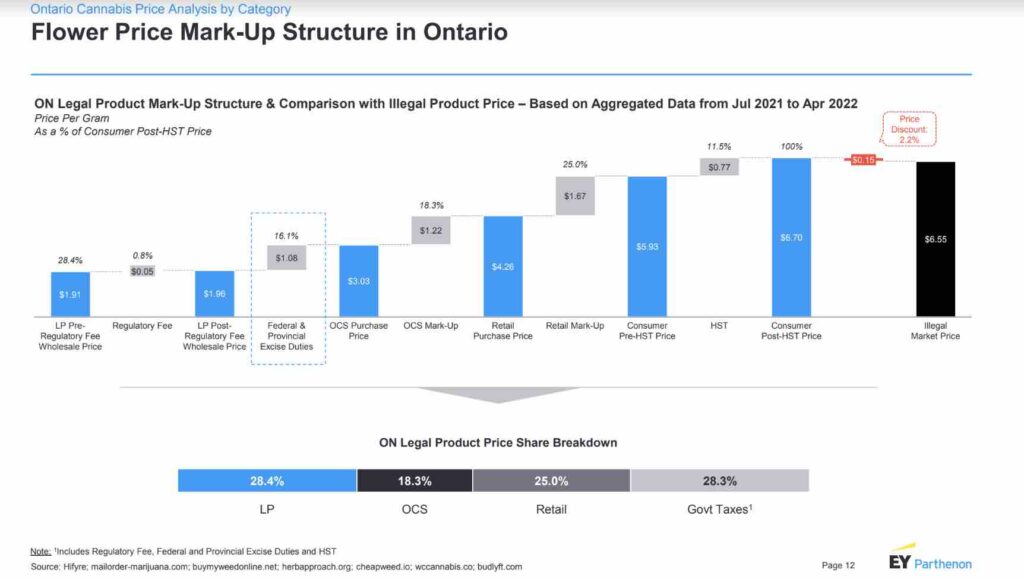

A new report presented at a recent industry lobbying event is highlighting the high level of taxation and markup on cannabis products in Ontario, and Canada as a whole.

The report, provided by EY Parthenon on behalf of the Cannabis Council of Canada, shows that government taxes and provincial mark-ups represent nearly 50% of the price of cannabis products in Ontario.

This brings into question the sustainability of the legal cannabis industry, concludes the report, with some, especially larger public licensed producers in Canada on the verge of bankruptcy.

The report calls on a reduction of federal and provincial excise duty rates, the creation of a single harmonized federal excise stamp rather than provincial ones, a reduction of regulatory fees, a potential increase in edibles potency limits, less restrictive marketing regulations and packaging requirements, and increased enforcement against the black market.

The report is based on data collected over the past three years by HiFyre, specifically looking at 1 gram flower, 1 gram pre-rolls, 750mg vape carts, and 10mg edibles, arguing that legal cannabis producers only capture about 27% of the overall retail price.

Predictably, these high markup rates make it difficult to compete with an unregulated, untaxed black market, especially when it comes to edibles and vape carts. These categories continue to be significantly more expensive than their illicit market counterparts, even as prices on legal dried flower and concentrates have gone down significantly since first introduced in the legal market.

This price compression hits products the most, as taxes and provincial markups continue to take a big bite out of profits. The share of new sales for licensed producers decreased from 74.2% in July 2019 to 60.8% in April 2022 while Federal and Provincial excise duties increased from 23.9% to 37.6%.

The report authors are planning on a “phase 2” of their work in the future looking at the price elasticity of demand for cannabis in order to use this to estimate tax revenues lost to federal and provincial governments at current excise duty rates, and the impact on the size of the contraband market and the profitability of industry licensees at alternative rates of excise duty.