Federal cannabis politics and regulations are often what makes for good headlines, but it’s at the provincial level where the real meat of the Canadian cannabis system is worked out—in the form of sales regulations, wholesale supply chains and public or private economic models. And 2022 was a busy and interesting year in provincial pot politics, with provinces pursuing various reforms and liberalization as the Canadian rec cannabis industry entered its fifth year of life. Stratcann was on top of these changes this year—here are some of the year’s biggest stories at the provincial level.

British Columbia

One of the provinces which saw the most significant reform activity, BC’s provincial cannabis wholesaler made several moves toward a less centralized cannabis distribution model. The first was the province’s launch of farmgate sales.

After a lengthy consultation process with the industry, farmgate applications were officially opened last month, though two farmgate stores owned by First Nations groups—Sugar Cane Cannabis in Williams Lake and All Nations Cannabis in Shxwhá:y Village—struck deals with the province to open early.

The other decentralizing move was its launch of a direct delivery program, launched in August. The program allows small craft producers to ship directly to retailers, bypassing the provincial wholesaler. As of mid-December, 64 cultivators and 34 processors had enrolled in the program.

The province also began allowing private retail stores to deliver cannabis to consumers this past summer.

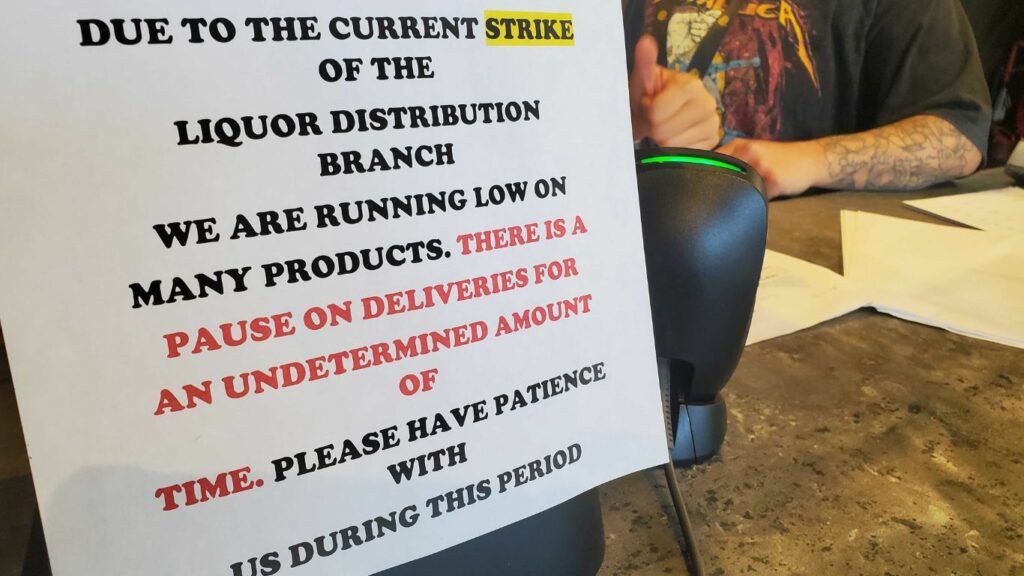

Outside of its reforms, the BC cannabis wholesale system was the target of frustration and scrutiny over the summer, as a brief strike by warehouse workers put a strain on retail companies, prompting fears of retail closures and job losses. (The impact ended up being relatively short-lived, as the strike ended on August 31.)

Financially, the strike didn’t appear to make much of a dent either: BC cannabis sales were up nearly 10 percent in Q2 of this year (July 1 to September 30, 2022), as the provincial wholesaler recorded sales of $110.3 million.

Alberta

The biggest shift in Alberta’s cannabis policy this year was that the province got out of the online delivery game in early March. Retail stores are able to ship their product via common carriers (like Canada Post) or using in-house employees, but not via third parties like Uber or SkipTheDishes. Retailers who spoke to Stratcann had a lot of different opinions on this back in March: some were ready, others were adopting a wait-and-see attitude. Though a significant regulatory change, the actual impact was likely small, since online sales have historically only accounted for around one percent of sales.

A big change that retailers were happy about was the end of window covering requirements, a change made in early August by the Alberta Liquor and Gaming Corporation in response to a string of break-ins at dispensaries in the Calgary area.

The province reported that in the fiscal year ending March 31, 2022, they sold nearly $470 million in cannabis. Though they still recorded a $12-million loss in their cannabis unit, their projections suggested that the wholesaler would turn a $7 million profit this year.

The provincial regulator is also rumoured to be considering allowing a direct-delivery model similar to BC, although details are uncertain. One of the most fine-happy provinces in Canada for cannabis companies, the government has collected more than $176,000 in cannabis fines since 2018.

Saskatchewan

Lacking a provincial wholesaler, there were few major changes at the provincial level in Saskatchewan this year. The biggest came recently when the legislature introduced the Cannabis Control (Saskatchewan) Amendment Act, which would allow First Nations to establish their own cannabis control frameworks to mirror provincial rules. The change was first initiated when an order in council in July exempted First Nations from permit requirements to run on-reserve dispensaries. As we’ve seen elsewhere, the jurisdictional question of cannabis on reserve land remains ultimately unresolved.

As of Dec 22, the bill was still at First Reading.

Manitoba

The other prairie province had a pretty quiet year in the cannabis department, too.

No decision has been rendered yet, but the province’s controversial ban on home growing continues to be challenged by the founder of TobaGrown Jesse Lavoie, who has been challenging the ban since 2020.

The provincial government is also looking to repeal its 6% social responsibility fee to help the legal market better compete with the illicit market. As of December 22, the bill was still at First Reading.

Though Manitoba has stayed out of the distribution game, allowing companies to contract with producers directly, it has sought to simplify logistics by awarding private distribution licenses to Delta9 and Open Fields (a Fire & Flower subsidiary).

Sales of cannabis topped $169 million for the year ending August 31, 2022.

Ontario

The largest of the provincial wholesalers, the Ontario Cannabis Store (OCS), generally stayed the course this year. The biggest change to its business model was the much-awaited (and frequently delayed) launch of the “flow-through” model, which allows retailers to order new products directly from producers, rather than only what is stocked at the OCS warehouse.

Over the summer the OCS was forced to delay both online and wholesale orders after their third-party logistics supplier, Domain Logistics, was struck by a cyber attack. It took the better part of a week until any orders started moving again, and some customers complained of orders being delayed by two weeks or more.

Financially though, results were good for the OCS: the provincial wholesaler reported profits of $184 million on sales of over $1 billion for the 2022 fiscal year, which ended March 31, 2022.

Quebec

The biggest story in Quebec cannabis this year is the ongoing general strike of 26 SQDC stores represented by CUPE. Employees called for a strike in May, and as of mid-December the action was still ongoing. (Stores generally remained open, albeit with limited hours.)

The province also launched its own craft cannabis promotion program, dubbed Project Petits lots de fleurs séchées. It’s currently in the pilot program phase (which will last until mid-January) and opens up a new path for product lots under 40kg to be sold in Quebec outside the usual product calls.

The SQDC’s new president told StratCann in June that it was pivoting from adding more new stores to trying to better refine consumer experiences.

Quebec launched its first cannabis edibles in 2022, first with “cannabis bites” in spring 2022, made of dates, hemp hearts, sunflower seeds, currants, and cinnamon and then cannabis-infused oven-baked beets, dehydrated cauliflower, and dried figs later in the year.

The latest financial numbers were strong for the SQDC, which generated $54 million for the Quebec government for its first quarter ended June 18, 2022, with the crown corporation posting a net income of $20.5 million and another $33.5 million in taxes.

Atlantic Canada

Moving into eastern Canada brings you into the world of public pot retailers, where provincially-run stores monopolize the game.

In New Brunswick, though, the biggest news in cannabis this year was that this is set to change, as earlier this year the province announced that it would be launching a tender for 10 private stores in “underserved areas”—in effect creating a mixed system (albeit a more strictly regulated one) similar to British Columbia. The tender closed in early October, although no tenders have yet been awarded as of press time. Cannabis NB has flirted with full privatization in the past, but scrapped those plans in early 2021.

In its most recent financial statements, reflecting the second quarter of this year, Cannabis NB recorded profits of $4.8 million on $21.7 million in sales—a decrease in sales of around 3 percent compared to a year earlier.

It was an even quieter year for Nova Scotia’s cannabis industry, which mostly chugged along without much fanfare. The local cannabis industry has quietly grown its market share with a number of craft growers now in the game, but beyond adding new retail stores, NSLC Cannabis has been quiet. Ditto for Prince Edward Island, which largely stayed out of the cannabis headlines this year.

The Nova Scotia Liquor Corporation doesn’t break out the profits of the cannabis category in its financial reporting, but did announce that the province saw cannabis sales of $28.8 million in Q2, while none of PEI Cannabis’ financial results for 2022 have been publicly released.

Newfoundland and Labrador saw some minor changes in their cannabis sector—namely, the introduction of vapes, and the return of cannabis clone sales to the island. In Q2 of this year, the province sold $17.7 million worth of cannabis. One retailer and producer in the province also began selling clones in 2022.

The Territories

We’ll round out our review of provincial cannabis news with our territorial friends. The cannabis industry has never been a huge presence up there—Nunavut has one single retail store—so territorial governments have not been all that eager to fiddle with regulations.

In the Yukon, the government is out of the game entirely—this October, they announced that they had closed their e-commerce business (which sold less than $2,500 in product last year). The Territory also introduced a new special order program for low-demand cannabis products.

In the year ending March 31, 2022, Cannabis Yukon recorded profits of $1.4 million on just over $7 million in sales.

In the Northwest Territories, the territory sold just over $2 million in cannabis between April 1 and June 30, 2022.