A new report from the Office of the Auditor General of Ontario has several critiques of how the Ontario Cannabis Retail Corporation is managing cannabis in the province.

The report, released today, lists several areas where the Ontario Cannabis Retail Corporation (OCRC)—operating as Ontario Cannabis Store (OCS)—can improve how they oversee product procurement, pricing, inventory management, and also calls for more action on social responsibility and education.

The conclusion of the report is that the OCRC needs to make numerous improvements to its operations “in order to effectively operate and administer the Ontario Cannabis Retail Corporation Act, 2017 and its regulations”.

For their part, the OCRC says it welcomes and accepts the insights and recommendations provided by the Auditor General.

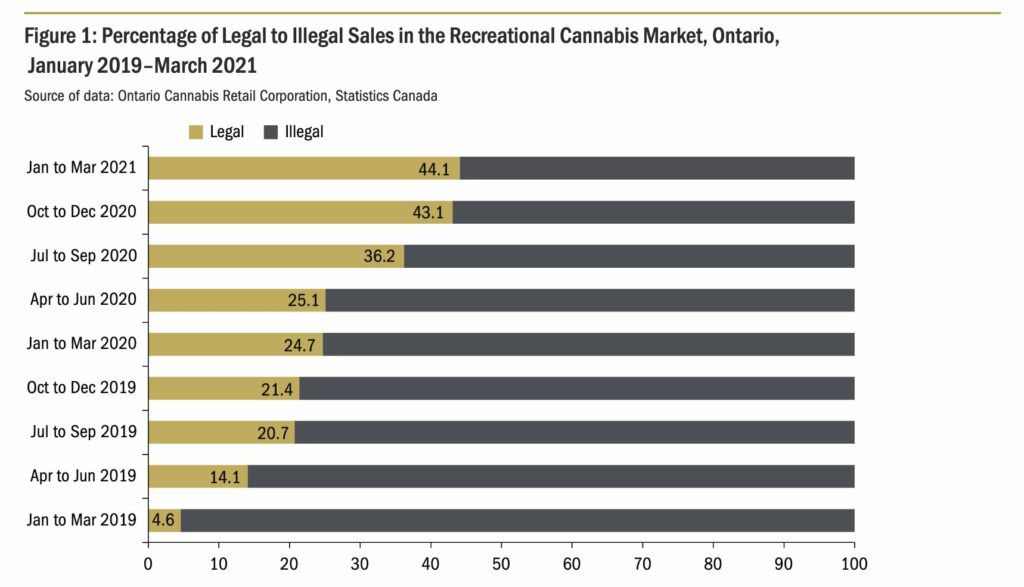

The 66-page report details many aspects of the history of how cannabis has been regulated in Ontario, from the initial implementation of a public store model and then switching to a private retail model. The private retail model initially had very few stores but exploded this year, creating concerns with a possible over saturation of the market and future store closures and consolidation.

Below are some of the highlights of the auditor’s findings:

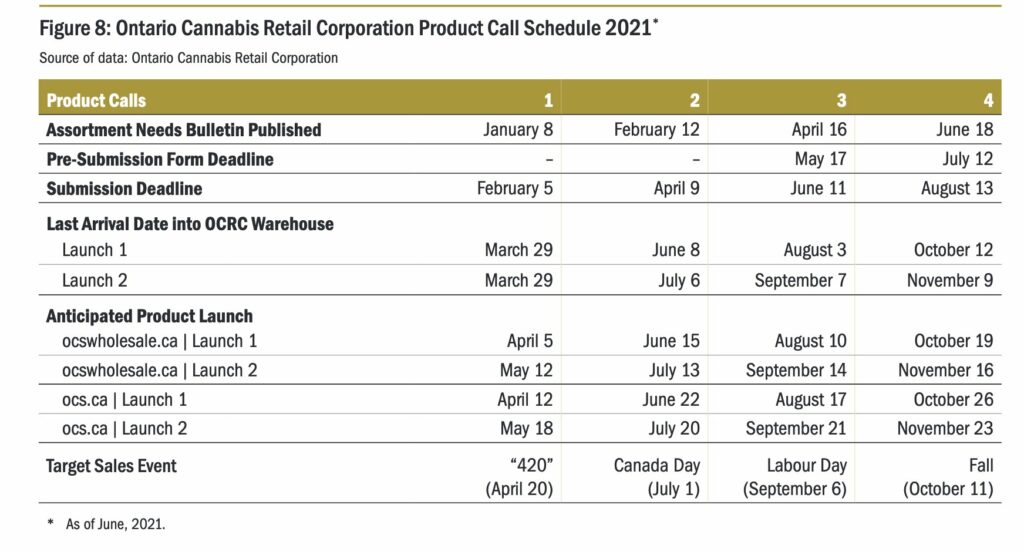

- Until April 2021, OCRC did not use any formal criteria to evaluate product submissions, resulting in non-transparent decisions about products selected for sale.

- OCRC created a scorecard with product submission evaluation criteria after we began our audit. However, we noted that it was not required to be used, and that where it was being used after April 2021, some product listing decisions did not align with the criteria.

- OCRC does not have a formal appeal process for product listing decisions and senior management sometimes reverses product listing rejections without any documented rationale, contributing to a perceived lack of fairness by licensed producers.

- OCRC’s recently implemented value-based pricing approach for listed cannabis products is not based on sufficient analysis and is not transparent to licensed producers.

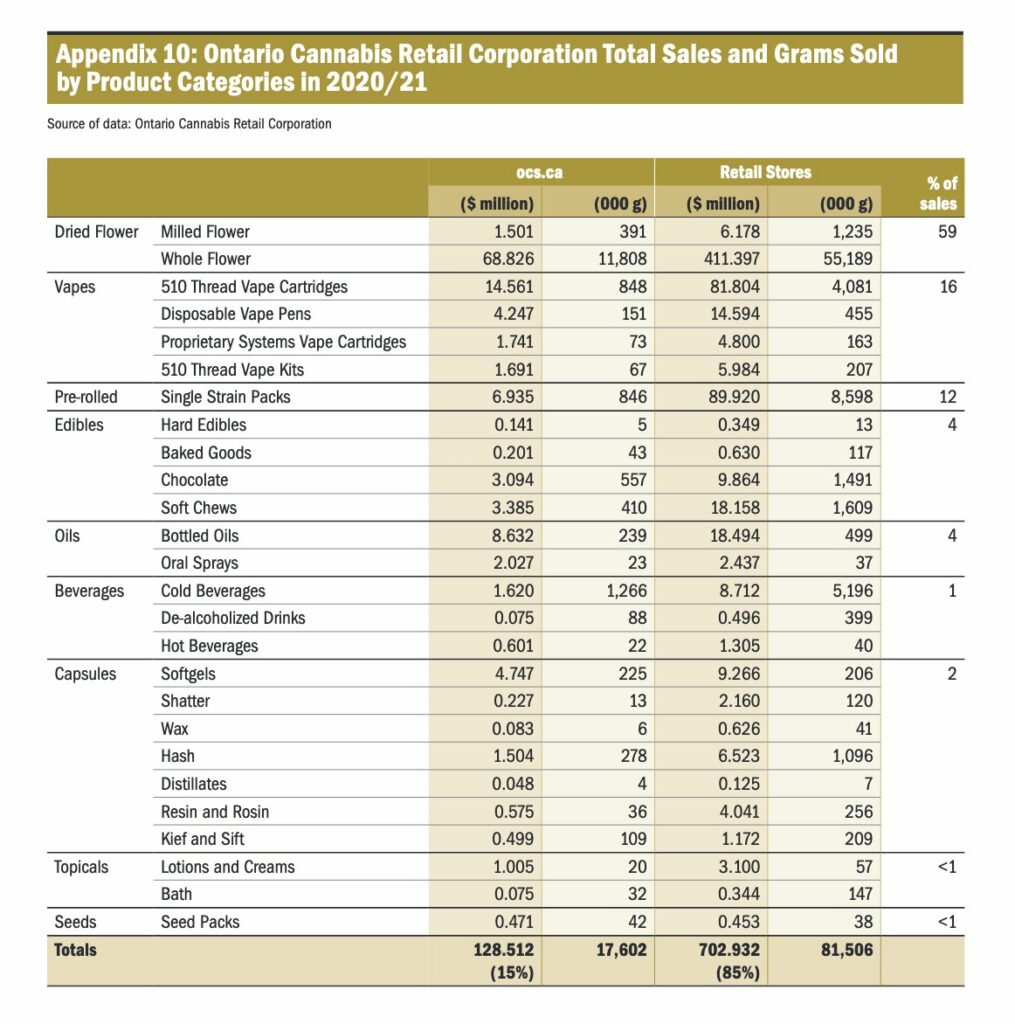

- Product availability has been a common complaint from private retail stores.

- Inaccurate inventory forecasting has contributed to products being out of stock, impacting potential cannabis sales for the first six months of 2021.

- OCRC has been appropriately disposing or returning cannabis products to licensed producers when required.

- OCRC does not have sufficient verification of age controls in place to prevent minors from purchasing cannabis through its online store.

- OCRC does not have sufficient verification of age controls in place to prevent minors from receiving cannabis product deliveries.

- OCRC does not have effective oversight of services provided by its major service provider, Domain Logistics.

- OCRC’s arrangement with Domain Logistics to lease equipment does not provide value for money

- The recent transition from outsourced to in-house customer care staffing in February 2021 has resulted in longer wait times for inquiries, claims, and complaints due to about a 50% reduction in dedicated customer care support as well as more retail stores.

- OCRC does not have documentation to support its decisions to procure non-competitively. Consistent with government directives, OCRC’s policy allows for non-competitive procurement.

- OCRC does not have effective mechanisms to oversee the use, retention and safeguarding of customer information retained by its service providers.

- OCRC does not yet have a consistent set of non-financial metrics to measure its yearly performance and progress

The OCS also provides responses to the Auditor General’s report and provides background on sales data within the province and the evolving retail and wholesale landscape in Canada’s most populated province.