in BC, at around 82 percent of market share, followed by non-carbonated drinks at about 14% and all other categories taking up the other few percent.

In December 2022, Health Canada announced changes that allow retailers to sell up to 48 cans of cannabis beverages at a time, up from the previous amount that allowed for only five. Sales figures following this announcement would not be fully captured in this most recent quarterly data that only goes through December.

Cannabis seeds and cannabis topicals

Sales of cannabis seeds saw a more than 50 percent increase compared to last year, with $12,641 in sales. This represented a decline from the previous quarter’s sales at $17,327.

Sales for cannabis topicals were down two percent from the previous year at $779,806, but this represented an increase from the previous quarter’s sales of $592,469. Sales were down YOY in all categories of cannabis topicals (Balms, Creams and Lotions, Massage Oils & Lubricants, and Other Topicals) except for “other,” which increased by nearly 75 percent, and Bath Products, which increased by almost 25 percent.

Creams and lotions make up the bulk of cannabis topicals sales at around 43 percent, followed by bath products at 28 percent, other topicals at about 25 percent and balms at just under 3 percent.

Direct delivery

This reporting period represents the second quarterly report that captures sales from the province’s new direct delivery option that allows producers to sell and ship products directly to retailers, bypassing the province’s centralized warehouse.

The program launched on August 15 and requires that cannabis flower used in any products must come from an approved BC grower who produces no more than 3,000 kg of dried flower a year.

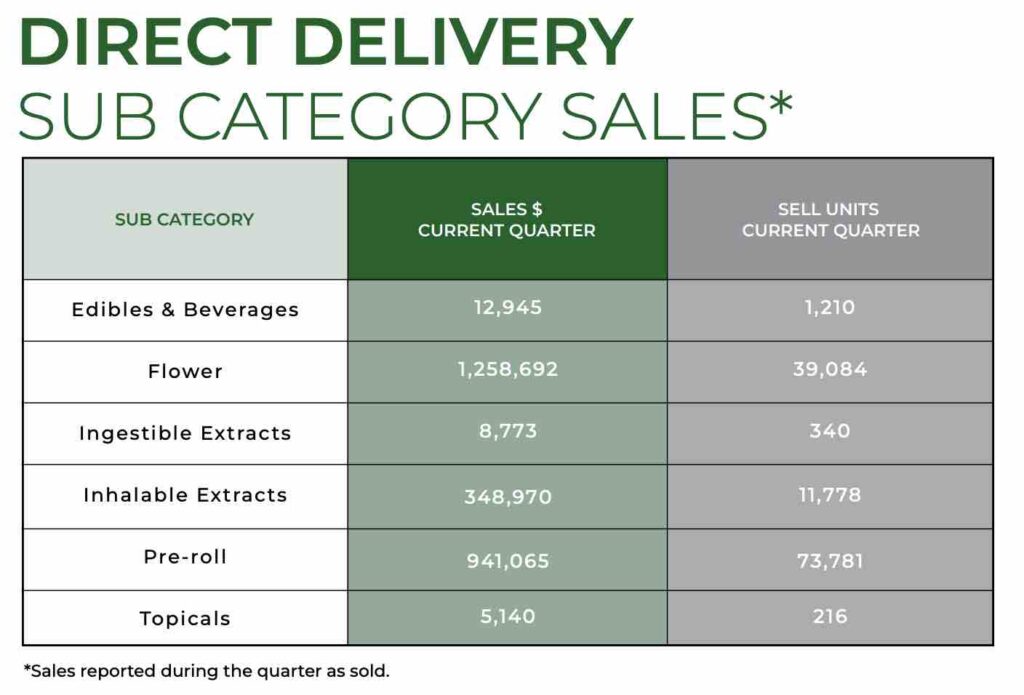

For October through December 2022, there were 362,180 grams of cannabis (and its equivalent) sold through direct delivery, accounting for $2,575,858 in sales.

Combined with the previous quarter’s sales, there were 480,010 grams of cannabis sold through direct delivery in BC, with $3,280,836 in sales.

Dried flower and pre-rolls represented the biggest portion of these sales, followed by inhalable extracts, edibles and beverages, ingestible extracts, and then topicals.

Sales by region

Unsurprisingly, most sales in the province were in the Lower Mainland, with nearly $46 million, a 17 percent increase in YOY sales compared to Q2 2021. The region, the most populated in the province, also saw the addition of 28 new stores from the same time last year.

Vancouver Island, the second most populated region of the province, saw the second highest amount of sales at more than $26 million, an increase of more than 10% YOY compared to Q3 2021. The island had 14 new stores compared to the same time last year.

This was followed by $25,195,731 in sales in BC’s interior, a nearly 10 percent increase from last year, with 12 new stores compared to Q3 2021. Lastly, Northern BC saw $16,016,622 in sales, a 12 percent increase YOY, with four more stores than the previous year.

BC currently lists 480 public and private cannabis stores.